So setting up your portfolio is one of the most important parts of crypto trading with a strategy in place. The first part of this article will focus on possible portfolio allocations.

If you are invested in crypto, it is probably because you believe in the blockchain technology itself or because you want to make money. Regardless of your initial motives, all should have a percentage of their portfolio for the long-term and the rest for your shill coins.

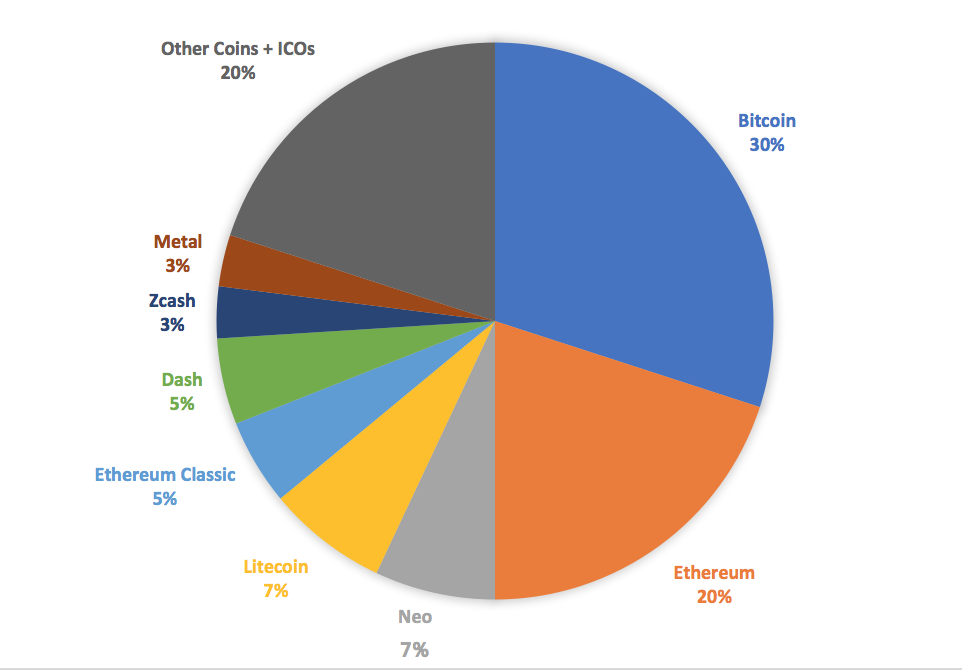

My personal opinion is that ~60% should be allocated to the big 3 coins with easy access to fiat: BTC, ETH and LTC. In particular, I recommend having 30% in bitcoin, 20% in ethereum and 10% in litecoin for example. Why these 3? As stated above, these three have access to fiat currencies in multiple exchanges, so it is very easy to switch to USD or Euro on coinbase for example in periods of extreme volatility (as we have experienced a few times). It is a hedging mechanism.

In addition, these three have the most mainstream media attention. Bitcoin and Ethereum are constantly being mentioned in financial TV shows and in news outlets, so it is safe to say that these 2 are here to stay for the time being. Because of that, I see them as a long-term investment. Litecoin has a great development team led by Charlie Lee and is just gaining mainstream attention. But, it is still volatile and younger and thus would not allocate as much percentage as the other 2.

More importantly, these 3 coins have access to many hard wallets (such as Trezor and Nano Ledger S) and other methods of safe storing instead of leaving them on exchanges. If you are planning to buy and hold any coins, find a way to store them out of the exchanges.

The other 40% of your portfolio should be allocated to your shill coins, those coins that you think will double soon or smaller projects that you believe in (including ICOs). There are over 1,000 tokens and currencies out there, and it is basically impossible to fully understand all of them and determine which are scams or not. What I suggest is to trade liquid assets (see volume amounts) on your trusted exchanges (polonium, bittrex, binance, etc.).

As stated above, with so many tokens out there, I recommend you stick to a few that you know are not scams and that have viable technologies and stick to trading those: buying low and selling high with the expectation that they will continue to grow in the long-term.

This is why you will here me rave about these coins: MTL, ARK, KORE, UBQ, QTUM, NEO, STRAT, STEEM, OK, RISE, XRP, POWR, CSNO, OMG, PAY, BAT, MCO, BTS, ZEC and a few others. These are the coins that I have studied and know how are traded.

As you can see, most of these are traded on bittrex, just to give you a feel of where I trade. Below is just a sample of a possible portfolio:

However, not all of these coins pose the same risks. BAT (Basic Attention Token) has been much more stable than OK for example. A simple comparison of their market caps ( ~235 million vs. ~18 million) will give you an indication as to why. Coinmarketcap is a good website to see these metrics. Usually coins with smaller market caps are more volatile. So be sure to look at the market caps before heavily buying a coin and be sure to KNOW YOURSELF and the amount of RISK you are willing to take. Thus I strongly encourage you put ~25% of your portfolio in these large-cap alt coins and the rest on your shill coins.

Hopefully this article gives you a better idea as to how to set up your portfolio. Let me know if you have any questions!

Remember don't go chasing pumps and HODL