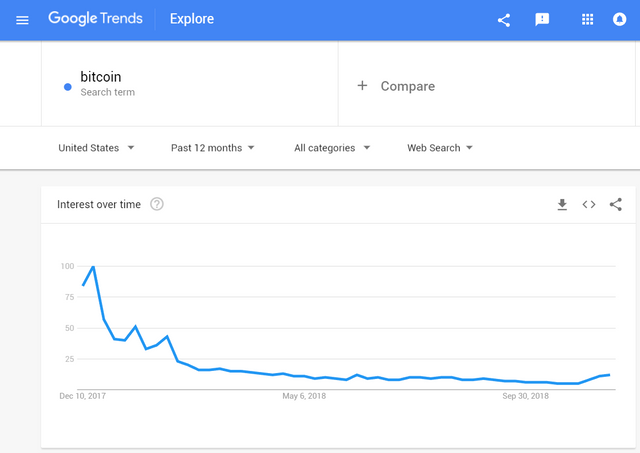

Let's look at the search for Bitcoin keywords. Google gives a trend graph of search data for about a year. Then, starting in November, the popularity of Bitcoin is a bit hot.

Let’s take a look at the trend of Bitcoin at the same time.

Obviously, these two trends have a certain consistency. In the first half of Google search, Bitcoin price fluctuated greatly, while the middle Google search was cold, Bitcoin was in the sideways position for a long time. After November, Bitcoin resumed discussion heat due to the plunge.

When Google search index grew significantly, it all predicted that the price of Bitcoin would change drastically, that is, Bitcoin will soon change.

This change is of course up to date.

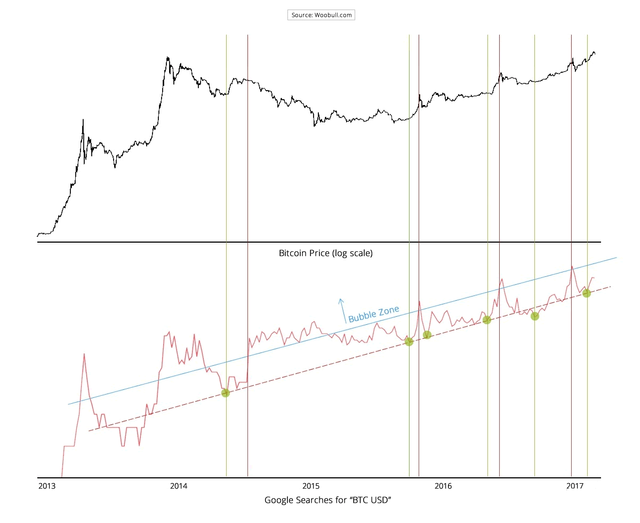

American venture capitalist Willy Woo believes that if Google's trend of Bitcoin is used well, it can accurately determine the market bubble.

The low amount of “Bitcoin” trend search volume that lasts for a long period of time is an obvious purchase benefit. This indicates that Bitcoin is in a period of severely underestimated by the market;

The long-term over-searching heat indicates that Bitcoin has entered the late stage of the bubble and may call back at any time.

Based on this theory, Woo compares the price movements of Bitcoin from 13 to 17 March with the adjustment of Google Trends (see chart below).

In the figure, the green dot shows the time when the bitcoin search is relatively weak, and it is suitable for purchase at this time; the red dot is the search for the high time, which is suitable for sale at this time!

Congratulations @costaer! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit