From 2008 to 2018, a full decade has passed since the global financial crisis occurred in 2008 impacting the world. Bitcoin born during this major financial event with a vision of changing the financial landscape by bringing scarcity and integrity of money avoiding financial risks, created a new era to exchange digital value by the invention of blockchain technology.

In ten years, the price of Bitcoin rises from less than 1 cent to a maximum of 20,000 US dollars, which has risen 2 million times; In 10 years, Winklevoss brothers invested US$ 10 million and get in return US$ 2 billion. The number of bitcoin wallets, transactions and merchants using Bitcoin boomed in the last past 2 years. The trend behind this new revolutionary way to exchange value in a peer tot peer way stay strong despite regulation uncertainties.

Therefore, where is the future? Today, Crypto4All takes you through “the golden age” of Bitcoin.

The birth of Bitcoin

In 2008, people are downcast, questioning the economy due to the subprime mortgage crisis in the United States, and the crisis rapidly spread to the world, resulting in a global economic recession. The confidence in the centralized government currency has begun to shake.

Based on this, the whitepaper entitled "Bitcoin: A Peer-to-Peer Electronic Cash System" was published in the world, and then the author of the paper, Nakamoto, "disappeared" in 2010, and Bitcoin gradually began to enter the public eye.

The first physical transaction: Bitcoin Pizza Day

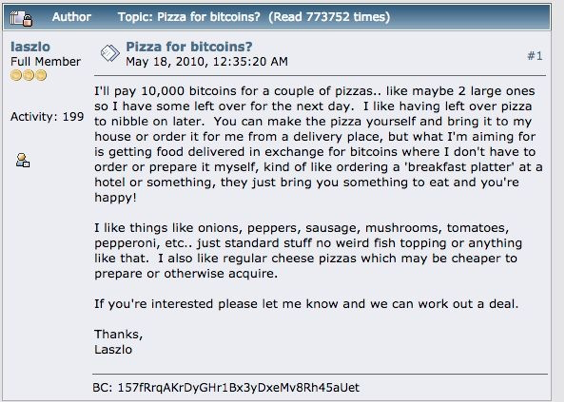

In May 2010, American programmer Laszlo Hanyecz purchased a pizza in 10,000 bitcoins. At the price of the bitcoin today, the pizza was worth about $45 million.

He posted at a forum for "order pizza": If someone helps him order a pizza delivery, he will pay 10,000 bitcoins. A few days later, on May 22, 2010, someone replied. This initiative directly promoted the popularity of the subsequent Bitcoin - soon several people joined the "deliver pizza" event, which led Laszlo eating pizza every day. After a while, someone started the “Register our website and send you Bitcoin” activity: as long as you register, you will give 5 Bitcoins.

Laszlo is not a foodie that sells bitcoin for two pizzas. He is not only the first to use Bitcoin to purchase things, but also the first to use GPU mining. This is the most expensive pizza and the first physical transaction in Bitcoin history.

The biggest bitcoin theft incident: Mt.Gox

Mt.GOX once entered the glory and became the world's largest bitcoin trading platform. The trading volume once accounted for more than 80% of the total bitcoin transaction.

But due to neglect of management, product defects and security vulnerabilities, Mt.Gox was hacked in February 2014, nearly 850,000 bitcoins get stolen. The number of stolen Bitcoins accounted for approximately 4 % of the total Bitcoin supply , and the total loss was more than $450 million at the current market value.

After Mt.Gox, the "world's longest-running trading platform" changed hands to China's rising star: BTCC. But after 6 years and 3 months of operation, it finally shuttered its door in September 2017, a crackdown by Chinese authorities on the domestic cryptocurrency sector following an ICO ban. This months, news just came out that Hong Kong-based Bitcoin Mining Pool BTCC will close indefinitely, which makes us wondering which cryptocurrency exchange will refresh this “long-run” record?

The earliest bitcoin fundraising and the most successful investment

The earliest bitcoin fundraising project was Mastercoin (Omni). In January 2012, JRWillett published a whitepaper on the Bitcointalk Forum, Mastercoin is a cryptocurrency and transmission protocol based on Bitcoin that integrates financial functions into Bitcoin without changing the underlying architecture. In June 2013, Mastercoin launched a crowdfunding campaign, which raised more than 5,000 bitcoins during more than one month of raising time.

The most successful bitcoin investment is the Ethereum (ETH) project. On July 24, 2014, Ethereum, developed by 19-year-old teenager Vitalik Buterin, raised a total of more than 31,529 bitcoins through pre-sales, which was more than $18 million at the current price (the price of Bitcoin that day was $612.94).

Bitcoin = Digital Gold or not?

Bitcoin is currently the most valuable cryptocurrency on the market. The issue is limited and has a fixed amount of 21 million. It is not issued by any person, institution or country and many stores can now use it to spend, or use it to trade on the market. Bitcoin is as difficult to mine as gold.

Although Bitcoin has not yet reached the status of gold in people's minds, it is so called “digital gold”, but it brings us unlimited imagination of the future.

Ten years ago, Nakamoto's white paper gave birth to Bitcoin. Ten years later, Bitcoin once again stand at a new starting point.

People should still optimistic about the future of Bitcoin. Just as broadband networks and wireless networks were not popular 30 years ago, Bill Gates predicted that "Everyone should have a computer on his desk and home." Who can be sure that the future bitcoin, or cryptocurrency, will not enter everyone's life?

What is the state of Satoshi vision nowadays?

In order to improve scalability, a part of the community was not agreed about technical solutions provided by developers to expand the block size, on August 1, 2017, Bitcoin hard forked to a new blockchain asset called Bitcoin Cash BCH.

After only 15 months, BCH faced the same problem regarding the vision and the roadmap of bitcoin in the past, Bitcoin Cash hard-forked again to Bitcoin ABC and Bitcoin SV. Bitcoin ABC is mainly controlled by Jihan Wu the CEO of BITMAIN which is the largest Bitcoin miner operator in the world, and Bitcoin SV backed by Craig Wright the CEO of NChain, who claims he is Satoshi, said that Bitcoin Satoshi Vision represents the original vision of Bitcoin creator Nakamoto.

The beginning of the incident was a hard fork promotion announcement issued by Bitcoin ABC, which announced the optimization of the script on November 5, 2019. For this hard fork, NChain, supported by Craig Wright, opposed the upgrade. He showed the world that the underlying agreement was locked in order to allow enterprises and developers to build on a stable cryptocurrency agreement. However, Jihan Wu believes that the underlying agreement should not only adapt to the needs of users, but blockchain technology is bound to encourage competition in the second decade.

Which one of Bitcoin network between BTC, BCH or SV is the Bitcoin of Satoshi? Will the hard fork weaken the vision? Let us know in comments.

Check also our previous blogs:

Is cryptocurrency an opportunity or a threat for IMF

Burning coins, a new economic leverage?

ICO legalization race– new turnaround for France?

Does Ripple (XRP) may continue to grow until the end of the year?

Can Bitcoin cash surpass Bitcoin?

What a remarkable journey to inspire this remarkable post. It is mind blowing that we have the ability to share this information and collect it to the accuracy that we have it. The power of the bitcoin is the idea itself a what it represents. What sells a product is sometimes based on the emotional response to it. The way it makes people feel about it. This feeling leads to the desire to buy in, or get a piece of the action. This is a lovely overview of the evolution of bitcoin. It is important contribution to the blockchain because you cant know where you are going if you dont know where you have come from. Peace Love and Respect OUT

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All that still just a birth of a baby that has a looong time to live and grow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crypto4allblog! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit