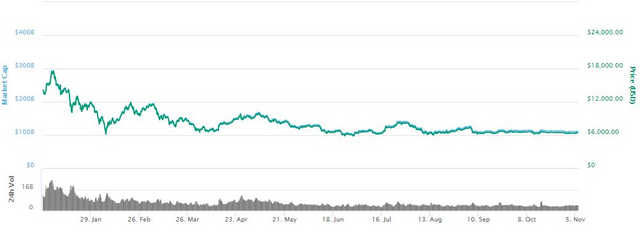

Months ago, certain similar models predicted both flat prices and a $6,000 range for bitcoin.

The week ending 26 October was bitcoin's most stable since the start of the year, writes Kevin Davitt, senior instructor for the Options Institute at CBOE Global Markets in CBOE's latest weekly bitcoin futures commentary.

"If we look at the weekly range over the course of October, it's a mere 6.6 percent, which is far and away the lowest monthly average," he writes.

A swift lack of movement

This trend is quite unmistakable if you look at bitcoin prices in the year to date.

It's not entirely unprecedented though. The better part of a year ago, two separate studies that used similar valuations models made the following predictions:

Bitcoin would be settling in for months of sideways price movements, sloping generally downwards to a more fair price

A fair price for bitcoin was about US$6,000

Prescient, no? Both used a Metcalfe's Law-based valuation model as their foundation. This theory gained traction as a form of valuing bitcoin in 2017, when put forward by Fundstrat analyst and bitcoin bull Tom Lee.

Metcalfe's Law

This theory, proposed in the 80s, is a way of valuing networks based on the number of participants. Naturally, it's entirely imperfect because you're basically just swapping out the variables until you find something that works.

For example, are bitcoin participants measured by the number of miners, wallet addresses or transactions? How do you account for users with multiple addresses? Are bitcoin prices driving participant numbers rather than vice versa? And so on. The theory was proposed in the 80s, long before bitcoin was even a twinkle in Satoshi's eye, so it needs tweaking until it fits previous observations.

Here's a brief rundown of the two separate models that made these retrospectively remarkable predictions.