Bitcoin is one of the most important inventions in all of human history. For the first time ever, anyone can send or receive any amount of money with anyone else, anywhere on the planet, conveniently and without restriction. It’s the dawn of a better, more free world.

— Roger Ver, CEO Bitcoin.com

While there will be significant volatility in the price and valuation of bitcoin over the coming years, I strongly believe it and the entire asset class of cryptocurrencies will become a core part of the financial system within 3 years or less. There is enormous risk in trading these assets—more so than gold, REITS and other commodities—but the global market capitalization of cryptocurrencies ($148 billion today) I expect to pass $1 trillion by 2019.

Many of today’s coins will die off, and the ones that survive will be colossal in significance, similar to the way Amazon emerged from the shadows of the dotcom bust in 2001. If you don’t believe this core thesis, this article might not be for you, but I’d love to hear from you.

What I’m going to explain is a 10-step guide on how to research, buy and trade some of the major cryptocurrencies and enjoy some of their growth.

- Learn how blockchain works

Goldman Sachs says blockchain technology “has the potential to redefine transactions” and will “change everything”. But anyone who claims to fully understand how blockchain works, and is not named Satoshi Nakamoto, is probably lying to you. And anyone who claims to be Nakamoto himself, is probably also lying to you. Fortunately, just like the internet, you don’t need to know how blockchain works to use it.

But here are the basics… a blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. By design, blockchains are inherently resistant to modification of the data, and serve as a public ledger of transactions between two parties. To date, the best analogy I’ve heard for blockchain compares it to a Google Doc:

“The traditional way of sharing documents with collaboration is to send a Microsoft Word document to another recipient, and ask them to save the document, make revisions to it, and send it back. The problem with this scenario was that you needed to wait to receive a return copy before you could see or make changes to the document. You are locked out of editing it until the other person is done with it. That’s how banks work today—they maintain money balances and transfer money by briefly locking access to the account (or decreasing the balance) while they make the transfer, then they update the other side, then re-open access (or update the balance).

With a Google Doc, all parties have access to the same document at the same time, and the most up-to-date version of that document is always visible and editable to all parties. This real-time shared Google Doc is just like a distributed blockchain ledger. The “real version” of the transaction is verified by analyzing all the available blocks on multiple computers and taking “the average”.

The decentralized and transparent nature is what makes blockchain highly secure and almost impossible to hack, because a hack to one ledger would cause a discrepancy in the entire network that will be ignored. Functionally, to hack the ledger one would have to hack all the computers on a network at the exact same time in order to change the “average”. For a currency like bitcoin, this would mean millions of computers. So the larger the network, the more stable the currency.

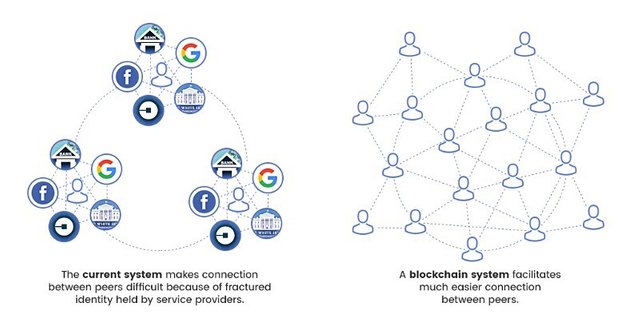

Current payment systems require third-party intermediaries like Google, Facebook, banks and government agencies to process transactions, and many charge high fees for doing so. A blockchain system, however, allows for faster direct payments between individuals and can even support micropayments.

“Blockchain solves the problem of manipulation. In the West, people trust Google, Facebook, and their banks. But around the rest of the world, people don’t trust their corporations as much. Blockchain opportunities are the highest in the countries that haven’t reached that level [of trust] yet.”

—Vitalik Buterin, founder of Ethereum

- Learn the top currencies

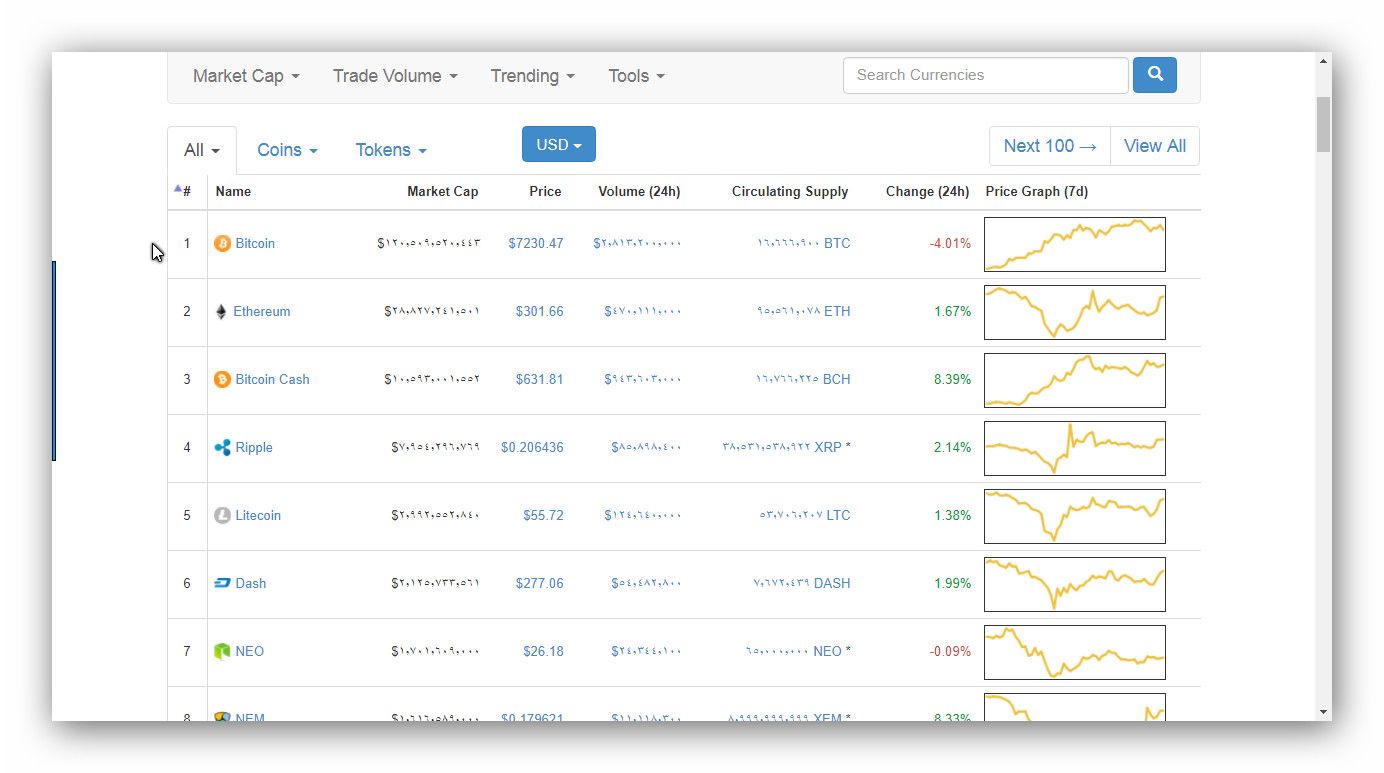

Bitcoin is here to stay. But the world of virtual currencies is getting crowded with many other “altcoins”. There are over 100 types of cryptocurrency that sell for more than $1 USD, according to CoinMarketCap. Even more are in penny-stock range, but I don’t recommend trading them right now.

What’s important to note is that bitcoin accounts for about 50% of the entire cryptocurrency market, and has the highest volume. It is undoubtedly the most important currency today. You’ll also notice a difference between the original version of bitcoin, Bitcoin Classic (BTC), and a newer version of bitcoin, Bitcoin Cash (BCH). Bitcoin Cash is a spinoff off of the original bitcoin blockchain. I’m not going to get into the technical differences between Bitcoin Classic and Bitcoin Cash, but understand they are separate currencies. So far, Bitcoin Classic seems to be favored by the public over Bitcoin Cash, and has an 8X higher market cap. But when people say “bitcoin” (lowercase) they could be referring to to either currency.

The other two currencies I would pay attention to are Ethereum (~40% the size of Bitcoin, also known as “Ether”), and the smaller and more volatile Ripple and Litecoin. Despite a smaller market cap, Litecoin enjoys higher trading volume than Bitcoin Cash and Ripple, likely because it’s one of the three currencies accepted by the #1 digital currency wallet, Coinbase.

- Understand all inherent risks

Bitcoin is more volatile than practically any other type of asset, including gold or the stock market. Cryptocurrency is still a young technology, and faces many challenges. While I believe the overall trend for bitcoin is upwards, trading this currency comes with considerable risk. Bitcoin prices are highly impacted by public sentiment about the currency. It will continue to fluctuate as companies and financial institutions make decisions of how to incorporate (or not incorporate) it into their businesses and workflow. It’s also highly sensitive to regulatory changes, as I will get to in a minute.

To give an example, in early June 2017, Bitcoin was trading at $2,983, before losing 30% of its value a month later in July—crashing to $1,992. Then it climbed up to $4,764 in September.

the Chinese government announced a few days ago that they are banning all organizations and individuals from raising funds through Initial Coin Offering (ICO). They barred all banks and financial institutions from doing business related to ICO trading. This is significant news, although not a surprise to many people, as representatives from the People’s Bank of China and China Securities Regulatory Commission had previously criticized ICOs as an unauthorized fundraising tool that may open the door to financial scams. (I will explain ICOs in the last section).

The news of the ICO ban in China had bitcoin trading down 12%, Ethereum down 23% and Litecoin down as much as 32%, as shown below. So don’t go throwing your entire savings account into Litecoin just yet, and being bullish long-term doesn’t mean it will get there smoothly.

There is also risk inherent to the exchange itself. Just like the cash in your wallet, the safety of your bitcoins or other currencies depend on your own diligence. While your bitcoins cannot disappear, the transactions are permanent and can only be refunded by the recipient. This means you should only do business with people and organizations you know and trust, or who have an established reputation.

Remember, bitcoin transactions are stored publicly and permanently on a network, which means that anyone can see the balance and transactions of any bitcoin address. However, only the bitcoin exchanges and/or the parties involved in the transaction can attach the addresses to a real person. So for the most part, the transactions are anonymous.

Other trustworthy exchanges I considered before deciding on Coinbase were (in no particular order): Bitsquare, Bitstamp, ShapeShift, Kraken, Poloniex, CoinMamma and Gemini.

For a full list of exchanges by country, click here--- https://bitcoin.org/en/exchanges

Read bitcoin news every day

Here are some great websites to bookmark for bitcoin news and discussion boards. The combined content here could keep you busy for at least a year.

Coindesk

Bitcoin Magazine

Business Insider

The Street

Coin Telegraph

Cryptocoin News

Quora

CNBC

Brave New Coin

Reddit

Bitcoin Talk

Crypto InsiderOpen a brokerage account

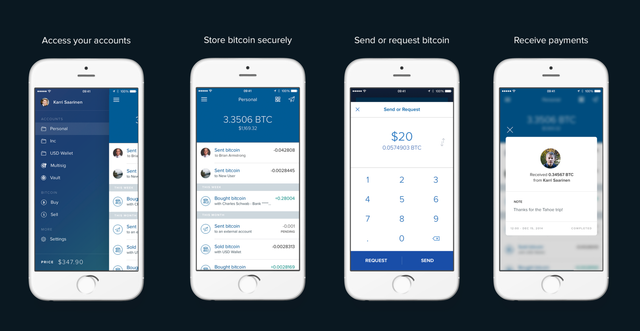

Coinbase is one of the most trusted and well-known exchanges for buying and selling Bitcoin, Ethereum and Litecoin. They are essentially a digital wallet for your cryptocurrencies, and their iPhone and Android app make sending currency and tracking prices super simple.

Coinbase link --- https://goo.gl/kX4k6A

What I like about Coinbase is they meet all the regulatory requirements in the countries they operate, and they have two distinctly separate but integrated products: Coinbase for buying and selling bitcoin or sending them to friends, and Global Digital Asset Exchange (GDAX) for more advanced and precise trading.

Previously, the GDAX was called the Bitcoin Exchange, but mid-2016 they decided to rebrand. From a product standpoint, you can tell they built GDAX with their own engineers, as the user experience is similar to Coinbase.

You can signup for Coinbase using my referral code, and you’ll get $10 in free bitcoin to play around with.

I would start by making a Coinbase account, then graduate over to GDAX once you feel comfortable. You can instantaneously transfer currencies between the two exchanges for free, which is really nice.

- Fund your account

Once you create an account on Coinbase (or another exchange), you will need to verify your identity by uploading a picture of your drivers license or passport. This only takes a few minutes, then you can fund the account.

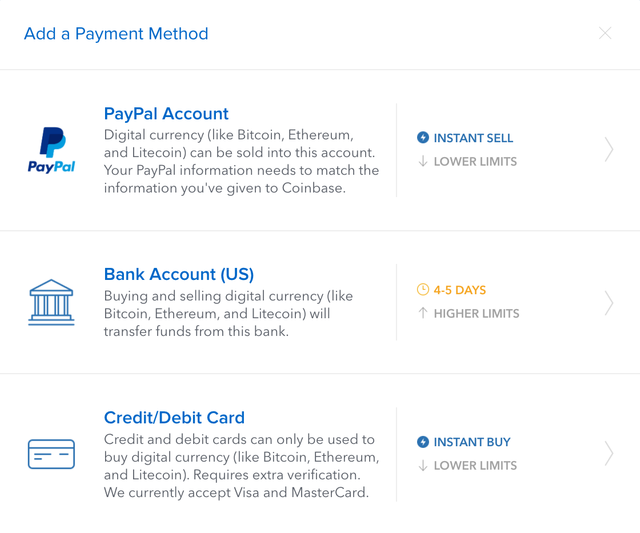

To add a new payment method, go to “Settings” and “Payment Methods” on the dashboard. You can choose a bank account or a credit/debit card. The bank account has higher limits, but takes longer for the funds to settle. The credit/debit card has lower limits, but the transactions happen instantly. If you go bank account route, you will need to verify two deposit amounts on your account. I personally did both—I funded the account with a few grand from my checking account, and thanks to my impatience I also put few grand on my credit card just so I could get started right away.

Keep in mind, Coinbase charges a 3.99% processing fee for all credit card transactions. I’d recommend using a credit card that gives you at least 3% cash back so you can offset some of the fees (I’ll cover the fee structure in more detail in the next section). You can use PayPay for selling currency, buy not buying currency; for PayPal the funds are available instantly but have lower payout limits. The bank account is usually your best bet.

- Buy and sell some bitcoin!

Once your account is funded, you can go ahead and make your first purchase. Remember, you do not have to purchase coins in full units. You can buy coins in fractions as low as one hundredth of a millionth, or about less than one-tenth of a cent at current prices. That makes bitcoin and other cryptocurrencies easy targets for speculation.

Coinbase does not charge to transfer bitcoin from one user to the other, which is the point of blockchain. But if you want to transfer money to or from an outside exchange, such as a US bank account, Coinbase charges a small conversion fee. The charge is 1.49% with a $0.15 minimum if you are using a bank account and 3.99% if you are using a credit/debit card. I’d try to avoid funding with a credit card unless you get ample reward points to offset the higher fees.

For a full breakdown of their fees, click here --- https://goo.gl/KfGoEC

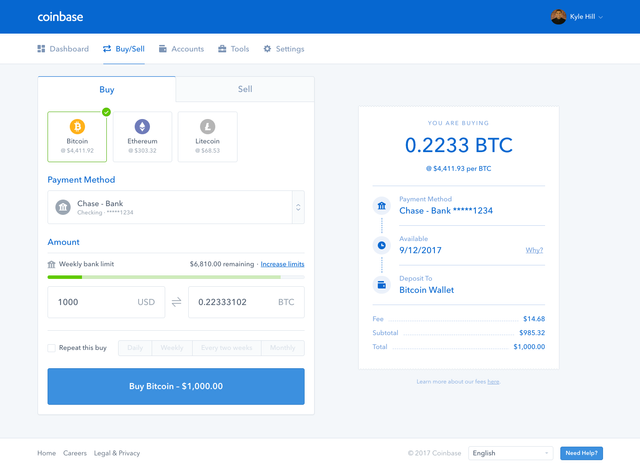

Lastly, if you choose the bank account payment method, the funds take 4–5 days to settle, and you are locked into the market price of BTC at the time of purchase. In the case above, I am buying 0.2233 BTC at a price of $4,411.93, totaling $985.32, and I’m losing $14.68 in fees. I am guaranteed that price regardless how long the funds take to settle. Coinbase essentially buys the bitcoin at that time and saves them for you in a virtual vault, and releases them in your account once they receive the funds from your bank.

- Graduate to bittrex

Once you’ve bought and sold a few bitcoin on Coinbase, you should graduate to the big leagues. Coinbase’s more advanced trading platform is called the Global Digital Asset Exchange (bittrex). It uses the same login and password as Coinbase, and you can easily transfer currency between the two platforms, which is really convenient. The bittrex features a pretty interface with real-time pricing data, order book, charting tools, trade history, and a simple buy/sell order process so you can at least pretend to be a pro.

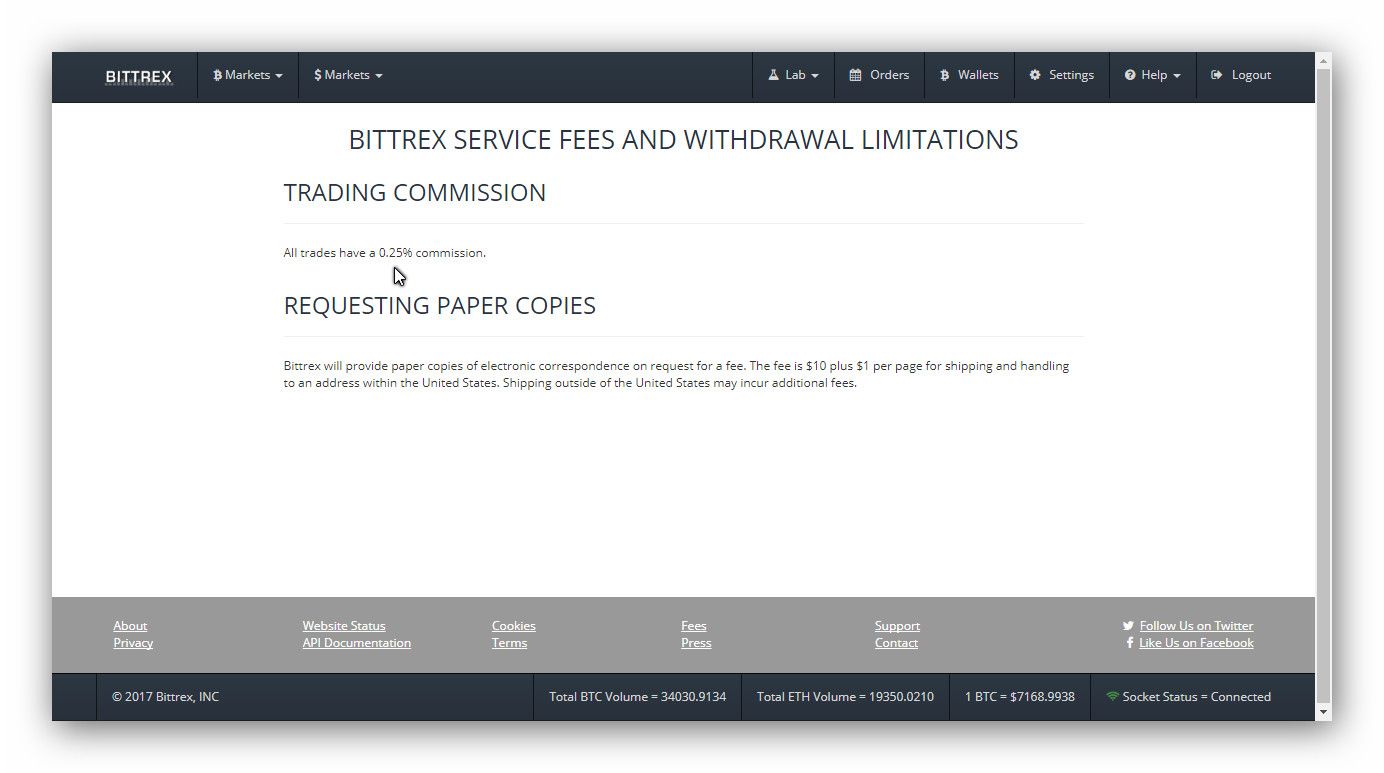

Once you’re comfortable with bittrex, you probably won’t use Coinbase anymore. bittrex charges lower transaction fees than Coinbase—only 0.25%

- Study charts to find trends

If you, like me, believe that bitcoin and the entire market capitalization of cryptocurrencies will increase in value over time, then the goal is to collect as many coins as possible, getting in at the right prices, and build a strong diversified portfolio of crypto assets that you can hold.

In order to do this, you must “buy the lows” and let the profits run. I’d recommend entering and exiting positions gradually in case the lows get lower or the highs get higher. Avoid buying/selling in big emotional or reactionary swoops, and try not to trade more than a few times a week to keep fees down and give your bets a chance to perform.

There are many other strategies traders use to predict trends, which I won’t get into today. These include Head and Shoulders, Trend Lines, Support and Resistance patterns and Candlesticks. Here’s a great article explaining each of these in a little more detail. Within the GDAX dashboard, you will find a price chart that looks similar to the one above, accompanied by four other sections in the same viewport:

The Price Chart in tradingview.com shows historical prices and volume data in two views: a line chart and candlestick chart (recommended) over various historical time frames.

The Depth Chart below the Price Chart shows a detailed visual representation of the bid and ask prices over a range of prices. You can increase or decrease the price range for the chart by using the plus or minus buttons of the chart. The price in the middle of the chart is the midpoint price between the best bid and ask prices. Moving the cursor over the prices will allow you to select a price in which you can create an order. Clicking the price will fill in the buy/sell price for you automatically in the left sidebar. This chart is a useful to see how close buyers are from sellers in their ask/bid prices; the greater the surface area under the curve, the more bids there are at that price.

The Order Book shows a live view of open orders on the entire Coinbase exchange, in what’s called an order ladder. There are three columns that show the market size, price and order size of each order. You can click any row and it will fill in the buy/sell price for you automatically in the left sidebar. Once you confirm the order, it will immediately show up on the order ladder and attempt to get filled.

The Open Orders section shows status of each of your open orders. It also shows filled orders. You can easily cancel any order at any time.

The Trade History on the right shows all completed orders.

The Open Orders section shows status of each of your open orders. It also shows filled orders. You can easily cancel any order at any time.

The Trade History on the right shows all completed orders.

On the upper-left (below) you will see a dropdown to change the currency.

The primary goal of these charts is to determine the general direction of the currency over a specified time period, and the prices at which you would be willing to buy and/or sell the currency before it takes a correction.

It’s important to specify a time horizon for your investment—such as short term (7–14 days), medium term (1–2 months) or long-term (6–12 months). I don’t recommend trading on time horizons shorter than 7 days unless you have access to margin (you probably don’t) or have large amounts of money to play with; otherwise, the fees will be too high relative to the returns.

- Set limit orders, and be patient.

Once you are ready to place an order, you will accept the market price or set what’s called a limit order. Limit orders provide investors and traders with a means of precisely entering a position without being victim of fluctuating prices. For example, a buy limit order can be place for $2.40 when a stock is trading around $2.50. If the price dips to $2.40, the order is automatically executed. If it’s a GTC (good ’til canceled) order, it will remain open until manually cancelled by the investor.

Once the limit order is set, be patient. Give the price time to fluctuate—testing highs and lows—and see if your limit order catches a buyer (or seller). There is no hurry to cancel you limit orders, so resist the urge to rapidly change your limit order prices. Many experienced investors will set multiple limit orders at consecutively lower prices to take advantage of a big selloff or take some profits when the price tests a new high. Limit orders are your best friend, use them.

There are other more advanced limit order options.

Conclusion

In future articles I will discuss in more detail some of the strategies I’m using to set my limit orders. But hopefully this article serves as a comprehensive guide to getting started trading cryptocurrencies on an exchange.

One advice I’d give beginner traders is to avoid falling for ICOs, or Initial Coin Offerings, in the short term and stick with the more established currencies like Bitcoin, Eurotheum and Litecoin. According to MarketWatch, an ICO is “a fundraising means in which a company attracts investors looking for the next big crypto score by releasing its own digital currency in exchange.” The ICO is similar to a initial public offering (IPO), but with a crypto twist and (as of now) no regulatory hoops to jump through.

A total of $1.6 billion have been globally raised via ICOs already, but as I mentioned, ICOs were recently banned in China, so the Securities and Exchange Commission (SEC) is receiving immense pressure to propose similar rules to regulate the ICO phenomenon as well. So any US-based companies planning their ICO might want to reconsider. You can find a comprehensive list of upcoming ICOs on CoinSchedule.com, although I recommend that you look but don’t touch. Now it not the time for ICOs.

Any question you would like to ask

I will be glad to answer

Do not forget our support for the upvote

channelcom for profit

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@kaleazy/10-step-guide-for-day-trading-bitcoin-ethereum-and-litecoin-79123673957c

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello & Cheers!! I'm a content detection and information bot. You are receiving this reply because a short link or links have been detected in your post/comment. The purpose of this message is to inform your readers and yourself about the use of and dangers of short links.

To the readers of the post: Short links are provided by url shortening services. The short links they provide can be useful in some cases. Generally their use is benign. But as with all useful tools there are dangers. Short links can be used to hide all sorts of things. Quite frequently they are used to hide referral links for instance. While not dangerous this can be deceptive. They can also be used to hide dangerous links such as links to phishing sites, sites loaded with malware, scam sites, etc. You should always be extremely cautious before clicking on one. If you don't know and trust the poster don't click. Even if you do you should still be cautious and wary of any site you are sent to. It's always better to visit the site directly and not through a short link.

To the author of the post: While short links may be useful on some sites they are not needed on steemit. You can use markdown to format your links such as this link to steemit. It's as simple as

[steemit](https://steemit.com)Unlike short links this allows the reader to see where they are going by simply hovering over the link before they click on it.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Could you use the limit function on bittrex when it comes to selling as well? Like, can I set a price I want to sell at and make it a “good till cancelled?”

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit