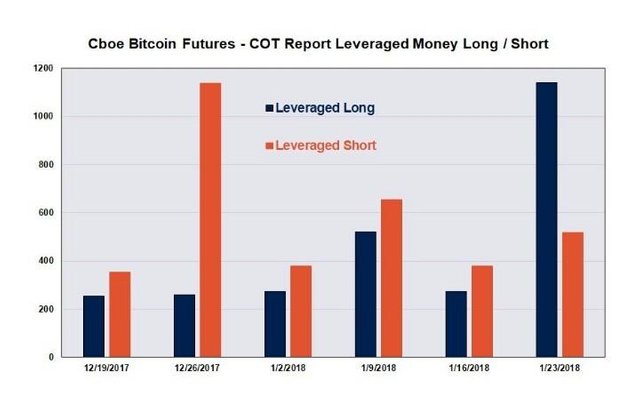

This week’s CFTC report states that leveraged positions show 1,142 contracts are ‘long’ (betting the price will rise) while only 518 contracts are ‘short’ (betting the price will drop). The data is in stark contrast to the weeks prior when Cboe contracts bet way more ‘short’ as contract counts indicated shorts overwhelmed longs 4 to 1.

Awesome data, where did you pull it from?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks mate. Got this from CTFC website. Lots of data now available on bitcoin futures from the CME, the CBOE and the CFTC.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I looked that up but I had a tough time finding the data, would you mind providing a link? I'm by no means lazy but I was on the site for a couple hours last night trying to pinpoint where it was and didn't have much luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

http://www.cftc.gov/MarketReports/CommitmentsofTraders/HistoricalViewable/cot011618

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit