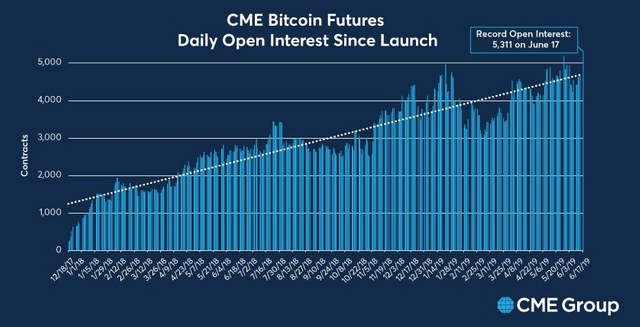

The Chicago Mercantile Exchange (CME) Group has published data showing that open interest in Bitcoin futures is increasing, according to an official Twitter publication on June 18.

According to CME, bitcoin open interest (BTC) increased on June 17 with a record high of 5,311 contracts for a total of 26,555 BTC, or approximately USD 246 million at the close of this edition.

Futures are standardized contracts that require a party to buy or sell an asset on a predetermined date. In particular, the CME group also observed in the Twitter publication that BTC futures seem to be gaining popularity among institutional investors.

Nikolaos Panigirtzoglou, an executive at the major US bank JPMorgan Chase (JPM), has also recently commented on a report on the status of bitcoin, stating that BTC markets seem to be increasingly influenced by institutional investors.

While CME is noticing an increase in interest and positions, Cboe Global Markets settled its last bitcoin futures contracts at 3 p.m. today, Chicago time.

Many have speculated that the recent announcement of Facebook's cryptocurrency will boost markets. Two days ago the social media giant published the white paper of his own stablecoin, Libra, which financial analyst Tom Lee says is a test of the community's interest in cryptocurrency.

BTC currently quotes around USD 9,290, which represents an increase of 2.55% on the day.