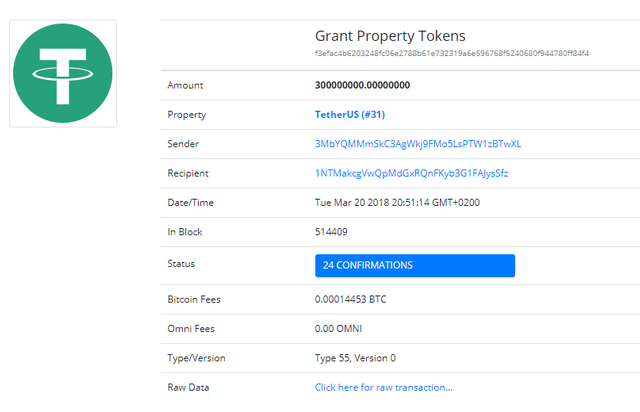

According to Omni Explorer, Tether, whose activities, in cooperation with BitFinex cryptographic exchanges, are closely studying both in the crypto-community and at the level of the financial controllers, is launching an additional 300 million USDT to the market. The project website says that this amount is authorized for release, but has not yet come into circulation.

The new issue of tokensized dollars occurred after a pause of almost two months, from the time the company received a summons from the Commodity Futures Trading Commission (CFTC). Until then, Tether for 8 months released on the market for 100 million USDT almost every week.

Recall, the BitMEX Research team believes that Tether's crypto currency is likely to have collateralised US dollars, but is either already facing, or will face regulatory problems. And previously independent agency Weiss Ratings, which published a report with estimates of a number of leading crypto currencies, issued a warning to investors about the danger of Tether (USDT).

In early December of last year, Bitfinex confirmed a close relationship with Tether and promised "to publish the full financial audit data" in the near future. In Tether, in September, they began to work on counteracting the doubts about its solvency that appeared in the crypto community. However, this does not contribute to the exposure of the blogger Bitfinex'ed, who already had to hire a lawyer because of threats to his address.