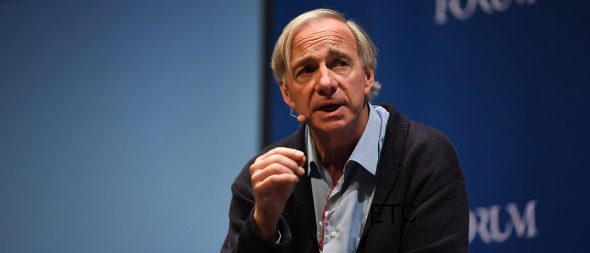

Ray Dalio, the billionaire macro investor, and founder of the Bridgewater Associates hedge fund has published an essay called Paradigm Shifts.

Paradigm shifts

Dalio explains that over his 50 years as a global macro investor he has observed that every 10 years or so there is a “shift to new paradigms in which the markets operate more opposite than similar to how they operated during the prior paradigm. Identifying and tactically navigating these paradigm shifts well and/or structuring one’s portfolio so that one is largely immune to them is critical to one’s success as an investor.”

Dalio says that the next paradigm shift is coming. Following the GFC of 2008, when the stock market collapsed and the housing bubble popped, central banks commenced easing strategies. By keeping interest rates low and engaging in quantitative easing, the U.S. Federal Reserve was able to create a reflationary environment. Global stocks and property markets went on to rally to new highs. However, the cycle is turning, according to the hedge fund veteran, storm clouds are on the horizon. Increasing global conflicts, negative interest rates and the depreciating value of money mean that currently in-vogue investments such as stocks, securities, bonds, and property may fall out of favor.

An effective portfolio diversifier

Dalio writes that any one single approach to investing will “experience a time when it performs so terribly that it can ruin you.” This includes cash, which is not risk-free because it can be depreciated in value, as the central banks are free to keep printing new cash.

Instead, says Dalio, “the big question worth pondering at this time is which investments will perform well in a reflationary environment accompanied by large liabilities coming due and with significant internal conflict between capitalists and socialists, as well as external conflicts. It is also a good time to ask what will be the next-best currency or storehold of wealth to have when most reserve currency central bankers want to devalue their currencies in a fiat currency system.”

Dalio finishes the essay stating, “I think that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold. Additionally, for reasons I will explain in the near future, most investors are underweighted in such assets, meaning that if they just wanted to have a better-balanced portfolio to reduce risk, they would have more of this sort of asset. For this reason, I believe that it would be both risk-reducing and return-enhancing to consider adding gold to one’s portfolio. I will soon send out an explanation of why I believe that gold is an effective portfolio diversifier.”

Traditionally gold has been considered an effective portfolio diversifier. While the correlation between bonds and stocks tends to increase during uncertain times, gold usually becomes negatively correlated with other asset classes in such times. This means that the diversification benefits of gold may increase during times of turmoil, or as Dalio would say ‘when the paradigm shifts’.

Gold good. Bitcoin better?

Gold has performed well in 2019, and it recently hit a six-year high. Even so, gold’s returns pale in comparison to Bitcoin. By most measures, Bitcoin is the best performing asset on the planet across the last 10 years. There is a growing body of evidence that makes the case for Bitcoin’s potential to effectively diversify an investment portfolio, but also increase its profit potential.

Is Dalio bullish Bitcoin? When he says, “It is a good time to ask what will be the next-best currency or storehold of wealth to have when most reserve currency central bankers want to devalue their currencies in a fiat currency system,” is he open to the possibility of Bitcoin being included in this category? That’s not clear.

Several industry commentators have speculated that Dalio may be warming to the idea of Bitcoin, or perhaps he even owns some. Travis Kling, the Chief Investment Officer at the Ikigai Fund tweeted, “This is pure speculation on my part, but after reading this post, I would bet that Ray Dalio owns BTC. He couldn’t tell the world that right now or price would be at an ATH next week, but you can't be that smart and hold that view and not be bullish BTC.”

If Dalio does eventually warm to Bitcoin, he will be in good company. Jack Dorsey, Steve Wozniak, and Peter Thiel are other high profile Bitcoin bulls.

Dalio has commented on Bitcoin and blockchain in the past. In a video interview earlier this year he made the argument that there are two things a currency needs. It should be a medium of exchange and it should be a storehold of wealth. However, because Bitcoin is not widely accepted as a currency, and because Bitcoin is volatile, Dalio argues that Bitcoin is not yet an effective storehold of wealth. He goes on to say that he is very impressed with blockchain and that Bitcoin may yet be valuable.

“Bitcoin is a highly speculative vehicle based on blockchain, which is a very impressive technology,” says Dalio. “It’s very similar to what the internet was in 2000. The internet was a fabulous force, blockchain is a fabulous force and there will be cryptocurrencies produced by central banks as well as the marketplace. I’m sold on the blockchain as a great concept but which cryptocurrency is going to be effective and what that will look like is a whole different question. Bitcoin could be Blackberry, Ethereum could come along and replace it. Very interesting, very significant potential with the blockchain technology underneath it, potentially valuable.”

Dalio’s comments are open to interpretation, but it’s obvious that he is keeping an eye on the blockchain space to some extent, at least.

In his essay, Dalio argues that gold has the potential to be “risk-reducing and return-enhancing” for investor portfolios, in a macro environment where securities and bonds may face diminishing returns.

Or as Travis Kling describes it, “Current global macro landscape: Worldwide monetary policy irresponsibility, worldwide fiscal policy irresponsibility, Chinese capital flight, Government overreach, Big tech overreach. Couldn't paint a more bullish backdrop for crypto if you tried.”

Image Credit Ray Dalio at Web Summit by Harry Murphy/Web Summit via Sportsfile / CC BY 2.0