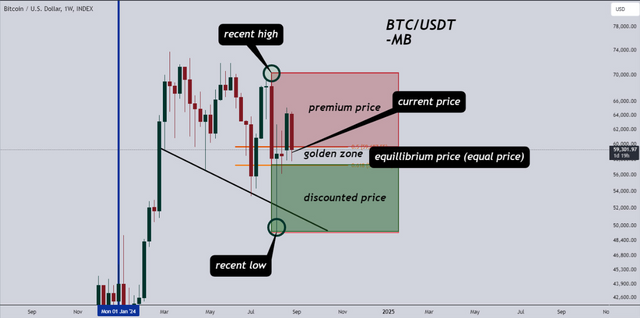

The current price of Bitcoin is within the Golden Zone level. The Golden Zone is also acting as a support level, as the 50% and 61.8% levels are highly respected. Many traders consider this area a key point of interest (POI). However, as a businessman, you need to anticipate both premium and discounted prices.

The Golden Zone represents the equilibrium price, or fair value. You can consider entering a long position here without much concern. But before you do, ask yourself: What assurance do I have that the market will rally from this point and favor my position? There is no certainty, which brings us to the concept of "probability," a crucial consideration before making any move.

Since the Golden Zone is considered a support level, what additional factors can increase the probability of a successful entry? There are three key factors:

- Another liquidity grab below the Golden Zone.

- Sufficient trading volume.

- A bullish candlestick pattern.

Remember, trading is a business, and as a businessman, you stand to gain more potential profit if you buy a product at a lower price. This is where the concept of a discounted price, which is below the equilibrium price and within the Golden Zone, comes into play.

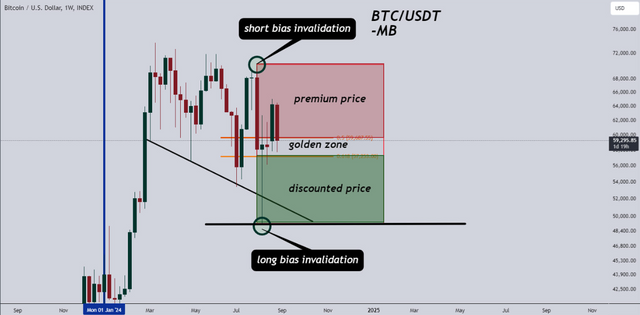

If you're planning to enter a long position, it's often better to wait for a discounted price rather than rushing to buy at an equal price that hasn't yet shown any assurance of increasing. As seen in the second image on the daily time frame, there has been indecision or no significant volume in the past four days.

It's simple: if you enter a trade without sufficient volume, your probability of success is 50% or lower. Now, if you enter at a discounted price, you need additional confirmation to increase your chances of the market moving in your favor, such as volume or a bullish candlestick pattern.

In summary, no matter how attractive a market discount might be, don't buy without meeting additional criteria. Trading is all about probability. When we enter a trade, we should always aim for a probability greater than 50%. The invalidation of a long position would be if the recent trend liquidity (recent low) is breached. Even if you're hit with a stop loss, the damage will be minimal, especially if you understand the importance of position sizing.

When it comes to selling, it's simple: don't be greedy. In retail, a standard markup is around 15%, but if you've already achieved a 100% ROI, why wouldn't you sell or at least trail your stop?

Lastly, and most importantly, follow your responsibilities as a trader or businessman, which means implementing your entry criteria. Without a solid entry strategy, your chances of long-term success are slim. Always adhere to the golden rule: No discount, no volume, no entry.

Is trading a business to you? If yes, then carefully plan your moves. Let's not run a business at a loss.