One Reddit user suggests that selling 5% of your Bitcoin in times of "extreme greed" yields a higher ROI than simply holding it.

DCA's Tested Strategy Suggests It's More Profitable to Sell BTC Under 'Extreme Greed' NEWS

Selling a share of Bitcoin

BTC

tickers down

€59,115

when the market is in a state of "extreme greed" it proves to be a more profitable investment strategy than buying and holding, according to one Redditor's analysis.

On March 21, Redditor u/skogsraw shared an analysis that found a greater return on investment (ROI) using the Crypto Fear & Greed Index to dictate a dollar-cost averaging (DCA) strategy compared to a DCA strategy standard.

u/skogsraw's "benchmark" strategy involved investing $100 in Bitcoin once a week, starting March 17, 2018, through September 9, 2023, resulting in an ROI of 124.8%.

The second strategy involved a tiered DCA plan, with the purchase of $150 of Bitcoin every week during periods of "extreme fear", $100 if in "fear", $75 if in "neutrality", $50 if in “greed” and $25 if in “extreme greed.”

The third strategy was the same, but involved selling 5% of the Bitcoins accumulated each week if the price found itself in the "extreme greed" zone. This strategy proved to be the most profitable, with an ROI of 184.2%, compared to the benchmark of 124.8% and the no-sales strategy of 140.1%.

Results of u/skogsraw's five-part test measuring BTC ROI with various trading strategies. Source: Reddit

The Redditor did not specify the reason for choosing the dates, but believes that it would not have been fair to set a market low or high. The period covers at least two large bear markets and one bull market.

User u/skogsraw, however, acknowledges that the tests were not cross-checked and stresses that they need to be conducted across multiple timeframes.

u/skogsraw's results do not take into account network fees for Bitcoin trading, which often peak during periods of "extreme greed."

"In any case, these are very convincing results in favor of adapting the DCA strategy. I hope they will be useful to you during the next bull markets!".

The findings align with the Crypto Fear & Greed Index's thesis that market corrections typically occur when investors become too greedy.

u/skogsraw also ran two other strategies – “AlphaSquared Risk Model DCA” and “PI Cycle Top Indicator” – which produced ROIs of 385% and 332.4%, respectively.

Some critics, however, have questioned the results of these two complex data-driven trading strategies.

Related: Crypto Greed Index Hits Highest Level Since Bitcoin's $69K ATH

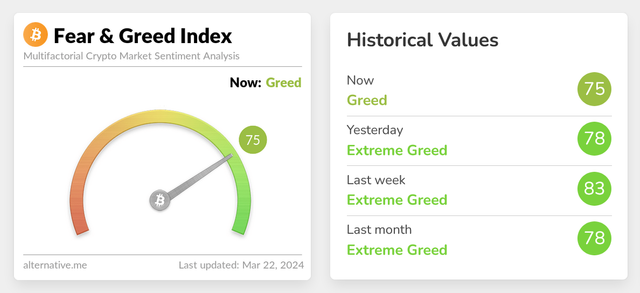

The Crypto Fear & Greed Index score is currently 75/100, in the "greed" zone.

Since March 5 – the date on which it recorded 90/100 or “extreme greed”, the highest score since February 20, 2021 – the level has dropped by 15 points.