Bitcoin is the future for many crypto-enthusiasts, or rather we should say that cryptoeconomics is the future: a future that is sure that it has come to our world to stay one way or another. But this does not automatically imply that all cryptocurrencies and tokens are going to be part of that future, much less that all of them have only countless idyllic advantages and no disadvantages.

As in any progress or progress of any kind, there are obviously also some great disadvantages in the specific case of Bitcoin. Some of these disadvantages are already seen today, as its limitation of operations per second that various forks are trying to solve with so much internal controversy, and others we can only see them as an unpredictable future arrives.

But there is another disadvantage of Bitcoin that is already revealed as a major drawback in the era of global warming: the huge energy consumption that may be involved in maintaining those colossal Bitcoin mining farms.

How much energy does the Bitcoin ecosystem consume?

This simple question may seem to have an easy answer, and no. Nothing is further from reality. The truth is that estimating the total energy consumption that Bitcoin is absorbing is a difficult task. A task that has already been put to work some crypto-enthusiasts, aware that the energy issue can assume the Achilles heel of the entire Bitcoin ecosystem.

Practically all articles that put figures of energy consumption to the activity of the Bitcoiners, do so based on estimates from the Digiconomist website, which periodically publishes alleged consumption statistics with its "Bitcoin Energy Consumption Index". There are numerous analyzes that take this index as an axiom, in fact almost all of them. One of them, for example, was an article in the newspaper The Independent, or another from the website specialized in Motherboard technology.

But it is necessary to go a little beyond the purported rigor of some consumption figures that really may not have just foundation. The reality is that the "Bitcoin Energy Consumption Index" of Digiconomist is based on premises that imply really little accuracy in the figures of energy consumption that they publish.

One of the fundamental premises is to assume (surprisingly) that, on average, Bitcoin miners spend 60% of their income on operational costs, and that, of those costs, every 5 cents of expenditure implies a consumption of 1kWh of electricity . What is the empirical basis to be able to affirm that these assumptions are correct? The crux of the matter is that the rigorous justifications that support this assumption are conspicuous by their absence, so these figures should not be automatically adopted as an axiom.

So, this analysis will be limited simply to the maximum rigor that the available estimates predict: the minimum reference, the approximate order of magnitude, and its future projection.

As a mere preamble to the more detailed analysis that follows, it must be said that the Bitcoin ecosystem consumes a lot of energy, a "lot" for which it has become clear that it does not make sense to provide figures with millimeter accuracy, but a "lot" that is guaranteed in its order of magnitude due to the fact that there are markets like the GPUs (Graphical Processor Unit) that have literally been taken over by the demand of the criptomineros.

Your computer has a CPU (or Central Processor Unit), which is neither more nor less the central processor of your computer. But many years ago, due to the consumption of computing capacity that videogames began to assume, the hardware manufacturers produced specific plates for graphic operations, which were GPUs, with a processor and a specific purpose architecture. These GPUs have turned out to be a cheaper and more efficient option for mining cryptocurrencies.

And to such an extent this has been so, that the demand for these hardware plates has grown exponentially as the power and number of criptomineros farms, and even the manufacturers have released specific models for cryptocurrency mining. As a result of all this, the price of GPUs has multiplied by a lot, but there are also countries where it is practically impossible to buy GPUs from those dedicated to mining: all are monopolized by the insatiable miners.

For example, this happened recently in Russia, having reached the point that the bank Sberbank had to go out to publicly apologize for having monopolized almost all the GPUs available in the Russian market. And such amount of GPUs hoarded in the market, with the consumption that all of them suppose in an aggregate form plus that of the corresponding servers that house them, can only be the preamble of the detailed analysis of the following lines.

An alternative calculation of minimums that can be taken as a reference

Preferring to sin of conservatives in the figures to take into account, reputed and rigorous means as the Washington Post have tried to shed some light on this subject (or rather on their figures), and have consulted various experts in the field, publishing the figures collected from the sector itself.

Indeed, the figures provided by these experts in the sector are far from those of Digiconomist, and while the index of the latter yields an annual consumption of approximately 37 TWh per year, this group of experts estimates that Bitcoin needs a sustained power of between 1 and 4 GW. Obviously, the first obstacle is that the two previous figures can not be compared directly, since they are expressed in different units of measurement.

But only simple conversions are necessary to be able to make the correct comparison between both magnitudes. One thing is electricity consumption (measured in KWh-Kilowatioshora, TWh-Terawatioshora, etc.) and quite another is power (measured in GW-Gigawatios, Watts, etc.).

To clarify concepts, in simple words, the power is what is contracted in a home as the maximum watts that can be taken from the network at each moment: if they are exceeded, the differential jumps. On the contrary, the consumption is expressed in Kilowatioshora, and it is the consumption that one has of watios of sustained form during one hour. That is to say, a light bulb of 100 Watts of power during one hour supposes a consumption of 0,1Kilowatioshora (the "Kilo" obviously here also only adds a multiplier by thousands).

With this, the estimated figures for Bitcoin's global consumption can be re-evaluated. The power figure estimated by the Washington Post experts was in a range between 1 and 4 GW sustained, which translated to sustained consumption for one hour is between 1 and 4 GWh.

Now, to be able to make a comparison between the low stringent estimates of Digiconomist and those of these experts, and thus to know to what extent we are being conservative about what many media are taking as market consensus, we only need to transform those 1-4 GWh to the annual consumption provided by Digiconomist.

For this, obviously, we must multiply by the number of hours of the year, which is approximately 8,760. The 1-4 GWh is transformed into a fork between 8.76 TWh and 35 TWh. It remains to be seen how the fork defined by the experts consulted by the North American newspaper practically coincides in its upper end with the little rigorous (but consensus) statistics of Digiconomist.

To be conservative, and thus avoid falling into the same error of other means of taking those figures by consensus, we will take as reference consumption the lower end of the fork: 8.76 TWh, or what is the same, a consumption 4.22 times smaller than that of Digiconomist.

It seems to be a conservative approach, although it is not rigorous for the strictest personal and professional criteria, due to the impossibility of estimating the global consumption of the Bitcoin ecosystem with due rigor, only its impact on the world energy system can be evaluated. to a reference of minimums and order of magnitude. That is, the analysis will be addressed by defining the most favorable scenario for the Bitcoin ecosystem (which is inversely proportional to its efficiency and energy consumption).

And established the minimum figures, you can make the comparatives

Well, laying the foundations of the comparison, it is appropriate to enter into the comparison itself. Assuming this more conservative scenario, those resulting 8.76 TWh are equivalent to the annual consumption of a whole country of reduced size such as Lithuania, Paraguay or Costa Rica, according to the classification of countries by consumption. It may not seem excessive consumption in this context, but we should also take into account the small fraction that, in the end, is Bitcoin functionally in the whole of our socioeconomic system.

To assess is also the aggravating circumstance that Bitcoin's energy inefficiency is a mere design issue, and that such high consumption is really unnecessary. Thus, the matter already takes another aspect.

If in addition, in the equation of the comparison, we add that factor of the relative weight that should occupy the socioeconomic function of Bitcoin, we should enter to compare with the energy consumption of that company that plays a socio-economic role equivalent to Bitcoin, but in the traditional economy: VISA.

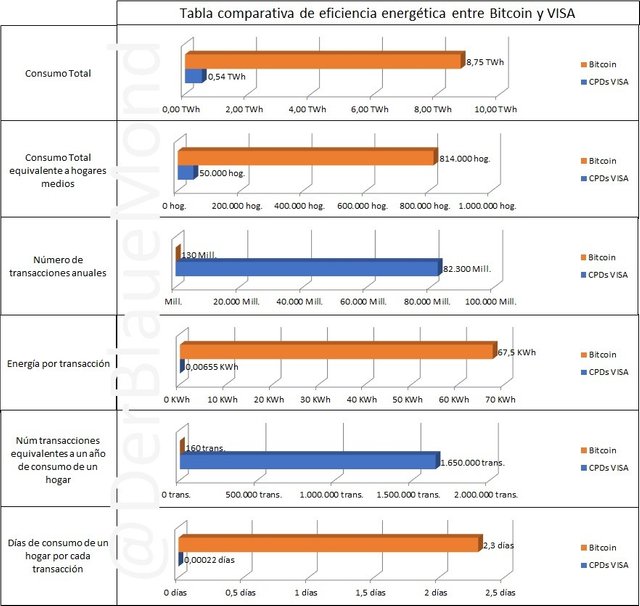

This comparison is already made by Digiconomist in the previous link, but it raises it with its consumption figures so little rigorous, and also raises it with some data that would be convenient to recalculate here in another way to make the central theme of today's analysis more evident . The necessary data is that of the consumption of all the Data Processing Centers (CPDs) of VISA, which is equivalent to the consumption of 50,000 American households.

According to the US administration, in 2016 an average household in that country made a consumption of 10,766 KWh. With this, our estimated calculations (to remember: of minimums and conservatives) imply that those 8.76 TWh of estimated annual consumption of Bitcoin equals the annual consumption of about 814,000 American households.

Indeed, the figures roughly match the quarter that was before the comparison of our figures with the KWh of the Digiconomist estimate, and for which the same page estimated a Bitcoin consumption equivalent to something less than about 3, 5 million American households.

That is, the multiplier again appears to be about four times more than our estimate of 814,000 households. The numbers fit together, making the comparison seem appropriate. The VISA CPDs consume what 50,000 American households, while Bitcoin (at least and today) already consumes what 814,000.

But, as always, comparisons are odious, especially when comparing pears with apples. If the previous comparison between Bitcoin and VISA is already overwhelming, in this comparison we can not fail to include the variable of the number of annual transactions processed by VISA and those processed by Bitcoin.

In 2016, VISA processed some 82,300 million transactions according to Digiconomist, which means that, with its equivalent of 50,000 households at a rate of 10,766 KWh per household, it means that each VISA transaction implies an average consumption of approximately 0.00655 KWh. Meanwhile, according to Digiconomist calculations that take into account the number of Bitcoin transactions, for their 37 TWh of consumption they get 285 KWh per transaction, which means that for our conservative estimate of 8.76 TWh, 67.5 KWh are obtained per Bitcoin transaction.

That is, a transaction with Bitcoin consumes 10,000 times more energy than a VISA transaction, and that is assuming the most conservative and Bitcoin-friendly scenario. The comparison is already totally hateful when, now comparing apples to apples, you have to, for that more conservative minimum scenario, with only about 160 Bitcoin transactions you would be consuming the same as a US home for a year .

This comparison should be put in context, and value all that the energy allows to do in a home during a year, comparing it in relative terms with those few 160 transactions. To put other equivalent figures that allow to value the data in all its magnitude, it must be taken into account that a single Bitcoin transaction consumes the equivalent of almost two and a half days of consumption of an average American household.

Or what is the same, with a simple transaction to pay for the bread every morning would already be consuming as much energy as a whole home in about two and a half days. A nonsense in terms of energy, especially when in addition to the bread should also recurrently transactions to pay for the purchase of the super, the gas tank, the butcher, and so on until a long etcetera that account for everything that a citizen pays half a day and week to week.

At this point, it should be remembered that our estimates are as conservative as possible with the available estimates. Although the approximation is not millimeter-accurate, the order of magnitude is also very significant and impressive. Now we can go on to analyze the possible environmental impact of this whole issue.

And why a high energy consumption can have environmental implications in the case of Bitcoin?

Well, the previous question is not trivial either, much less. It is also a totally pertinent question at this time. Actually, a high energy consumption does not necessarily imply a high environmental impact: everything depends on the energy mix of each country, or in other words, what energy sources each national energy system uses to generate all the electric energy that flows through its distribution network.

Indeed, the cost of energy is key in the profitability of Bitcoin mining. That is why, for example, there are mining farms that are established in the same hydroelectric power plants because the small differences in cost of being wall to wall (or dam to dam) with the energy source can mean a differential of profitability in mining more than appreciable.

So for example there is an Austrian company that is also included in the stream of miners who advocates feeding the Bitcoin ecosystem with renewable energy, as explained by The Verge.

Without subtracting an apex neither of merit nor of vision to initiatives like the previous one, the certain thing is that Bitcoin is a global cryptocurrency, that orbits around an ecosystem and a global community. This means that all socioeconomic agents of this ecosystem, in the absence of a global regulation that seems more than difficult to achieve, will seek the greatest efficiency in mining. And this happens inevitably and almost exclusively by mining where the energy is cheaper.

And this reasoning is not a theoretical reasoning that can not be contrasted with figures. It is a verifiable fact endorsed by reality and by the configuration of the current criptomineros community today. Currently, the vast majority of those huge Bitcoin mining farms, which have proved to be the most profitable and almost exclusive way to mine Bitcoin today, are located in China. And the Chinese generation energy mix is not characterized precisely by its status as renewable or sustainability: rather it is the opposite.

As the Bloomberg financial information website published, 58% of Bitcoin's mining farms are located in China. On the other hand, also in the previous article, it is explained how in addition the energy sources of these mining farms will be cheap, but they are very very polluting.

In fact, the cases that abound most are cases such as the cited Bitmain Technologies Limited, which owns a mining farm in the region of Inner Mongolia where there are 8 mammoth metal ships of 100 meters long each, which house in total no less than 25,000 servers, which mine Bitcoins 24 hours a day.

The entire Bitmain installation consumes energy generated with one of the most polluting energy sources: carbon black. And so there is a long list of mining facilities that only contribute significantly to global warming (which is already more than evident), in addition to raising the harmful levels of environmental pollution.

This is the reality of the generation of most of the energy that feeds the Bitcoin ecosystem, which has already been demonstrated before, which is nowadays a considerable consumption of energy.

And this is the current picture ... What if the projections for the future are included in the balance?

But what if, at this point in the analysis, the fact that the massive adoption of Bitcoin is currently barely residual as a means of payment is now introduced, and does it really have a long way to go before growth? It must be remembered that this growth will be so much in use by the population in general, as its infrastructure to serve so many millions of future potential users.

Undoubtedly, the only "but" to all this analysis can be to mention the day in which the maximum will be reached by design of 21 million possible Bitcoins. Surely many will say that then the energy and environmental impact will cease because there will be no more mining activity.

First of all, we must bear in mind that the complexity of Bitcoin mining increases considerably as there are more miners and fewer bitcoins to be mined, and with the complexity, energy consumption increases in parallel. That is why the scenario until reaching this limit of 21 million represents a non-negligible time horizon, especially because of the exponentially growing consumption that will exist until then.

Additionally, once the mining is finished by design, Bitcoin will continue to face inefficiency by design. While Bitcoin may not be as inefficient (forgive the redundancy) as the mining itself, it is true that its Proof-of-Work design makes it equally inefficient in its daily operations, which together with the massive adoption It will probably make the energy problem not only persist, but go to (much) more.

Paradoxically it is the distributed nature of Bitcoin that has made it a future solution for so many things, but now it turns out to be its own Achilles heel: the distribution causes each transaction to lead to the same Bitcoin operation involving a computational load that is multiplies proportionally to the size of the distributed network.

And the implications on the cryptoeconomy as a whole would be

But that Bitcoin is in its current design an activity of excessive energy and environmental impact does not have to imply that it will continue to be in the future. The design of Bitcoin can be modified in different ways, and it can not be ruled out that in the not too distant future the community may decide to undertake a fork that radically changes the current terrible carbon footprint of the Bitcoin ecosystem.

This is not to mention (today) other alternatives and ecosystems that are already in cryptoeconomy, and whose design is efficient in energy terms. In environmental terms, really, little can be done if the future mining or operation conglomerates are located in countries with low energy costs but with a black energy mix such as coal.

Here there could only be a halo of hope with some kind of international regulation that seems complicated with a decentralized cryptoecosystem by nature, and which is also one of its great advantages. Although the truth is that, if the ecosystem is efficient, you would already have a lot of earned land.

Bitcoin brings enormous advantages under its belt, but, far from achieving golden perfection, it also has some important drawbacks already present (and other futures to come). Like everything in our ever-changing world today, cryptoeconomics also has to continually reinvent itself to survive, and Bitcoin must already start rowing in the direction of energy efficiency.