I think it is difficult to overstate the importance of what began on the 3rd of January 2009. The first crypto-currency, and the genesis block of the first blockchain database was created on that date, by Satoshi Nakamoto. Almost entirely unnoticed by anyone, including me, the embryonic foundations of a new monetary and financial system were laid on that day.

I won’t go over what Bitcoin is and how it works, I assume most people reading this will already be familiar with it, and if you’re not, there are many resources already in existence that explain it’s functioning. It’s the societal implications of this new technology that I want to discuss here. I posit that decentralized, open-source networks of trust will bring about changes in human economic cooperation that will lead to a profound reorganization of societies.

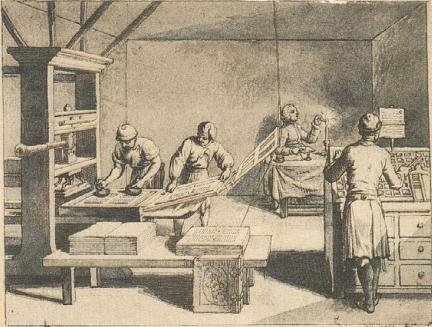

Occasionally, a new technology emerges that radically empowers the individual, and radically dis-empowers the collective, such as the printing press. Prior to the introduction of Gutenberg’s invention in 1440, books were laboriously hand written by scribes, usually clergymen, making written information expensive and scarce. Additionally, Latin was the general medium of communication at that time, a language usually only understood by churchmen and the aristocracy, not by the common person. This gave the priesthood a monopoly on knowledge. The Bible, which was seen as the indisputable guide to life in medieval Europe, could only be translated by the local pastor. The potential for abuse was huge. Who could challenge the cleric’s pronouncements about what was right and wrong, when he held the only copy of The Book, written in terminology that only he understood?

The press allowed the mass production, and therefore the cheapening, of the printed page. The common man could now afford access to knowledge, and printers began publishing works in the local language. This use of the vernacular, and the explosion of information that followed were “agents of change”[1] in Europe, leading to the reformation, the renaissance, the enlightenment and eventually the scientific revolution.

The existing power structures fought long and hard against this new, decentralizing technology, seeing the power that they once enjoyed through the previous centralized system erode. It was the printers themselves who suffered the brunt of the abuse, with Henry II of France, in 1559, making printing without license an offense punishable by death. Despite this, and similar measures elsewhere, peoples insatiable appetite for knowledge ensured that the presses kept on running, and that books continued to circulate.

We face a similar situation today in regards to finance. These systems of finance we use, are wholly owned by the state, and the institutions of finance that are employed, such as the banks, are beholden to the state. In many countries these financial giants have amalgamated with the state to produce a hybrid corporate-government power structure, an incestuous relationship where “too big to fail” banks sponsor and lobby politicians with the near infinite money that the system they underwrite allows them to have. Banking used to be a periphery function in the 19th Century, making up about 2% of a typical countries economy. Banks typically were small and local, and baking failures were therefore localized and contained, they did not present a systematic problem. Today, look at the tall buildings in any city center, and you will see that most of them are related to finance. This is not representative of the value that these corporations provide to society, but rather of the value they are able to parasitically extract from society, through their capturing of the governing bodies. The moniker of the “Vampire Squid”, directed at the investment bank Goldman Sachs, is indeed apt.

The government’s control over people’s finances is near total. Income tax is removed from citizens salary payment before they even receive it, sales tax is included in the price of all goods and services we purchase, the tax authorities can reach into anyone’s bank account and extract money at will. None of these ‘payments’ require the consent of the individual, and will occur even despite objection. If you are a US citizen, the situation is even more dire. Because the US dollar is the worlds reserve currency (for now), the US government has been able to bully all the worlds financial institutions into compliance with it’s regulations. The law I am referring to is called FACTA, and it allows the US government to control the finances of all US citizens abroad, with nowhere to hide.

What the state decides to spend your money on is not up to you. Perhaps you agree with some of the states spending choices, such as the centralized provision of medical services, educational services or welfare. Perhaps you disagree with some of the governments other spending choices, such as continuous foreign wars and “the war on drugs”. No matter, your agreement is not needed, and you will continue to fund these objectives, like it or not. Taxes must be paid by force of law, and your consent is irrelevant.

