The new record of digital assets under management fails to stop the volatility of Bitcoin, which closed at USD 103,706.66.

The price of Bitcoin experienced a slight drop of 2.30% this Wednesday, closing at USD 103,706.66. The decline occurred amid the recovery of the dollar after President Donald Trump's announcement on tariffs on China. Despite this drop, cryptocurrency ETF funds reached a new historical record in assets under management.

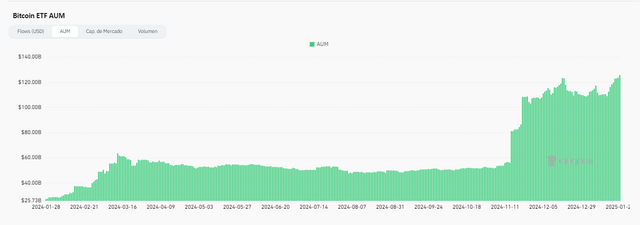

Digital assets under management (AUM) hit a record high of $125.67 trillion / Coinglass

Impact of Trump's tariffs

Donald Trump's recent announcement on the increase of tariffs on Canada and Mexico, which will be implemented from February, as well as 10% on imports from China, had a direct impact on the cryptocurrency market. With the dollar strengthening, experts warn that this could lead to an increase in inflation in the United States. This could complicate the Federal Reserve's decisions regarding interest rates.

The DXY index, which measures the value of the dollar against six major world currencies, showed stability with a slight recovery of 0.19%, positioning itself at 108.27 points. This upward trend in the dollar is evident since mid-December, when the Federal Reserve announced that there would be no further rate cuts in January 2025.

Rumors about a Bitcoin Strategic Reserve (SBR)

In an intriguing twist, the market is also aware of recent rumors about a possible US Bitcoin Strategic Reserve (SBR). Senator Cynthia Lummis met with Eric Trump on Capitol Hill to discuss this initiative. This rumor follows Lummis' announcement last year about the Bitcoin Act of 2024. This seeks to establish a strategic reserve of 1 million BTC within a five-year period, funded through the restructuring of existing resources of the Treasury and the Federal Reserve.

Positive ETF Flows and New Records

Despite the slight drop in Bitcoin, capital flows into cryptocurrencies have been positive. Net capital flow into Bitcoin via ETFs reached $802.60 million on Tuesday, marking the fourth consecutive day of positive inflows. Digital assets under management (AUM) reached a record high of $125.67 billion. While the market capitalization of ETFs also reached a new high of $124.26 billion.

The Bitcoin price is consolidating in a resistance zone near $108,000, at levels close to its all-time highs. Although the market was calm and trading volume was reduced, the medium- and long-term outlook still points to a bullish sentiment. Bitcoin remains above the EMA50 and EMA200. If this trend continues, we may see new all-time highs in the near future.

The crypto market is at a crucial moment, influenced by political and economic decisions that could define its course in the coming months. While investors remain vigilant, the future of bitcoin and cryptocurrencies depends on multiple factors, including US monetary policy and President Trump's reaction to the digital sector.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies involves risks, and it is recommended to consult a professional before making investment decisions.

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit