The growth of digital assets under management (AUM) reached historic levels, reflecting a growing confidence in Bitcoin and Ethereum.

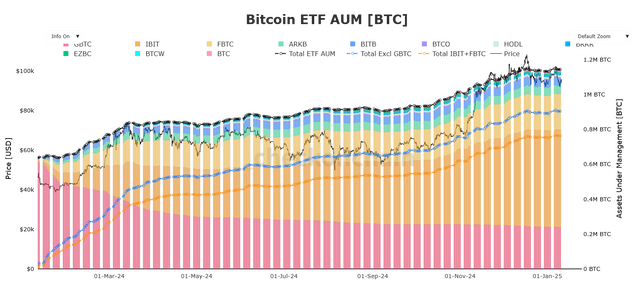

According to data from CheckonChain, digital assets under management (AUM) grew by 81% in the last year, reaching the figure of 1.14 million BTC. This growth is driven by the rise of exchange-traded funds (ETFs), which brought Bitcoin to a new level of acceptance in the financial world.

Since the launch of ETFs, Bitcoin price sees a staggering 126% increase. / CheckonChain

Impressive growth in the world of ETFs

AUM is held by ETF companies that launched investment vehicles to gain exposure to BTC. This allows investors to buy shares of these funds, which in turn hold Bitcoin on behalf of their clients. This mechanism proved to be an attractive solution for those who want to gain exposure to the price of Bitcoin without the need to manage their own wallets and private keys.

Since the launch of the ETFs, the amount of BTC under management (AUM) shows a steady growth, stabilizing at 1.14 million BTC as of December 17, 2024. This increase not only indicates a net flow of capital into the ETFs, but also reflects a growing confidence in the world's leading cryptocurrency.

A market on the rise: Bitcoin and Ethereum

Since the launch of the ETFs, the price of Bitcoin experiences a staggering increase of 126%.

This Friday, the world's leading cryptocurrency closed at USD 94,726, with a daily high of USD 95,836 on Binance. This increase occurred despite a jobs report that showed that the US economy added 256,000 jobs in December, exceeding economists' expectations.

In parallel, the AUM of ethereum grew even more proportionally, reaching USD 121.77 million with an increase of 349% since the launch of its ETFs. These numbers reflect a remarkable investor interest in the crypto sector, which continues to grow.

Implications of the jobs report for the crypto market

Even though the strength of the labor market could lead the Federal Reserve to maintain interest rates, Bitcoin showed a remarkable increase driven by risk demand. The jobs report has been interpreted as a sign of relief from recession risks, which favored market sentiment towards cryptocurrencies.

Bitcoin managed to maintain dynamic support at the EMA50, which is located at USD 94,400, indicating that buyers are defending this crucial level after a three-day decline. This upward movement is supported by a slight increase in trading volume, providing a solid base for bulls.

A bright future for cryptocurrencies

The growth of AUM in Bitcoin and Ethereum is not only a positive trend, but also reflects a significant change in market perception towards cryptocurrencies. As more investors seek refuge in these digital assets, market confidence and participation are likely to continue to rise.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your research and consult with a professional before making any investments.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit