The times are crazy, weird, and wondrous. A blind man will get bucketsfull. Did I say weird and wondrous?

The 10,000 year wind is at our backs, this changes (nearly) everything —

- “everything” centralized will be not or to be repurposed, and everyman's value will be trustlessly measured/quantified, and with his own branded token/s

- every governance will be on the blockchain or embedded in the network

- the 10,000 year wealth model will be flattened and equalized — everyman and node will have access to the entire network resources, as much as he is responsible and can handle

…and the 2nd great flood will wash over us…are we ready?

A rising tide makes no competitors and enemies collaborators, and suppliers and clients partners.

Scarcity begone

Current economic model is rooted in bias to scarcity of and constraints on availability of resources and their access. Tokenization and decentralization moves us closer to the free energy equivalent of the new value generation and discoveries. The western capitalism economic model (with Adam Smith as the prophet) with the compounding debt servicing model at its core “naturally” favors the selection and use of the scarcer resources over the abundant in order to more securely securitize and serve the debt.

Randomly

The fiat world itself is a Proof of Stake system + the bias of a centralized zero sum game and further gamed by its authority over the supply and demand.

March 19, 2018 US Congress Releases Extraordinary Report Praising Cryptocurrency and Blockchain Technology

Oracle sees 10% of the Global GDP will be stored in blockchain technology by 2027.

What is expected to happen for the All-ins

We have lift off, few more days to escape velocity.

“Wealth is never destroyed”. Migration of the world’s wealth from the hub centers and intermediary gates to the edges…resistance is futile.

Some $400 B (Jan ’18) is the market cap of all the crypto-currencies — vs. — the some “the $ 8 Tril in Gold; the $80 Tril in all the fiat currencies/liquidities” and “The capital markets are valued at 118 Trillion…while the derivatives market that leverages assets, including the ones from capital markets, are estimated around USD 1.2 Quadrillion…”

In “10 years” — if say 50 / 50 balance of the cryptos and fiats, then $40 Trillion marketcap for cryptos or 100 x from Jan 2018. No upper limit perse, and this is the difference from stocks which has geometric growth ceiling. We are at the beginning of the 2nd inning, we are already up 100x, 8 more innings to go.

New — mother of all — zero sum game alternative is going on in the — sociopolitical and economic context#H3

The current fiat world is the father of all zero sum game. It violates the law of thermodynamics.

Its hub and spoke model was built over millenniums. Such architecture and the energy requirement for its construction and to hold the structure is exponential to the net new value creation. We are at the tipping and the decision point of the model for its further continuance and existence. If to continue, its new energy needs will be in orders of magnitude. The toll would be unacceptable. The society needs to implement the alternative energy model being recently demonstrated — which will repurpose the energy hedl in the millennium structures and also then uncap the creativity energy and new value creation, and this rising tide will lift all.

A new alternative and wrapper has been created “around” the current zero sum game and entropically - the hub structural wealth is being mined and migrated (for some, plz excuse the attendant pain), however new sources of wealth and entropy aligned models are being discovered and created as well. Examples are the coming tokenization and funding raises for public infrastructure developments and public budgets; and for public officials, delegates and politicos.

tl;dr:

Miko Matsumura “…we reached a point in our civilization of peak centralization”. Wrap a target hub or hubs and let the new model extract the values — shorten the distance between A to Z or the effect to the cause — the more gates and larger the hub/s, the bigger the opportunity, e.g. Ripple. The value flow from the edges to the hub is being reversed.

Btw, the payments for the new value are in the fiat for the “waste”, i.e. the miners exchange fiat for the electrical power. The PoW is not wasteful — Veriblock asks to do the comparative energy waste comparison on a societal level, e.g. to compare the cost of the of the creation, storage, transfer and handling of a crypto vs. the same for fiat and all its related costs- — plz stop this memeing.

“In addition to transportation, information and other costs, the biggest cost of the market is the lack of trust”…”for the first time in human history, the blockchain has given the human core issue, the problem if trust a complete solution…”(Fusion white paper).

“Venezuela” or “Africa” tokenization

The more structured and resourced based economy a nation or region is, the easier to tokenize it.

This can be done without the political unification and avoid the hard questions, and at a lower levels in the economy. A starting formula could be to give the existing power structure the equivalent stake in the country, region, sector or segment being tokenized and liberated. E.g., the top 1% could be given control of 80% of the tokens of the resource backed tokenization in trade for their acquiescence, and the pie will grow bigger for all and rebalance over a generation painlessly.

Alternatives or additional to the political national borders could be other organic, lateral and shared socioeconomic values expressed through tokenized marketplaces.

The value to the tokens is created at least in two ways

From the “mining” of the values from the existing centralized hubs or value or authority handling chains (stock, title, etc. transfers) due to the efficiencies of the tokenization; and the other is the creation of new values from the users or the edges by the shorter distance between the cause and effect and enabling greater collisions. It is important to empower the users and to frame the system to be enable creation of net new value for the ecosystem, instead of just relying on the value migration from dissolution of the hubs.

Three factors that hammer Bitcoin price down

Regulator FUDs: Chinese banning Bitcoin in Dec. 2013, the SoKo restriction and on trading in Dec. 2017, the SEC possible regulation of exchanges in Mar 2018; the regulatory restrictions on the fiat to crypto flows, add the FB and Google bans on crypto ads for good effect; and the bounce effects of the regulation FUD being removed lifting as in “Bitcoin Soars $1000 Off The Lows After G-20 Rejects Crypto Crackdown”.

The space— hacks and crack ups/events, systematic risks: Mt Gox, DAO, etc.; deliberate opaqueness or worse, of some services (e.g. exchanges, USDT).

The space fundamentals / profit taking; and the rising realization now that majority of the recent ICOs may fail; user/market adoption timing.

“94% network effect” — Tom Lee.

“the burst of the bubble is attributed to fundamental events: In 2011, for example, the bitcoin exchange Mt. Gox was hacked, which resulted in a 88% decrease in the cryptocurrency’s price. In 2013, China banned financial institutions from using bitcoin, which caused bitcoin’s market cap to drop by 50%, and two weeks later Mt. Gox shut down. Similarly, in the end of 2017, South Korean regulators threatened to close local cryptocurrency exchanges, which triggered a steep decline in prices. However, the fourth and most recent bubble was much longer, and it is plausible that the triggering factor, which resulted in the bubble’s bursting, was bitcoin’s all-time high price of 20’000 USD. In other words, bitcoin collapsed under its own weight.”

https://hackernoon.com/are-bitcoin-bubbles-predictable-6aa5b830f41a

https://www.zerohedge.com/news/2018-03-18/are-bitcoin-bubbles-predictable

A Blockchain (Enterprise) Primer

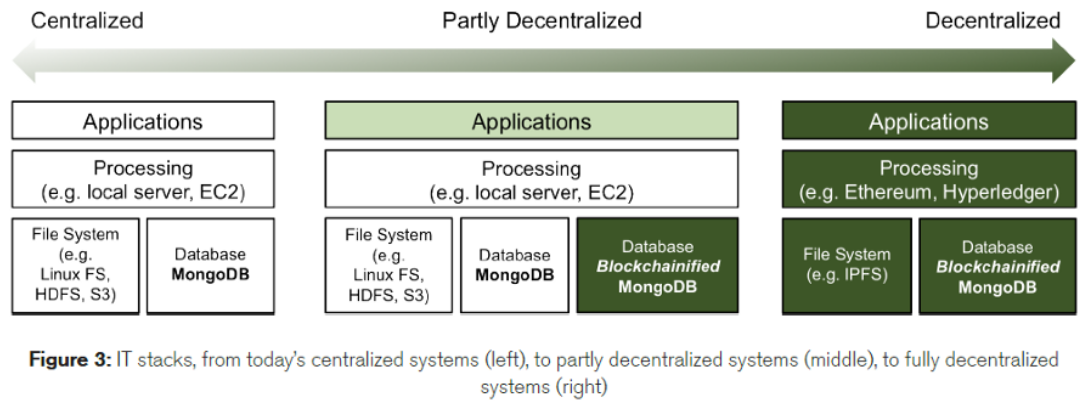

“…Now as we approach the 2020s, we are moving towards mass adoption of blockchain technologies. The blockchain movement removes friction along three key axes: control, trust, and value, which in turn unlock new applications & opportunities:

Control — in the new model, multiple entities share control, that is, the system is decentralized. A fully public blockchain network acts much like a public utility. Or, in consortiums, different parties (even traditional competitors) can more easily share data infrastructure to the benefit of all participants. Finally, even a single enterprise can dilute risk by having multiple system administrators share control of that organization’s IT infrastructure.

Trust— in the blockchain model, writes are considered immutable to enable tamper-resistant audit trails, for applications from supply chain tracking to art provenance, from financial auditing to food safety. It also gives a single shared source of truth, which simplifies applications from financial reconciliation to tracking music rights.

Value — now, one can issue and transfer assets, without reliance on a central entity. For example, you own (and can transfer) the bitcoins at an address if you have the private key at that address. This concept works for almost any digital or physical asset. Accordingly, there are significant opportunities to streamline and better-secure registries and exchanges, such as land registries and stock exchanges…”

Source: Building Enterprise-Grade Blockchain Databases with MongoDB. Nov. 2017

The path and pace of innovation is imminently discoverable and quantifiable: the path — remove the involuntary exertion including cognitive, destination is all voluntary time, all the time (yup, that’s it — whenever you are stuck look for that move); the pace —based on state of the art, unamortized sunk costs, agendas. Then Alice asked, what will we do with all that time?

Congratulations @chungmojo! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit