As Bitcoin prices continue to skyrocket, analysts at Bank of America Merril Lynch have weighed into the debate around Bitcoin’s role in the global financial system.

The analysts said Bitcoin has benefited from a first-mover advantage, but expressed doubts about its effectiveness as a payments system.

“The most important technical issue, we think, is to do with the coin’s capacity to scale,” the analysts said.

The main road-blocks to scalability are that Bitcoin is still slow and expensive, relative to more conventional payment processing platforms.

Cost of transactions

The BAML team said for each Bitcoin transaction, miners charge a fee to validate the Bitcoin blocks. In the first quarter of 2017, the fee was $US2.40 per transaction — up significantly from US24 cents in Q4 2016.

“One of the reasons there is a fee is because the larger the transaction data size, the longer and more energy it will take miners to validate the data,” they said.

“Fees are not strictly enforced like transaction fees in normal banking, but if you don’t include appropriate fees, there is a serious risk that a transaction won’t be processed by a miner.”

In addition to the transaction fee, BAML estimates that the underlying cost of each transaction would be significantly higher, based on the economics of Bitcoin mining.

Right now, the reward for each new block mined on the blockchain is 12.5 Bitcoin. At current prices, that’s around $US75,000.

According to BAML, there are around 2,000 Bitcoin transactions in each block mined so based on that information, a baseline price of $US37.50 ($US75,000/2,000) per transaction can be derived.

While not calculating a specific figures, BAML said its likely the mining reward factors into the real economic cost of a Bitcoin transaction.

Speed of transactions

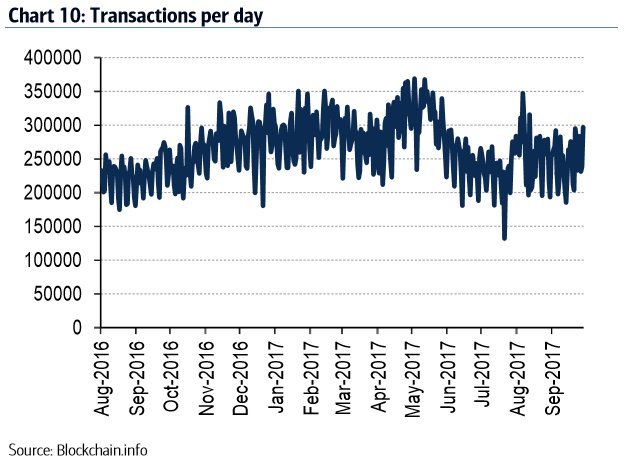

Turning to transaction speed, BAML said the median confirmation time for a Bitcoin transaction was around 10 minutes, and there are currently around 300,000 transactions per day:

As a comparative, BAML said Visa’s payment system processes an average of 2,000 transactions per second, with a maximum capability of 56,000 per second.

“Assuming 20,000 retail transactions are processed every second, it would take about 100 minutes for one second’s worth of transactions to be processed on the Bitcoin blockchain,” the analysts said.

That suggests significant speed upgrades will need to be developed before Bitcoin can be meaningfully adopted as a payments platform.

Comparing costs, BAML said standard transactions fees for transaction processors such as Visa and Mastercard range from 0.2% to 5% depending on factors such as the merchant’s size and location.

So taking into account Bitcoin’s $US2.40 transaction fee plus the 0.20% charge applicable in the incumbent industry, BAML said the minimum size of a transaction would have to be $US1,200 for Bitcoin to break even.

The bank’s conclusions follow research from Business Insider in August which showed Bitcoin is rarely being used as a form of payment, with most of the increase in transaction volume relating to Bitcoin trading.

“Bitcoin is a magnificent proof of concept that something like its blockchain can work,” the BAML analysts said.

“However, so far it looks to have not made much headway in its obvious agenda, to provide a ‘purely peer-to-peer version of electronic cash’.”

The explosive popularity Bitcoin and other digital coins has led an increasing number of analysts to consider their role of cryptocurrency the global financial system.

So far, Bitcoin appears to have more of a use case as an alternative store of value, such as gold. Whether Bitcoin and other cryptocurrencies will have widespread adoption as a means of exchange remains to be seen.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.businessinsider.com.au/heres-a-key-reason-why-bitcoin-will-struggle-as-a-payments-system-2017-10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit