Disclaimer:

*As a preface to this post, please understand that this is a purely speculative theory and is not backed by any provable facts or evidence. The intent of this post is to share my personal, unproven theory and promote an educational, controversial conversation on the topic.

That being said, put on your tin foil hats and proceed with caution...

//

COINBASE - FIAT TO CRYPTO VIA BANK TRANSFER

As many of you know, when you purchase Bitcoin, Litecoin or Ethereum on Coinbase (from a fiat bank account), there's a long waiting period before you actually receive your cryptocurrency. This waiting period can be as long as 10 days...

Now, I understand that they do this as a risk prevention strategy to combat against payment reversals and transaction cancellations, but is this all that it's for?

A lot can change in the crypto-world in 5-10 days. In an ever-changing market that never closes, doesn't it seem kind of absurd to lock in your price for BTC/LTC/ETH up to 10 days before you even receive your cryptocurrency? In extreme circumstances, such as we've seen with ETH's volatility, you could hypothetically lose more than 50% of your investment without ever even having the option to cut your losses and sell it.

And then it struck me...

Coinbase is shorting BTC, LTC & ETH for a profit and using their customers as the fuel to their fire.

In a bear market, they could logically wait the entire 5-10 day period and purchase the cryptocurrency at a much lower price than their customer paid for it.

In a bull market, it's possible that they use their customers' money right away and give themselves a 5-10 day window to make the correct trades to make a large profit off their "borrowed" money. This could be done as easily as taking the average price customers paid that day and making trades to put themselves at a higher number than what that daily average was.

It's really a textbook strategy, yet no one seems to have publicly talked about/realized this before.

Seemingly, they win big on every transaction.

//

Next...

SYSTEM OUTAGES

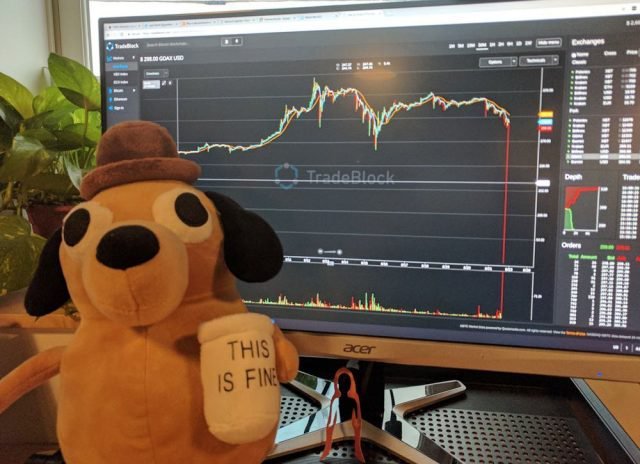

How about their frequent system outages? Isn't it convenient that nearly every time there's a serious market crash, their system goes down?

My theory on this frequent occurrence is that they freeze the trading system, causing absolute hysteria amongst their users and then load up limit buy orders on GDAX (at dirt cheap prices) and then capitalize on the panic MARKET SELLS which ensue immediately upon unfreezing the system.

I understand that this is outlandish thinking, but think about it... is it that farfetched?

As a consumer, there would be absolutely no way for us to prove this manipulation. Especially if the traders who are capitalizing on these system outages aren't even officially employed by Coinbase on paper. Let's be honest, is insider trading and market manipulation THAT crazy of a thought in this competitive cryptocurrency world?

I'll leave that up to you.

//

And lastly...

THE INFAMOUS ETHEREUM FLASH CRASH

Oh, flash crash...

Ok, I get it, this can all be chalked up to a whale making a huge mistake and losing his entire Ethereum fortune on a misclick... but is this true?

Wouldn't it make more sense for this crash to have been orchestrated by the exchange themselves to accrue a gigantic profit off unsuspecting traders?

Let's take a look...

So, the ETH market crashes down to $0.10 USD and in the coming days, GDAX announces that they're going to reimburse everyone that lost ETH at an unfair price due to the crash. I get it, it's a nice gesture, but I believe that this was to cover up the inside job that took place that day.

In their statement, they basically said that anyone who bought ETH during the crash could keep their discounted ETH, yet anyone who lost ETH would be reimbursed for their loss, out of GDAX's own pocket.

Hmm... Yeah, well... this really confirmed all of my suspicions. It was now clear to me that this was an inside job and that their own inside traders were the ones with the $0.10-100 USD BUY ORDERS and scooped up all that cheap ETH.

The flash crash was not to profit off "the whale," but instead, to profit off all the vulnerable traders with STOP orders placed that would trigger at MARKET PRICE (i.e.: $0.10-100 USD) when they executed their predetermined flash crash.

That's right, I believe "the whale" was an inside trader, working directly with the exchange, fully aware that he would be getting his $30 million USD in ETH refunded to him after he induced the flash crash for the exchange's benefit. I believe that he was the centerpiece of the plan to profit millions of dollars off vulnerable, unsuspecting traders with STOP orders placed, exploitatively "stealing" massive amount of ETH from helpless traders.

(Just to clarify, STOP orders trigger at MARKET PRICE. Only traders with STOP LIMIT orders would have survived the flash crash. In the midst of a flash crash, if you only have a regular STOP order placed, you will sell your cryptocurrency at MARKET PRICE when your number is reached. MARKET PRICE during a flash crash is whatever BUY ORDERS are in the order book. And in this case, BUY ORDERS dwindled to as low as $0.10 USD in a matter of milliseconds).

Oh, and I almost forgot... a large percentage of the victims who lost ETH for pennies were margin traders. So, basically, since GDAX is refunding them for their losses, they didn't actually lose anything in the first place. The only people who lost anything were regular traders who were trading ETH purchased with money out of their own pockets.

Now, you could say "but they're being reimbursed, right? So what does it matter?" Yes, technically you're correct... but they're NOT being reimbursed right away. Traders have yet to get their refunds.

And how convenient?! Over the course of the week, the price of ETH dropped from roughly $350 to $250 USD since the date of the incident.

Again, any half-decent technical analyst could have predicted this inevitable crash (at least a moderate crash, considering ICO network congestion, etc.) and anticipated a multi-day/week window to SHORT the ETH and return it to the victims at an incredibly lower price than where it was when they lost it. Thus, scooping millions of dollars in profits and appearing to be the "good guys" by returning the digital assets to the victims in the end.

Am I crazy or does this all seem to make a lot of sense?

//

End notes:

Coinbase/GDAX is a highly reputable company and is a staple in the cryptocurrency space. They provide a wonderful service and have historically been very safe to transact business with and store cryptocurrencies with. This post is not meant to discredit or slander their company in any way, shape or form. As far as I'm concerned, they're the safest, most reliable company to buy, sell and store cryptocurrencies with.

//

Now, I put this theory in your hands...

Let the real discussion begin.

I'd probably do this too if so many people were willing to let me hold their fiat for 10 days before I give them what they want to buy.

The 10 day waiting period will eventually take coinbase down, insider trading or not.

I'm not saying they have 100% malicious price manipulation intent either.

Last week, my bank charged me an overdraft fee in error. They told me it would take 10 days to credit my account with the money they erroneously stole from me.

I wonder if they are sitting on my money in the vault, not using it?

Or if they have used the time "holding" my money investing it - and will pay what they owe me out of someone else's held funds while they wait 10 days to get it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Off topic is that image from Signs (the movie)?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yup xD

Classic tin foil hat scene.

Thought it was overly appropriate ;D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really makes you think

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit