It's no secret that Bitcoin has gradually built up different factions of people that have differing opinions on how transactions need to scale, or whether they should scale at all.

Bitcoin is proof of work, and as such the miners are ultimately the ones who decide whether a fork happens or not. But for them, this is a conflict of interest because higher transaction fees mean more profit for miners. Bitcoin is designed to find a new block on average every ten minutes no matter what the blocksize is, or how many transactions can be crammed into a block. If Blocks are 1MB, then the storage needs are kept low, while if block sizes were to grow exponentially, storage costs for miners would also grow exponentially.

Mining for Bitcoin is big business, with many bitcoin farm startups hardly staying in business unless they have cheap electricity, cheap real estate to house their operation, and a cold climate to remove the need for air conditioning. Large transaction fees for a congested Bitcoin network mean better profits and lower storage costs long term. Of course, mining for altcoins is a cheaper alternative, but Bitcoin is the prize horse for those with the capital.

So Legacy Bitcoin can handle about 3-5 transactions per second. cool.

If the entire BTC network was filled with Segwit transactions, you could in theory increase that limit with a 1MB block size by as much as double. cool.

But uhhh.... there's only one problem.

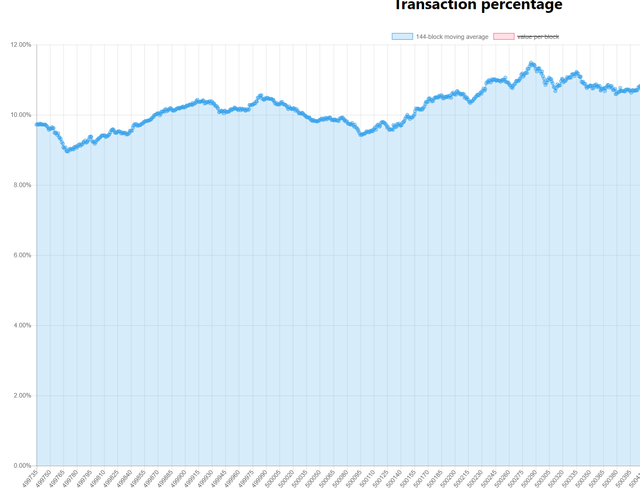

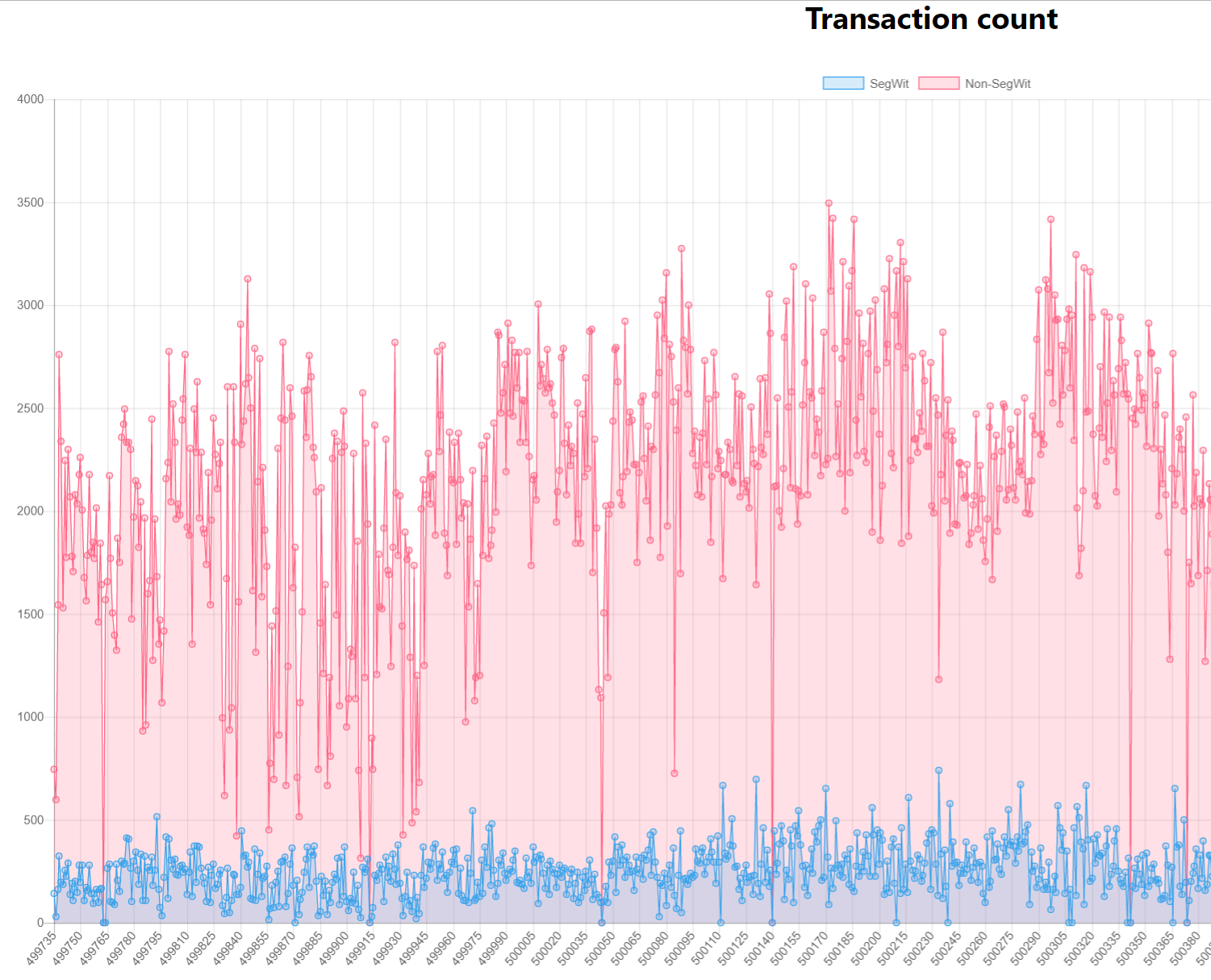

Yeah, Segwit only accounts for about 10-12% of active BTC transactions.

sources: http://segwit.party/charts/

As you can see, this means that BTC is -for all intents and purposes- still using Legacy Bitcoin, mostly unchanged since Satoshi placed the (what was supposed to be temporary) 1MB block size limit. Many of the big exchanges are still using legacy wallets, and the 10-12% of segwit addresses in use are likely smaller online wallets and personal hardware wallets.

This strengthens the case for Bitcoin Cash tremendously. It's been months since the big Bitcoin fork, and BTC has barely upgraded. Why? because it depends on user adoption. Bitcoin Cash on the other hand is a change to the mining protocol, allowing for bigger blocks and cheaper transactions overall. While not all miners will flock to BCH, this lack of adoption increases the profits for those that do mine BCH.

Yes, in the long term Segwit will get the adoption from big exchanges and transaction fees will go down slightly. But for now, BCH supporters claiming that BCH is the original Bitcoin... well, that's up to market speculation I suppose. For there to be "one" Bitcoin, the rest need to disappear. BTC is still trying to get people to adopt Segwit - many of which probably don't even know that Segwit only has 10-12% network adoption, while at the same time they are baffled by the large transaction fees.

Despite Segwit being purely optional, you would think that everyone but the miners would want segwit to gain full adoption. But big exchanges aren't chomping at the bit to get rid of legacy either. At least their reasons are justifiable, as the switch isn't cheap or easy to do quickly.

Time will tell if BTC can get unstuck between the rock and hard place it is deliberately sitting in. Futures markets being added to the mix only serve to justify leaving BTC as-is, and the emo politics of Roger Ver aren't helping BCH's image either.