ICO’s or initial coin offerings are popping out of the ground like mushrooms. How to select the diamonds from an oversupply of ideas and even scams? Where you can find “easy money”, there will be scams. Other risks to your purchases could be inexperienced entrepreneurs/teams, and opportunists without conscience that just want to give it a go with a basic idea and a lot of marketing. However how and where you spend your money is your own responsibility. There are multiple indicators that can help figure out if an ICO is a potential winner, or something to stay away from.

A recent ICO were we bought tokens during the ICO phase was NAGA (NGC). This was at the end of 2017. We bought for $1 USD and it is currently trading at $2.4 USD. It went as high as $4 USD in the first week after it hit the first exchange HitBTC. NAGA is a good example of a successful case. We expect that this cryptocurrency will now further develop in a more mature and solid backed currency. Why:

- Team: The team behind it is backed by Roger Ver (advisor) who was an early Bitcoin adopter and the key persona behind Bitcoin Cash and Bitcoin.com. Also a global leading Chinese investment group (Fosun) is a key investor.

- Market focus: It focuses on a unique niche/part of the market (Gaming and Trading)

- News: in general there was quite some news and information available online. In this case there were also a couple of very negative articles. Just make sure you check the source of those articles and then try to filter.

- Distribution and activation: Naga has an own ecosystem that connects to an existing framework. Switex for gaming and virtual goods. SwipeStox for trading.

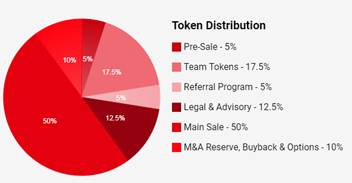

- The numbers: The numbers make sense. They have raised over $50 Million USD in the ICO. They have a clear planning and distribution of the funds and the maximum amount of tokens that will be in circulation.

Source www.nagaico.com

- Exchanges: Which exchanges will support this coin. The moment it will go to HitBTC, Bittrex, Binance, Kraken, Poloniex, Bitfinex you can be sure that there will be enough volume when it gets traded. Naga started on HitBTC and will go to another 5 exchanges in the coming period.

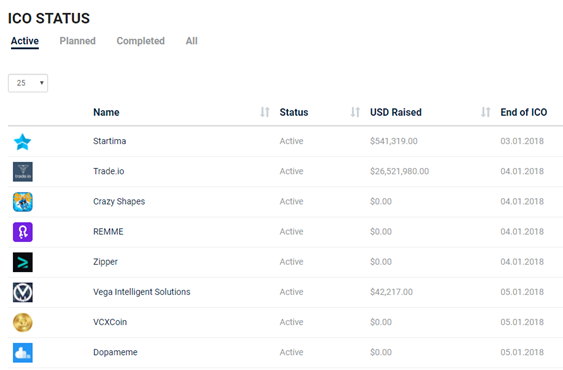

There are multiple portals where you can get more information about ICO’s;

In those portals you can easily follow the status, the amounts raised, closing date and some details on the ICO.

https://www.icodata.io/ICO/active

Source: https://www.icodata.io/ICO/active

Also Coindesk keeps track of ICO’s via their ICO tracker. https://www.coindesk.com/ico-tracker/

It is definitely worth to spend some of your time to read through the new ICO’s . Especially when there are well known teams, a large community acceptance, or simply great innovative ideas.

Missed an interesting ICO?

It could be that you just became aware of a very interesting ICO. Let’s say the Singularity ICO. What often happens in the ICO phase is that the ICO phase has 1, 2 or 3 rounds where various percentages of discounts are provided. This would mean that when the price is $1 USD per token for example, a large group was able to buy those for $0,80 USD. Usually when it hits the exchange, the price opens on at least the $1 USD (token price of the last round in this case) maybe a bit more. In that situation there will be a large group of token owners that immediately start with a profit due to their discount. Various type of buyers have different goals or even mixed goals. Let’s say a buyer bought 10.000 tokens for $0,80 which is $8000 USD. They could have bought those with the goal to hold 5000 for a medium to long term. And 5000 for short term and quickly recover the initial investment. That “profit” hedges their risk because when selling 5000 tokens * $1,20 = $6000 USD. This basically means they have the other 5000 for only $2000 USD which is only $0,40 USD per token. In the Example of Naga, they would have lowered their risk initially. And at a price of $4 USD (within a week or 2) they would have made 10X on the part that they keep long term.

Coming back to; “what to do if you missed a token sale”. Right after its launch on an exchange the price is in general still conservative and close to the final token price as many holders are already making profit from the first second. Keep an eye on the Twitter of the exchange. At launch set your bid on the token price + 10% or 20%. (of course this is not a guarantee, but we have seen this work multiple times)

Some of the ICO’s we are looking at this moment.

- Crypterium https://crypterium.io (Contactless payments)

- SkyChain https://skychain.global/ (Artificial Intelligence in Medicine)

- SinglularityNET https://singularitynet.io/ (Decentralized Marketplace for IA)

This article was written by an independent (not native English) blogger. All was written with the best intent to share some advice and ideas. Use this to your benefit. We are looking forward to constructive feedback.

Congratulations @crypterian! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypterian! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit