Bitcoin is controlled by a group of powerful cartels ranging from Top Nations to Fortune 500 companies.

Most of us in the cryptocurrency industry should’ve heard these adjectives used to describe the nature of Bitcoin. Recently, the co-founder of Dogecoin accused the cryptocurrency industry of being controlled by some wealthy right-wing cartels. Bitcoin promises billionaire livelihood for ordinary people like you and me, the latter accused.

We are feeling uncertain about the future of Bitcoin, “the most underrated asset class” in the current world. So if Bitcoin is a better asset than gold, why should it fall from its all-time highs of $64,000 to just above $32,000 in less than a month. It lost almost 50% of its value in less than a month.

But no one ever remembers that the market went from $6000 to $60,000 and retraced back to $32,000 still on a YoY basis; the profits from bitcoin are 300%.

Does bitcoin create an artificial demand?

To most people, the 21 million fixed supply of Bitcoin is protection against Inflation. But for others, it is an artificial demand that keeps the valuation of Bitcoin higher. Of course, the fake demand or artificial demand is genuine, but it is not new.

If you take the stock market, a program called “buy-back” is used to reduce the common stock out there in the market to create a demand for the stock. Artificial demand or reduction of supply is invented for the very nature of its cause to act as a protection against Inflation.

The problem with gold is that it’s mineable and mined until exhausted, so keeping gold as a hedge against Inflation is to buy more gold as the supply increases. So there is a dire need for an asset fixed in supply that protects holders’ interests against the fungible USD.

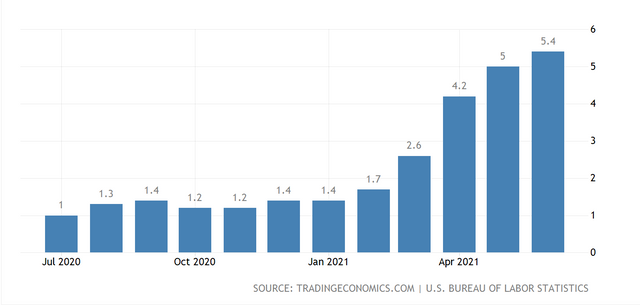

Is Inflation a real problem?

Inflation is a political statement; 4% inflation means annually you’re losing 4% of your store value which most people don’t. People invest in at least 401(k) or any savings scheme that yields them at least 6–8% annually. So the current worry about Inflation is an artificial problem created to unrest people.

Also, with the digital economy growing, the cash reserves held in hand are significantly less, so this might be a plot to reduce the cash reserves as people will deposit them to any digital form that the government can absorb over time.

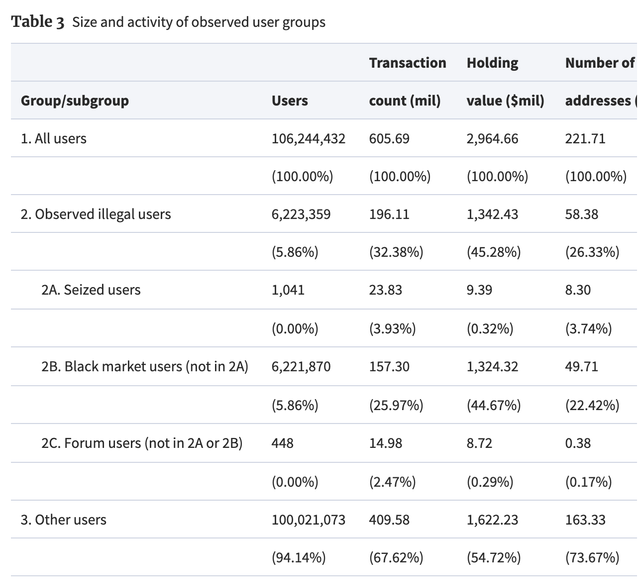

Do Bitcoin increase the number of crimes?

There is a rate of just above 5% of the bitcoin users use it for organized crimes. So the rest of them are using Bitcoin for some legal purpose. The entire drug industry was once running with United States Dollar predominantly, which doesn’t mean the Dollar is promoting crimes. People choose to pay for the illegal services through Dollar as it’s more stable.

We could see that most of the TOR websites still accept payments via PayPal. The other thing to understand is, Bitcoin is more serving as an asset. It can never be a currency because of its non-fungible nature. So USD will remain robust, and its role as a reserve currency is intact. To use Bitcoin, it must convert people to USD. This process of conversion is a heavily scrutinized one involving various KYC & AML policies.

So Bitcoin helps organizing crimes is a baseless statement. Crime happens for many reasons, and Bitcoin is trusted even by criminals who are highly financially educated.

Bitcoin is not an enemy to banks or governments.

It is hard for law agencies to regulate this new class of hybrid assets, which can act as an asset and a currency. So the government is working on improving the law. So the current uncertainty in the market is a source of revolution in financial regulation, not the decentralized ledger technology.

Banks are here to stay until the last human is alive, so as Bitcoin. Sooner (or) later, we will start using these cryptocurrencies through banks; that’s what they call “Central Bank Cryptocurrencies”, which are nothing but cryptocurrencies transacted through the bank.

Central Bank Cryptocurrencies are useless and baseless since they cannot operate in a decentralized manner. So the likes of it being a success are pretty low in a federal nation unless the government forces people to use them as in some countries.

So final thoughts are we can be less worried about the daily price movements of Bitcoin and other cryptocurrencies and start focussing on our everyday life. Bitcoin & Banks are here to stay and make human lives a more valuable one.

The $1,000,000 dream per Bitcoin is still on the market, and anything could happen; I would be happier to see the new financial technology growing. Let’s not get greedy, if gold earns you 5% annually let Bitcoin be the same kind of asset. People expect more from Bitcoin, because of the artificial demand for money created by the banks. So Bitcoin & Banks are two financial partners who co-exist and continue to thrive.

Disclaimer: The motive of this article is to promote the awareness of distributed ledger technology among people and remove the FUD from the current market scenario where there is heavy speculation in the market. We do not endorse you to buy, sell or trade-in cryptocurrencies. Views in this article are personal and are not meant to hurt/demotivate any class of people.