In the last couple of weeks we have seen the bitcoin market in certain places in the world like India and Pakistan trading at a premium of , at some times, $200 + a coin. Many people have asked why or how this happen if hypothetically arbitrage should work? I want to discuss how that actually happens , what will happen in the future and talk about how bitcoin might not be actually as widespread as we thought.

The basics of how the bitcoin price goes up 90% of the time is simple, demand is higher than the supply so the price goes up. This is what we saw in India the past few weeks, with the removal of certain denominations of money for a period of time before they could roll out other bills and comments made which seems like the nation will be cracking down on cash, it seems that many sought bitcoin as a speculative option that the perceived anonymity could help with their problem. This sent large amounts of people to the few bitcoin exchanges in India, who are more centralized exchange like platforms (think of coinbase or circle) rather than a full bid ask exchange. They lacked the actual liquidity to sell the amounts that were demanded so they had to start charging more for the coins.

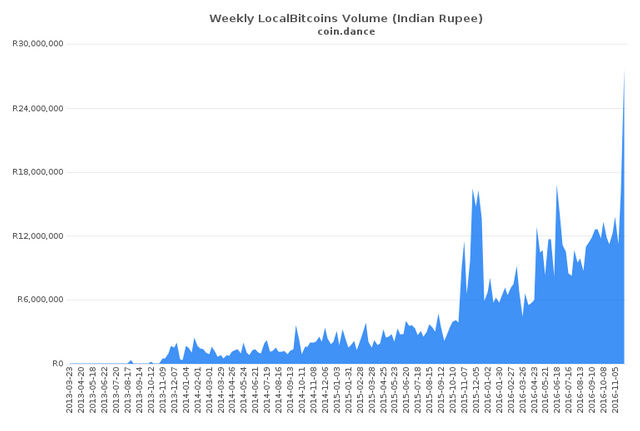

Hypothetically arbitrage should have happened and more bitcoin should have entered the market, but the lack of actual bid ask exchanges and the ability to pull out or trade rupees for bitcoin made that impossible. Instead the price continued to rise where it capped out at around $1,000. It has moved down since as the operators of sites like zebpay and unocoin have acquired more coins, but it shows that even still most of the coins in the world are unavailable to the developing world. It took only a small fraction of the volume a medium sized western exchange does, to push the price up a large percent. This is what many people talk about when they mean that we have yet to breach the world market as a whole.

If a country like India with 1.2 billion people, only had around 1000-2000 coins even available to buy, what do we expect for smaller countries that also want to buy coins. Despite being available for 8 years now, bitcoin’s exchange infrastructure still can be built upon for various other places in the world. We have localbitcoins, but many times sellers are few and far in between. Localbitcoins seems to be the best bet for people in developing economies, but it would also mean that someone would have to take the risk of bringing coins into the country to sell them to the public, because there are currently none. With most coins coming out of China and either being funneled to the United States or other western nations, it is hard for small developing countries to even get their hand on some.

I think in time this problem will sort itself out as if there is potential to make money , someone will capitalize on it. Also many countries still have no idea what bitcoin is and what benefits it could have for them, which , if trends continue, they will soon hear about it. As a store of value bitcoin might not be less volatile than gold, but in many places where crime and government intervention is a real problem, you could keep your private key hidden in a diary in the middle of a page and no one would ever know where to find it. I am and have been a proponent that we are still in the early days of bitcoin because the majority of the world still does not see what benefit it can bring. While I mostly see the store of value benefit and borderless payments aspect the most important, there are definitely other projects that are bringing utility to the blockchain.

I fully expect that, given enough time, bitcoin will start seeping out of countries like China and the US to countries that we consider on the outskirts of the modern world, which is where I believe bitcoin can be of the most value. I think India and Pakistan is just a start of what will become a large craving for bitcoin in the developing world. I listened to a recent podcast with Unocoin CEO Sunny Ray who says that their volume has been increasing at an exponential rate and still most of the country knows little about bitcoin. India is definitely an interesting place to watch right now and has potential to be another area where bitcoin thrives.

-Calaber24p

In itself monumental news... Let's see how far that goes to push forward the history making of cryptocurrencies. All for one and one for all! Namaste :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i saw one woman in a village using her cell to pay for items and she said everyone in the community had been taught to do it for the most part, so they haven't been much affected by the run on atms/cash crisis as of late... time for some crypto to the rescue?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post. It's weird to think that BTC can be so limited in different markets, but you're absolutely right. There are huge frictions in traditional money flows across borders and these def prevent arbitrage.

Here's a working paper i have on the same phenomenon:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2666243

I've considered trading on it, but overcoming the USD-BTC-other fiat frictions is tough in real life.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think you are right. As demand goes up you will see capital flows (BTC transfer) move to where the demand is. You could almost say that BTC is undervalued, because it has not reached maximum demand yet.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Liquidity is only an issue because INRBTC exchanges are greedy as hell.

Unocoin, Zebpay charge close to 10% when trading BTC for INR - this translates to ~$100 when you trade that BTC in. Why on earth would anyone use this channel as opposed to Localbitcoins ?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit