A little over a year ago, Bitcoin bounced back from one of the worst price drops in recent times. At the same time, the first cryptocurrency was on the verge of entering a new age of acceptance that would drive it to new all-time highs within the next few months.

From an annual low in 2020 of around $ 3,700 per BTC to $ 10,000 in September 2020 - to finally $ 52,640 at the time of this article. Bitcoin , with a gain of 478% since the middle of last year, has proven why the coin is one of the best-performing assets of the decade.

Around this time, from March to June 2020, the software company MicroStrategy bought its first coins. The company's CEO Michael Saylor celebrated this decision in a recent post on Twitter.

According to Saylor, the world economy is tending towards inflation due to the monetary policies of the major central banks. Hence his decision to invest a large part of the company's value in a store-of-value fund.

When deciding whether it should be gold or Bitcoin , the managing director chose the latter because of its characteristics. Saylor is a well-known bitcoin bull - and so far his bet has paid off too.

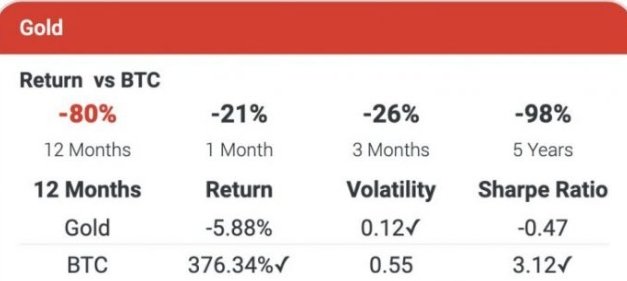

As the graph below shows, if MicroStrategy had invested in gold instead of Bitcoin, it would have lost 80% of its value within a year if the initial investment of more than $ 2 billion had been in gold. In the past 30 days it would have lost 21% of its value.

Data from BitcoinTreasuries.org shows: MicroStrategy owns over 100,000 BTC, or 0.5% of the total supply. As seen above: The investment has grown in value by 376.34% in one year.

MicroStrategy outperforms gold because of its bitcoin investment

Further data provided by Ecoinometrics suggests a correlation between the performance of the MicroStrategy (MSRT) share and the Bitcoin price. Since the company launched its BTC treasury program, its stocks have risen 428%.

Bitcoin and MicroStrategy have managed to outperform two of the major stock indices, the NASDAQ and the SP500. The former has a 68.3% gain while the latter has seen a 54.8% gain since the software company announced its BTC treasury program.

MicroStrategy has become a BTC price proxy for many companies, banks and hedge funds that want to legally get involved in cryptocurrency. Giants like BlackRock, Capital Group, Morgan Stanley, The Vanguard Group, and others have massive positions in the company.

MicroStrategy and its CEO met distrust from many in the crypto community. Many expect the company to throw its BTC on the market when the opportunity arises. To these statements, Saylor replied that he plans to hold Bitcoin "forever".

Undoubtedly, the company was able to start a movement that has led BTC to new highs in terms of price and adoption. Tomorrow El Salvador will introduce the Bitcoin standard. The country is officially in the list of Bitcoin holders - right after MicroStrategy, Tesla, Square and others.