Found this other great article by Gordon Scott.

You might as well get used to the Bitcoin headlines. They aren’t going away. And that’s because cryptocurrencies like Bitcoin aren’t going away. If history is any guide, this may only be the beginning.

Bitcoin may be the most lucrative trading opportunity since internet stocks such as Amazon.com Inc. in the dot-com era. If that notion sounds as scary as it does exciting, it should. While it is true that trading digital currencies holds real risk, there is also a real opportunity for traders right now.

Please note that I said traders here, not investors. Even if it were true that investors could multiply their money, they would take that trade at the risk of great volatility. Since inception, Bitcoin owners have endured price drops greater than 75 percent of previous peak values. Most recently, during Bitcoin's 2017 June swoon for Bitcoin saw prices fall nearly 40 percent before bottoming out.

Amid the roiling price churn and innovation headlines, it is important to see the bigger picture. Bitcoin and all the other cryptocurrencies (yes there are others — over 800 and counting) are the start of something big. That’s because the blockchain, a technological accounting protocol, is an idea whose time has come.

In very simplistic terms, the blockchain is a set of thousands of interconnected ledger books where anything that gets updated on one copy of the ledger is copied on all of them. While that might sound like something you’d expect from the world of Harry Potter, it is a growing reality in the world of electronic payments right now. The implications for efficiency within and across any given political borders are quite staggering.

Whether it be land rights in developing economies or lower fees on e-commerce transactions, blockchain technology enables value transfer without a middleman and promises many more possibilities.The latest run-up in the price of Bitcoin is an indication that many more people are starting to believe these promises could actually be fulfilled.

But if the speed of these rising prices seems a bit too fast for your taste, consider that this has happened before — most recently with internet stocks and their rise leading up to the dot-com crash of 2000.

In those days some stocks clearly got caught up in the media, and some ventures never left the ground, but the stocks that rocketed to orbit, and stayed there, are the companies we rely on today.

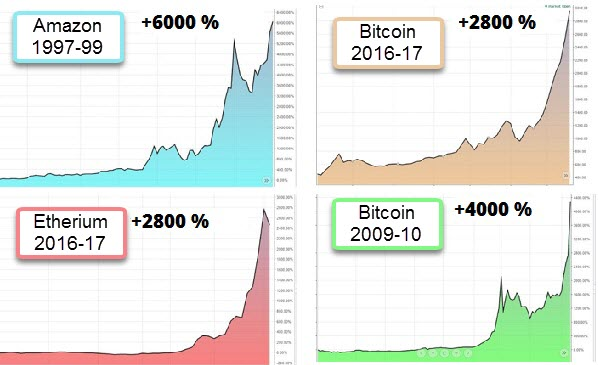

In fact, there is a worthwhile comparison between one dot-com of that time and Bitcoin prices today. Consider the following charts comparing Amazon (AMZN) shares from 1997 to 1999 (blue chart) with Bitcoin from 2016 to 2017 (tan chart); Ethereum, Bitcoin’s biggest rival, from 2016 to 2017 (red chart); and Bitcoin from 2009 to 2010 (green chart).

Charts comparing early Amazon Stock to Bitcoin and Ethereum's rise.

Investors were not able to fully and accurately quantify Amazon share value at first. Can you blame them if it was hard to analyze the idea of using supply-chain management software to create a virtual book warehouse and factory outlet mall synthesized into a single website?

Even by the start of 1997, everyone knew Amazon had a great idea, but no one could fully explain how much its shares should be worth.

Consequently, investors had to guess at the company’s value, notoriously overestimating the possibilities for a time. Amazon rose more than 6,000% in its first two years after its public offering. 18 years later the peak price from back then looks cheap by comparison today.

Surprisingly, Bitcoin’s performance in its first two years only achieved two-thirds of Amazon’s original run-up. The recent price appreciation of Bitcoin over the last two years and the price of Etherium since its initial coin offering have both made dramatic gains, but have yet to match Amazon’s meteoric rise.

It’s possible that cryptocurrencies are not only here to stay, but potentially a life changing mechanism for all of us. If that’s the case, then Bitcoin offers investors a multi-decade investment opportunity, rising like Amazon's market cap — and a price — that defies logic.