BTC Remains in a Key Range as Dollar Fluctuates and Economic Data Creates Uncertainty in Markets

The price of Bitcoin (BTC) is in a neutral consolidation phase, according to on-chain data, currently trading at $97,088, with a key support at $91,800. While the dollar shows weakness amid expectations of a US-China trade deal, strong US labor data could strengthen the currency and put pressure on cryptocurrencies. We analyze the key indicators and the outlook for BTC in the short and medium term.

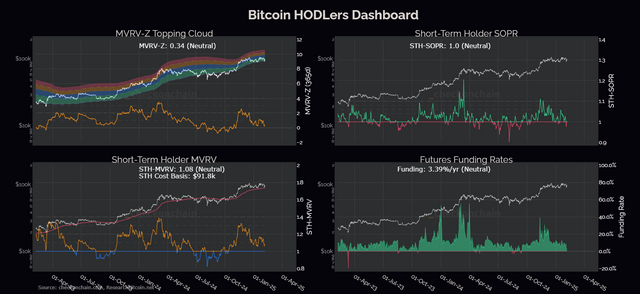

According to CheckonChain's Bitcoin HODLers Dashboard, on-chain indicators show a balanced market / CheckonChain

Bitcoin in Balance: On-chain Data Reveals a Neutral Market

According to CheckonChain's Bitcoin HODLers Dashboard indicator, on-chain indicators show a balanced market. The MVRV-Z (0.34) and STH-SOPR (1.0) reflect neutrality, suggesting that Bitcoin is neither overbought nor oversold. Additionally, the STH-MVRV (1.08) indicates that short-term holders are in modest profits, with the cost basis at $91,800 acting as a key support level.

Futures funding rates (3.39% per year) also point to a market without excessive leverage, reinforcing the idea of a consolidation in the short term. However, the BTC price is facing technical resistances, such as the EMA50 at $98,800, which is acting as a dynamic resistance level.

The dollar and economic data: Key factors for Bitcoin

This Wednesday, Bitcoin showed a slight drop of -0.69%, trading at $97,088 at the time of this report, while the dollar hit a one-week low. The weakness of the dollar is partly due to hopes for a trade agreement between the US and China, which generates optimism in the markets. However, strong US jobs data, with 183,000 new jobs reported by ADP, support the dollar and could limit Bitcoin's advance.

A strong dollar typically puts pressure on risk assets such as cryptocurrencies as it reduces their attractiveness to international investors. Furthermore, a robust labor market increases expectations that the Federal Reserve (Fed) will maintain high interest rates, which could negatively impact BTC.

On the other hand, the ISM Services PMI (52.8), although in expansion territory, showed a slowdown, which could weaken the dollar and support Bitcoin in the short term. This data suggests that the US services sector is losing momentum, which could lead the Fed to adopt a more cautious tone.

This Wednesday, Bitcoin showed a slight drop of -0.69%, trading at $97,088 at the time of this report / TradingView

Is Bitcoin's bullish trend losing steam?

Bitcoin has been moving within a bullish channel (blue) since early December 2024, recording higher highs and higher lows. However, the bullish trend seems to be losing steam, as the price closed yesterday below the EMA50 at $98,800, a level that now acts as resistance.

The key dynamic support is found at the EMA100 at $93,000, a level at which the price bounced on several occasions and defines the lower side of the channel. Although the trading volume on Binance is low, which gives some control to the bears, the bullish sentiment in the medium and long term remains intact.

What to expect from Bitcoin in the coming days?

In the short term, Bitcoin is in a neutral consolidation phase, with $91,800 as key support and $98,800 as important resistance. Economic data and the strength of the dollar will be determining factors for the next movement of BTC.

Investors should be on the lookout for upcoming economic reports, such as the NFP (Non-Farm Payrolls), which could influence the direction of the market.

Disclaimer: This analysis does not constitute financial advice. Cryptocurrencies are volatile assets and investors should conduct their own research before making decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit