Cryptocurrency, the money of future as most market experts call it. Unless, you’re living under rocks, we’re sure that you would have come across something about cryptocurrency. If not, don’t worry, you’ll know about it soon. Presuming that you are here out of curiosity, you’re at the right place. In this post, we will share everything that you need to know about ‘Cryptocurrency’.

In this post, you will learn the following:

What is Cryptocurrency?

What is Blockchain?

How are cryptocurrencies generated?

How does cryptocurrency work?

Transactional properties of cryptocurrency

Final thoughts

Without further ado, let’s begin.

What is Cryptocurrency?

Cryptocurrency is a peer-to-peer electronic payment system that is completely anonymous, decentralized and secure. It’s the most used application of Blockchain.

The concept of cryptocurrency came to limelight as a serendipity after an unknown inventor of Bitcoin, Satoshi Nakamoto, published his paper on it. In his paper, he said he has developed an “A Peer-to-Peer Electronic Cash System.“ which many failed to create before Digital Cash came to the market

“Announcing the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent >double-spending. It’s completely decentralized with no server or central authority.” – Satoshi Nakamoto said in the >Bitcoin white paper he released.

The reason why Satoshi’s invention turned out to be a globally accepted and a benchmark in the financial industry is that he found a way to build a decentralized digital cash system. However, there were many attempts to create ‘digital cash’ a trend and change the course of history in the 90’s, but none of them survived.

“… after more than a decade of failed Trusted Third Party based systems (Digicash, etc), they see it as a lost cause. I >hope they can make the distinction, that this is the first time I know of that we’re trying a non-trust based system.” – >Satoshi Nakamoto said in an email to Dustin Trammell

The lack of a decentralized system to carry out cash flow was the sole idea behind cryptocurrency. Furthermore, the only problem that the traditional payment network has to solve is the double-spending, i.e. to prevent spenders from spending the same amount twice. To do this, the traditional system has centralized servers in place, which is also the reason behind the charges/fees the users have to pay.

Additionally, Bitcoin(the first and leading cryptocurrency) or any cryptocurrency for that matter, is so insanely accepted globally is because it eliminates the double-spending problems without having a centralized server for that. In fact, there are no servers involved.

Let us consider an example to understand both the system and decide which one is better, right away.

Scenario one: Traditional payment system

Person A sends payment from the USA to Person B in India. A deposits the amount in his bank to send it to B, in India and is charged a certain amount as fees. The fee is here is to just ‘virtually’ make that amount available to B, without actually depositing that amount in B’s account. The bank simply updates the balance and doesn’t actually deposits the ‘cash’ A deposited.

The banks charge the fee to maintain the intermediate servers and other agents in the process and to make a profit. Even after this, the funds will take at least a day to appear in B’s account. The bank here has complete control over your money. You might even lose your money if the bank becomes bankrupt overnight. As everything is centralized and there’s a single point of failure for an attacker to exploit. One failure and all the data including bank account balances & personal information is compromised.

Scenario two: Decentralized payment system.

Same Person A sends Person B same amount via cryptocurrency. Here’s how it flows. Say A needs to send $100 to B. A will buy Bitcoin worth $100, and send that to B’s Bitcoin address. Unlike the traditional payment system, A didn’t have to pay a significant percentage as fees. B received it in minutes. No information is recorded of this transaction other than the transaction amount and sender and receiver’s address.

You are not known by your identity, you are known by your address, i.e. your payment address is your identity. Payment address is an alphanumeric & 30 characters long, that is unique for every user. Depending on the cryptocurrency you use, you can create any number of addresses you want.

Talking of fee, it depends on the cryptocurrency you use and the number of transactions in a particular block of the blockchain.

That being said, let us explain the concept of blockchain brief. It will help you better understand the whole thing here.

What is blockchain?

The blockchain is a cryptographical representation of records or blocks that are linked to each other in a logical manner. The blockchain is also known as a public ledger as it’s globally accessible and has the records of all the verified & unverified transactions.

A block is a group of transactions happened on the platform. The number of transactions in a block depends on the block size. Block size varies from cryptocurrency to cryptocurrency. Bitcoin has a block size of 1MB. Imagine block size as digital space or a 1MB spreadsheet with records of transactions in it.

These blocks are accessible all over the globe(remember we called cryptocurrency as a decentralized financial system? This is what we meant) and is anyone with an internet connection can access it. The blockchain is like a feed of any social media platform. Like there posts on the feed, there are transactions on a blockchain which the miner/mining pool has to verify.

There are a series of steps involved here, let’s introduce you to that. Imagine you are accessing the blockchain right now as a miner, and this is what you’ll do.

Step 1: You log in to your preferred mining pool

Step 2: Access the blockchain of your preferred cryptocurrency(each cryptocurrency has unique blockchain and there are around 1600 cryptocurrencies)

Step 3: The blockchain will show you the recent/current unverified transactions.

Step 4: You verify it and add the verified transactions to the public ledger

This is a brief about blockchain and how it works. The details are too big to be included in this post. We will roll out a dedicated post on it soon.

How are cryptocurrency generated?

Unlike the fiat currencies, cryptocurrencies are not generated by the central body. Nothing is centralized in cryptosphere. Hence there is a mechanism which generates cryptocurrencies. For the sake of this post, let’s take Bitcoin as an example.

Remember we mentioned something called ‘verifying transactions’ in the steps above?. This verifying transaction is what generates cryptocurrencies.

Let’s explore it how.

This is a two-in-one process, which includes

Verifying transactions

Mining new coins

Let’s understand it one by one

Verifying transactions

As aforementioned, the blockchain is a public ledger/database of ‘verified’ transactions. In other words, a blockchain is a database of a complete history of transactions of that cryptocurrency since the beginning. Furthermore, a block is a group of ‘unverified’ transactions that miner is supposed to verify. Depending on cryptocurrency, the algorithm used in this process varies. In the case of Bitcoin, the algorithm used is SHA256.

As part of this process, the miners run the hash (transaction id) and the algorithm will check for double-spend, the genuineness of the transaction, and many other factors. A hash is something that links one blocks with its previous block and the next. Miners need to spend their time and efforts of the computer to get the hash of transactions. Once they get the hash, that transaction is ‘verified’ and can be added to the blockchain/public ledger.

This is the whole process of verifying a transaction in a nutshell. Let’s take a look at what this results in.

Mining cryptocurrency

The only way to generate cryptocurrency is to mine it. Mining is something that happens automatically. New cryptocurrencies that are generated are a by-product of the process of verification of ‘unverified’ transactions. Anyone can become a miner, it just takes an internet connection and computer to mine it. To mine cryptocurrencies, one needs to run algorithms day in day out to ‘verify’ transactions. Depending on the power of your computer, cost of electricity in your region, mining may or may not be fruitful for you.

So here’s how mining works.

While the miner, verifies transactions in a block and adds it to the blockchain, the algorithm generates new cryptocurrencies in the network. A fraction of it is given to the miners as an incentive.

Now you know why miners spend their time, electricity and efforts to mine cryptocurrencies? They get paid in cryptocurrencies that are worth hundreds of dollars. The percentage of share keeps decreasing as more and more people get into mining. However, mining full time is as fruitful as a full-time job may be more than that.

Read also: A Japanese man earns an extra $500 a month by mining.(http://bitfolio.org/mining-cryptocurrency-in-dormitory)

How does cryptocurrency work?

Cryptocurrency is a peer-to-peer payment system. That is the transaction happen directly from sender to receiver, no middlemen in between. Unlike traditional payment system, the transactions on in cryptocurrency happen in minutes, i.e. the recipient receives the funds within minutes.

There are three major steps involved in this whole thing.

*A sends X amount to B

*This transaction is verified by miners and the hash is added to the blockchain

- As soon as the hash is created, B receives the amount

The verification part is already explained in brief above.

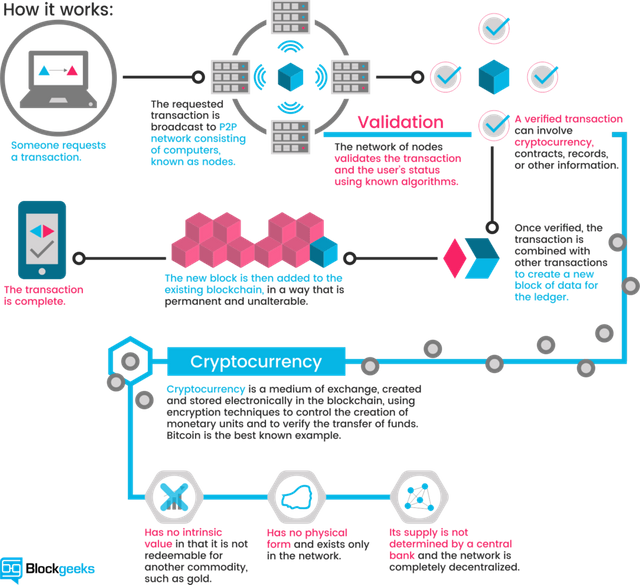

See the image below to visualize the working of cryptocurrency better.

Transactional properties of cryptocurrency

Irreversible: Sure, cryptocurrency brings privacy to the table but the very nature of blockchain is one way. Once you send payments to someone, it is irreversible. While the transaction is in ‘unverified’ state you have the chance to cancel the transaction, though not directly.

In case you want to withdraw the transaction, you can reduce the account balance less than the amount you’re sending and the transaction would fail and the algorithm would not allow it to pass. There’s no other way you can stop the transaction from happening.

As once your transaction gets into the pool, there’s no chance you can stop it as the miners across the globe are continuously picking up transactions and verifying them. Even if you accidentally send it to hacker, scammer or unknown person, it’s gone means it’s gone.

**Made-up names: **To give utmost privacy, neither your account nor the transactions are connected to the real world. These are randomly generated names that are unique and it never repeats ever again. One can manage to trace the transaction flow manually, but it’s impossible to trace the identity of the users involved in the transaction.

Global & Fast: As mentioned earlier, the transactions are added to the block immediately but depending on the blockchain in use, the verification time would vary. While Bitcoin takes 10 minutes to verify one block, Ethereum, on the other hand, takes 4 seconds on average to verify a block of ether transactions. This difference is because of the block size and the algorithm involved.

Secure: With made-up account names, comes privacy that’s unbreakable. No one can figure out the user details, the origin of the transaction or any other transactional detail. No matter what. No one including, miners, your bank, POTUS, FBI, CIA, and aliens. This is definitely something we desperately wanted, but it's also a threat to us. As criminal use cryptocurrencies to make payment for illegal goods, dark web users use it, and all those who don’t to be traceable for doing things they’re not supposed to do.

No permission required to use: Cryptocurrency is a piece of code, which anyone can use. Your barber, maid, nanny or even aliens if they come to invade earth and run out of cash. There’s no authority governing the users. Just install a wallet, generate your account address, buy cryptocurrencies using fiat money and you’re good to spend.

Final thoughts on cryptocurrency

Uncle Ben, long ago said, “With great power comes greater responsibilities” Only Spider-man wasn’t moved with this teaching. It all makes sense now when cryptocurrencies, in spite of having a potential to change the whole financial system, is being misused by a handful number of people.

Sure, the cryptocurrency provides utmost privacy to us, which is something we ever wanted. No more annoying calls from banks asking if we’re interested in their services, no more spam, no more extra fees, no more wait. Cryptocurrency has eliminated all these problems in one go.

But,

Because of the misuse, few people are doing, cryptocurrency is finding it very difficult to get a green signal in many countries. Countries like India, have put a ban on cryptocurrency until some regulations are made without affecting cryptocurrency’s main essence of anonymity and decentralization.

It will definitely take time for the world to adapt cryptocurrency, but with proper regulation, one thing we are assertive about is that cryptocurrency is here to stay.

What do you think about cryptocurrency? Comment down your say and share this article with anyone you think is looking for this information.

bitcoin the best crypto

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Again u comes with a new debate or conclusions of cryptocurrency.. it's have a own world on itself , bcoz there is many things to know it's a buisness whulifh holds worldwide.. very nice nude content and very helpful post .. very useful.. keep it up keep posting and keep up the good work... Being crypto.........

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit