While Bitcoin is a platform for sending money from one person to another, it is decentralized, requiring a type of incentive to keep the system going. It comes at a great cost, and this has to be repaid somewhere. Bitcoin block rewards are only set up to be a temporary payment model, rather than permanent, with the end goal being survivability through the collection (and paying out) of fees.

The Order of Transactions

Transactions are given a "weight" of sorts to determine which ones should be prioritized in any given block, with those that have the highest weight being first. There are a few things that go into this calculation, which are:

- Size (in kb): this is the actual data makeup of the transaction, comprised of metadata, inputs, and outputs

- Age: as the input coins get older, they gain more weight

- Fees: the more you pay, the more weight there is

Once you send out a transaction, these calculations are all going, and the weight will continually grow due to the age. However, fees are designed to help get you to the front of the line faster.

How to Determine Fees

One of the best parts about Bitcoin lately is that pretty much every client automatically determines the average fees you need, which is done by evaluating the blockchain's backlog, seeing what fees other people are paying, etc. From Android and iOS applications to Web wallets and things like Trezors and KeepKeys, it's not really something you need to worry about anymore. However, you should be aware of the fluctuations.

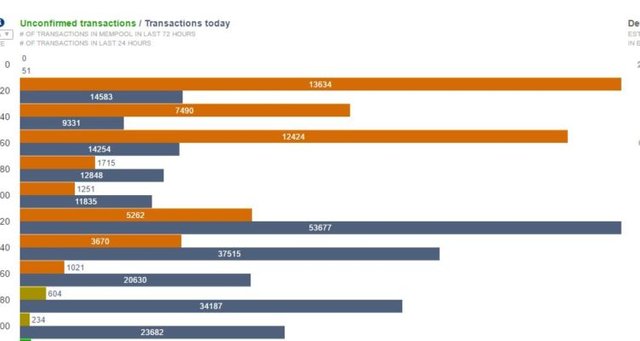

As the blockchain becomes more filled, fees required for a speedy transaction start to go up. A normal fee may be 220 satoshi/byte, but this could go up to 1k+ at some points. This would take the average transaction fee (of around 0.0005 BTC) and bring it up to 0.005 – or a boost from around $0.85 to $8.50 as of this writing. That is a huge jump.

If you aren't in a rush to get funds out, something you can do is check out a fee calculator, such as BitcoinFees. This tells the fees needed at any given moment and allow you to see if it's a good time to send or not. And most clients will further tell, based on your transaction specifically, how much they want to charge prior to sending it out. Do note that if you wait out the backlogs, the fees will return to sane levels again and you can send cheaply once again!

Who's Getting These Fees?

Unlike sending a transaction through Western Union or another system, the fees in Bitcoin aren't given to any company. Instead, they are attached to transactions and whoever solves the next block gets them all. And the best part about this is that because Bitcoin is decentralized and anyone can mine it, that means even you could potentially get them. But what this ultimately means is that there is no central authority that is deciding what fees should be paid, when to increase or decrease them, etc. Instead, it is a truly free market, where it's the senders that are making that decision – as demand goes up, the cost goes up, and as demand goes down, the cost goes down.

Picking Custom Fees

I want to close this out with a note about custom fees. You are absolutely able to decide how much you want to pay, overriding the fee calculator of most clients. However, you really don't want to. The calculators are designed to work out the most optimal fees based on getting your transaction through in a decent amount of time. Can you pay less and have a delay? Yes, but you may also find that it never goes through due to being too low priority. The safe road is to watch the average fee and just time your send in conjunction with it being at a decent level for you, rather than taking the risk and overriding it.