In most western countries the average person is paying about a 50% tax rate. If you add income tax, sales tax, property tax, capital gains tax and any other taxes, many working people could easily be paying more than half of their income in taxes. You could consider a slave to be someone on a 100% tax rate. All the fruits of the slave’s labor are taken from him, all the energies of the slave’s work is directed towards an end he did not choose for himself. Let me ask you this then; If you are forced to pay a 50% tax rate, what does that make you? A half slave? Half of your working day is spent laboring towards a goal you did not choose, half of your energies are directed towards an end not freely chosen by yourself. If you do not control your own finances and your own spending decisions, you are not a free person.

Crypto-currency is such a powerful technology because it stands outside of the current system in every way. They do not use dollars, pounds or euros, they do not use the legacy conduits of money transmission and they are impervious to regulation. Legacy financial institutions, that once seemed all powerful, and permanently embedded such as the IMF, the BIS or the Federal Reserve are rendered irrelevant. Crypto-currencies are open to anyone who has access to the internet, without any permission required. As they are essentially just internet protocols, any attempt to censor them will fail laughably. The upcoming war against crypto-currencies by governments and banks is wholly predictable, both in it’s scope and eventual outcome. I will write more on this later.

It is commonly known that Bitcoin offers only a form of pseudo anonymity, all transactions are visible to anyone who cares to look at the blockchain. However, we are still at an early stage of development, recent advances like Tumblebit, that offer off chain coin mixing are coming. Also consider more recent crypto-currencies such as Zcash, that includes mathematically provable anonymity at the protocol level, and the more recent currency with the odd name of MimbleWimble, that works in a completely different way to Bitcoin, and is anonymous by default. It is only a matter of time until entirely anonymous methods of payments are available to all.

Imagine a world where any person can pay any other person any amount of money, and there is no way for either the payer or payee to know who each other is, and no way for any third party to examine the record of that transaction and know who those people were or how much was transferred. When people’s money is completely out of the hands of any central authority, how can the payment of taxes be enforced for sales or income? What if investing in a company or a fund becomes blockchain based? How can capital gains taxes be applied to this, when hiding your identity online is so easily done?

These developments all come at a time when government and the legacy banking system has never looked so fiscally precarious. Most governments are hopelessly indebted, way beyond the point of no return. The banking system is levered to such an absurd ratio of assets to liabilities, that another 2008 type of failure is a certainty. The only way out for the current system is a massive expansion of the monetary base, or money printing as it is more commonly known. This will surely cause a loss of faith in government backed currencies as long term stores of wealth, and one would imagine, their subsequent abandonment and rapid devaluation.

If taxes become voluntary, that is to say, involvement with the state become optional, how many people would choose to stay aboard this sinking ship? Who would continue to pay into a social security system, when the chances of getting paid back starts to look incredibly dubious, and an opt out is available? Blockchain based technology could cause a massive shrinking of government tax revenues, and consequently the radical shrinking of the state. What would a world with much smaller government, or even no government at all look like? To some this prospect seems terrifying, to others liberating. The functions of government, from doling out welfare to pursuing endless warfare would grind to a halt.

The linchpin of the centralized “big government” model is control of the monetary and financial system. This is root of all of the states power, being able to force a token of no intrinsic value, that only the state can create onto society. This is also the states Achilles heel however, take this away from them and these once mighty institutions that seemed like permanent fixtures on the landscape, will collapse like a house of cards as they are revealed as dysfunctional paper tigers.

The phrase “replace government with open source software” has been bouncing around for a while within certain communities online. How serious this statement was meant to be taken, or how achievable this goal is, I was never really sure. To me it is looking more and more possible with every passing month, and certainly more an more laudable.

Bayon.

It has been long long time since I have ever read anything more significant and teaching. I am thinking of translating this into my native language. And give to it much bigger accessibility in human society layers surroinding myself. 50-98% of people who i know would not have a chance to to get this, to read this, simply because their knowledge of English is misserable. And even if màybe only 1-2% of them would care to know, to read all this in the way they can understand - I stilĺ think it is worth to do this translation.

Upvoted.

Resteemed

Followed.

..And you all reading this here - please do the same. Even it will be just a tiny tiny steps, it will be your steps in a RIGHT DIRECTION.

STEEM ON !!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This was excellent and I really liked your tie-in to the printing press. I didn't know that it was suppressed like that.

I think crypto is already too big to be stopped by the banks. When businesses can create and benefit from their own coins they will become the new "coin dealers" and it will take things to the next level.

Can you imagine a "Game of Thrones" coin?

https://steemit.com/steemit/@trevorlyman/a-game-of-thrones-coin

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit