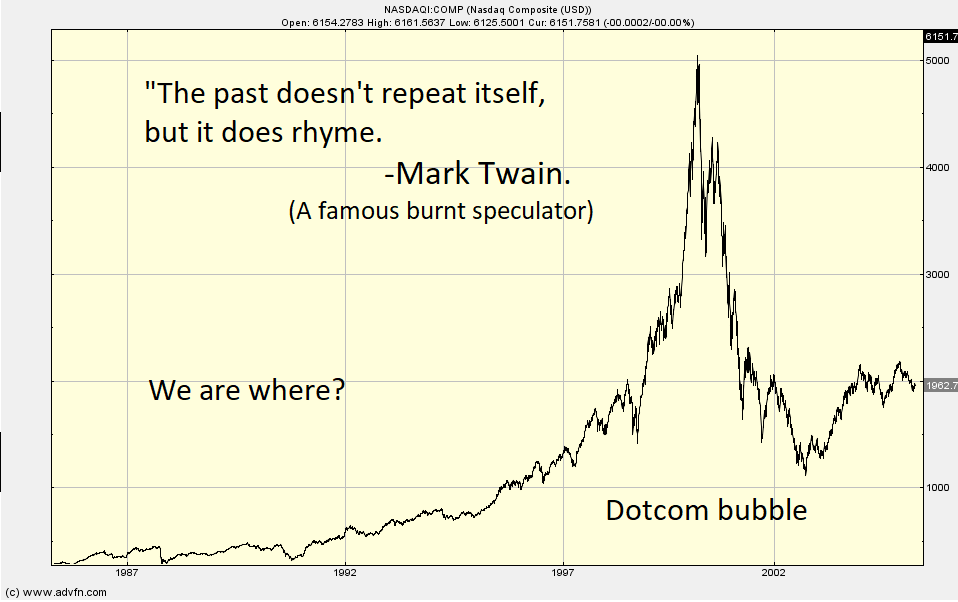

History doesn’t repeat itself but it does rhyme. Mark Twain.

When the dotcom crash kicked into high gear an old broker said to me, “well that’s it for another generation of investors. There will not be another stock market boom for 25 years.”

He believed there was a financial market bubble once per generation. When it burst that damaged generation avoided the stock market for good. It would not be until the fresh meat of a group of people uninfluenced by the last crash came to financial maturity that the cycle would repeat itself.

Well here we are. Another cycle is underway, but it is not in the stock market, it is in a new market: Cyptocurrency.

But wait before you start to say, “this time its different,” This new cycle is not all bad news.

Bubbles do not create Armageddon, just a legion of people moaning about how it wasn’t their fault they lost their shirt.

Even though the Tulip Bubble was the mother of bubbles, billions of dollars of Tulips are still grown every year in Holland and auctioned in Amsterdam. There are very rich Tulip growers.

Amazon, Apple etc are worth billions more than they were in 2000. New dotcoms have risen worth hundreds of billions.

Wall Street, post 1929, did not disappear and continued to be the financial heart of the globe.

Fortunes are made in bubbles and the aftermath of a crash is never an extinction event.

Tulips bubbled, Fiat money bubbled many times, Autos bubbled, electronics bubbled, Radio bubbled, the interwebs bubbled. Bubbles are as unavoidable as rallies and corrections; they are just part of distribution curve of financial events. They are created by people not things.

No one should argue whether Crypto is a bubble, they should worry instead about how to make optimal money from the trend and how to make and keep money through this immensely chaotic period of growth.

Here are five rules distilled from the experience of the Dotcom boom that should help.

- Don’t believe its real.

It might be real; it might almost certainly be real but treat the whole phenomenon as a mirage. At some point in the cycle a large proportion of the audience will throw away all concerns, skepticism and rational considerations and go ‘all in.’ Everything will go haywire, even by Cryptocurrency standards. This will ring the bell that the grand finale is near of the first and most spectacular part of the revolution: the boom, bubble, bust.

- Don’t call the top.

A bubble goes vertical and there can be seen no clear top on the way up to it. It’s a little easier to see it after it has happened but its still tough, until the top is long gone. To best capture the top you have to ride it past the unknowable peak and take theoretical paper losses by riding the fall by a pre-planned amount.

Here is an ancient book on a technique you can use: “How I made $2,000,000 in the stock market” by Nicolas Davas. http://amzn.to/2td7Qu3

It is a classic from the 1950s stock market bubble and outlines techniques to ride exploding values in any market.

A market can go boom way past anyone’s expectations and slump back when you aren’t even awake. This reality is already here in Cryptocurrencies. The key is to have an exit strategy in place and when your criteria are met, you must pull the trigger.

If you want to practice take a look at the Nasdaq from 1998-2002. It is a strong generic model for what happens through a bubble. Don’t forget to zoom right in and notice the rise looks ballistic at many scales. You can take a look at Apple and Tesla too to see various permutations of booms and bubble. These charts are previews to the hindsight everyone will get after its too late.

Don’t confuse a bull market with your brains.

However much you are making, however cool your Crypto-expertise voodoo, never think you are winning because you are smart. This is a golden rule in investing. In Tennis they say, “no matter how good you are there is always someone better.” It is always true in finance. Stay humble, stay rich. As you make all this money, it’s the bull market making it for you, not your superior intelligence. Hubris is lethal in finance, bad newspapers headlines and jail cells are full of hubristic finance people.When you start to get extremely nervous about your positions take some off the table.

You might call cash, ‘fiat’ with a curl of your lip, but a pile of Benjamin’s will look great on the table in front of you. When you can’t sleep and you find yourself scouring the web for clues about tomorrow and whether you will be skinned alive, take some risk off. You can do this in many ways.

Sell an arbitrary bit of what worries you, and repeat the process every, day/week/hour, until you are relaxed about your position.

Top slice; cut a fat chunk out of your position that is immediately sufficient for you to relax.

Sell the whole position, put it into cash and look at it. Then put the amount back up to your comfort point. If you sold what you have now, but then wouldn’t want to buy back in again, you should sell it anyway.When Uber drivers start talking to you about how much they’ve made in bitcoin.

When the media starts reporting how Bitcoin is worth more than all the real estate in Tokyo and the janitor is telling you how they made $5000 in bitcoin last month, the end is weeks away. Media consensus that something is ‘going to the moon’ or for that matter is ‘dead forever’ are wonderful contra indicators. Sell the Janitors good fortune and short the mainstream media’s sudden epiphany.

So if you see Janitor bitcoin millionaires on CNN saying Bitcoin is now bigger than NASDAQ, its time to smile and sidle over to the exit.

Remember nothing ever bubbles and then vanishes. There will be fortunes to be made after a crash, when the real winners from the revolution emerge. Take a look at the post dotcom crashes history. It’s a road-map to wealth.

All Cryptocurrencies likely future trajectories have already played out hundreds of times in the stock market and a good model is the tech booms cycle of 1992 to 2002. Those who forget the past are doomed to repeat it. But the past is actually a treasure map to the future.

Build yourself a thesis and benchmark it as events unfold. There will be winners, there will be losers. History tells us being in the former is pretty tricky. It even trickier if you don’t treat the process as a pure skill game.

I think cryptocurrency is still a very small world, so this bubble/bust cycle will not be the last. It won't stop until your mom starts asking about it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very good article. Thanks for sharing!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

totally agree :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"When Uber drivers start talking to you about how much they’ve made in bitcoin." --- Yep this is basically what I'm waiting on too. Right now, so few are aware of what the cryptospace is. We're far larger than we were in 2013 when the first real bust happened, with entire industries sprouting up to support the space, so an immediate pop of the bubble isn't likely IMO. However, the day that everyone around us is talking Bitcoin (or whatever the poster child is at that point) then it's time to start cashing out for sure. As for now, we should just enjoy watching the boom/bust cycles repeat on a monthly/bimonthly basis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazingly this is still early days in my opinion. Which is wild when you consider the value already created. I will be writing more on here and trying to pass on my general market knowledge while keeping up with crypto nuances.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I feel like from March through June alone I've lived through an entire generation of life. It's been moving so fast, yet... yeah so much further to go. Amazing time to be alive :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good post. I also think we are in the early stages of a crypto mania. I made some money in the early 2000s tech mania by selling 20% of my shares in a pre-IPO stock at 10 times purchase price. Intended to sell the rest of my sweat equity post IPO, but it did not happen as we did not float in time. It was clearly a mania and I was keen to get out. Most investors held on and lost all. Most people can't see a bubble when they are in one because they don't study market history.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its hard to see a bubble when you are in it. :) ... the key is to have a strategy to cope.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit