Donald Trump's victory and expectations of new regulations boost investment in cryptocurrencies

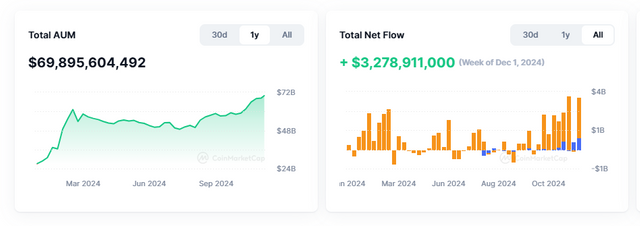

The total digital assets under management (AUM) reached a new milestone of $69.89 billion, marking an increase of 12.10% in the last 30 days. This growth is attributed to the increasing demand for cryptocurrency derivative products, especially Bitcoin. Since the launch of Bitcoin derivatives in January, digital assets under management grew by a staggering 61.22%.

The total digital assets under management (AUM) reached a new milestone of $69.89 billion, marking an increase of 12.10% in the last 30 days. / Coinmarketcap

Political momentum and paradigm shift

The investment surge began in September and accelerated following the presidential election in the United States. The victory of President-elect Donald Trump, who promised to reduce regulations on cryptocurrencies, created a favorable climate for digital assets. In addition, Trump appointed Paul Atkins, a Bitcoin proponent, as the chairman of the Securities Commission, ensuring greater stability for the sector.

AUM Composition

Of the $69.89 billion in digital assets under management, $57.95 billion is in Bitcoin ETFs, while $11.93 billion is in Ethereum ETFs, according to data from CoinMarketCap. Institutional demand soared, with positive net flows into both ETFs. On Wednesday alone, net capital flowing into Bitcoin reached $747.80 million, with $428.5 million going into Ethereum. This data reflects an optimistic backdrop, especially with the recent surge in the price of bitcoin, which surpassed $100,000.

Market Trends

Since December, net flow into Ethereum ETFs reached new highs of $752.80 million. This reveals strong interest from investors, who are taking refuge in bitcoin as a safe haven in the face of economic uncertainty. This trend is also supported by an interest rate cut program by the US Federal Reserve.

The greedy mood in the market is reflected in the fear and greed index, which currently stands at 83 points. Despite signs of correction, demand for digital assets remains robust. Analysts believe that the momentum could continue until the change of government in the US, scheduled for January 20.

Cryptocurrency dominance and performance

Bitcoin reached a dominance of 54%, while Ethereum accounts for 13.1%. In this environment, the alternative cryptocurrency market is showing strength, with 85 points out of 100 in the recent season, where more than 75% of the top 100 cryptocurrencies are generating returns that exceed bitcoin. Over the past three months, bitcoin generated 84.78% returns, while coins like VIRTUAL impressed with a return of 6356.39%, followed by PNUT and HBAR with 2496.50% and 625.16%, respectively.

With a market cap of $3.68 trillion, bitcoin's uptrend seems firm. On Friday, the cryptocurrency closed with a gain of 2.88%, trading at $99,740.84, supported by a trading volume that doubled since Trump's victory.

The rise of digital assets under management is a phenomenon that reflects both economic and political factors. The combination of rising prices, favorable regulation, and institutional capital are shaping a new ecosystem in the world of cryptocurrencies.

Disclaimer: The information presented in this article does not constitute financial advice. Readers should conduct their own research and consult a professional before making investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for this great post. I had missed the performance of PNUT and HBAR. Also very interesting is the fact that investments in Ethereum ETFs are increasing. Here in Italy we talk about Bitcoin, but still few know about Ethereum. I am convinced that the crypto market will grow further

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It is a great pleasure to make these publications. We are equally convinced of the growth of the cryptographic sector.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit