All Bitcoins issued and fees of Bitcoin transactions are distributed exclusively through mining. Each miner gets rewards of the amount in proportion to a ratio of his/her hashpower to all hashpowers on average. For example, as of totay (July 27, 2017) about 12.5 BTC is mined every 10 minutes by the hashpower of 6,585,327 TH/s. If you have the hashpower of 10 Th/s, you can get about 0.000038 BTC (= approx. 0.1 USD) in 10 minutes.

A typical misunderstanding: If I can get 0.0000380 BTC in 10 minutes, I would get 2 BTC in a year! (A year = 365 days × 6 × 10 minutes) The purchase of 10 Th/s is less than 1 BTC. It looks very prospective investment!

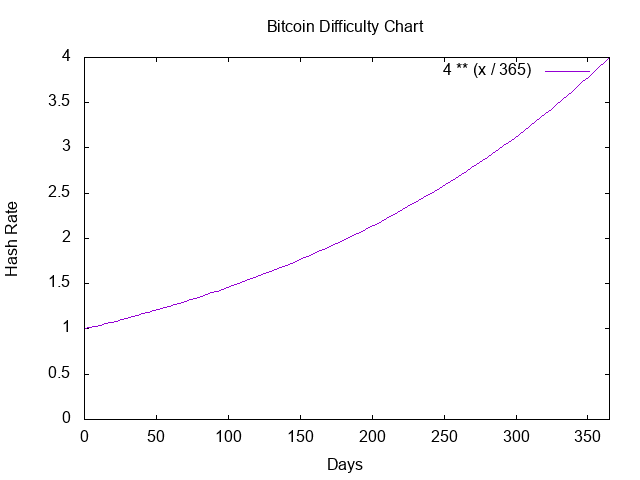

Actually not. The fact that most newcomers to mining overlook is that the Bitcoin hash rate has been increasing *exponentially*. At the moment, it increases by four times in a year[1]:

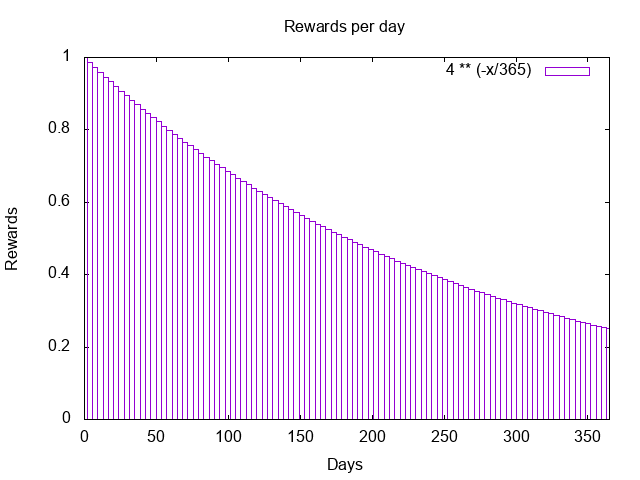

If so, the rewards will decrease accordingly:

Thus, if I can get 0.0000380 BTC in 10 minutes, I would get about 1 BTC in a year.

Hmm... It still looks moderate profit. In the coming posts, we analyze why it is not possible in specific environment of mining rigs or specific contracts of cloud mining (How profitable is Bitcoin mining? (Part 2) Analysis of Genesis Mining using an idealized model.).

You can calculate the ratio of an estimated reward with hashrate change to one with a constant hashrate by the following Ruby code:

k = 4.0 # Hash Rate increase per year

p 1.0 / 365 * (0..365).inject{|sum, i| sum + k**(-i/365.0)}[1] Hash Rate change for one year, https://blockchain.info/en/charts/hash-rate?timespan=1year