So you have researched and found a coin to invest in. For ease of numbers, lets say the coin was priced at $1.00 per coin. A week or two goes by, and the coin has dropped by 20% to $0.8. Not the best start, but you have faith it will go back up. Sure enough, after another few weeks, the coin gains 20% from the $0.8 mark. Good. You broke even, right?

No.

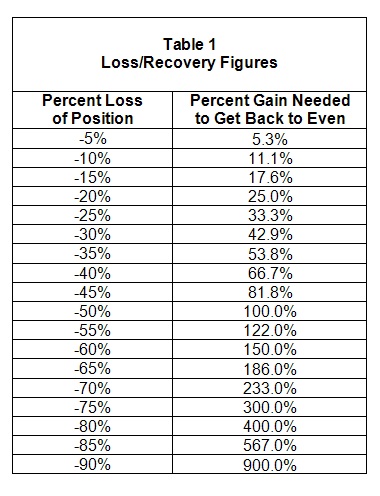

When the coin was valued at $1.00 and lost 20%, it went down to $0.8. When the coin gained 20%, it only gained 20% from $0.8, leaving you with $0.96, or a 4% loss. The coin would actually have to gain 25% for you to break even at $1.00.

As the higher the percent loss gets, the percent needed to break even gets higher and more difficult to reach.

Another Example. You buy a coin for $1.00. This time, it goes up 20% to $1.20. Following that, it drops 20%. Are you ahead, even, or down?

Down again.

This is because the 20% gain was on $1.00, while the 20% loss was taken from $1.20, a larger number. You gain 0.2, but lose 0.24 on the correction. This again leaves you with $0.96.

Keep this in mind when determining how long you are willing to hold onto a losing coin before cutting your losses. It may be more difficult to recover than you think!

Congratulations @bitcoincanada42! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @bitcoincanada42! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit