Hello fellow Steemians and Crypto investors,

As I've been saying for a while, Bitcoin and Altcoins are obviously siphoning off Gold market cap. It's only a matter of time for Gold bugs to capitulate and diversify further into Crypto. Following I'm sharing this interesting article from ZeroHedge on the subject.

I don't think Gold will go away or drop to zero but it doesn't deserve its 7 trillion market cap in today's internet connected world ripe for disruption. I expect Crypto to take over at least half of Gold's market cap by 2020.

I know, it's a delicate subject for many Gold bugs, clinging on to their precious metal, but the sooner they realize a new reality is inevitable and diversify some of their funds, the better for them it will be.

BTW, I do own some Gold, I'm long on it, not because I think it will increase in value, but because I believe the dollar will keep inflating. I own a diversified Crypto portfolio as well.

Don't forget to leave your comments below!

"It's Been Dismal" - Gold Coin Sales Slump As 'Bugs' Bounce To Bitcoin

by Tyler Durden for ZeroHedge

Nov 1, 2017 1:15 PM

Gold prices are rallying, but retail gold dealers and shops are struggling to survive.

As The Wall Street Journal reports, businesses that sell gold coins and other products made from the precious metal usually thrive during years like 2017.

Gold futures have gained more than 10%, boosted by a weaker dollar and by big investors looking for a haven during recent geopolitical tensions surrounding North Korea and Iran.

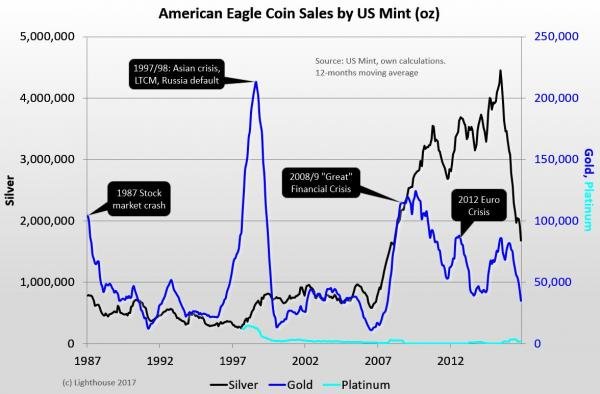

But despite higher bullion prices and solid demand from not-American-central banks, American Eagle Coin sales by the US Mint in October 2017 are down 87% YoY for gold and down 73% YoY for silver...

The weak demand is taking a toll on gold dealers, some of whose sales have dropped as much as 70% compared with last year, according to Jeffrey Christian, managing partner at market-research firm CPM Group.

“It’s been absolutely dismal," said Peter Thomas, senior vice president of metals at Zaner Precious Metals, a Chicago precious-metals dealer.

“A lot of guys have been really hurting.”

And as WSJ notes, one reason for the declining business: A number of retail buyers are turning to cryptocurrencies like bitcoin to store money during periods of stress, some analysts say.

Bitcoin has “taken some of the dedicated interest in gold away from gold,” said Mohamed El-Erian, chief economic adviser at Allianz SE, who warned at a CME Group event in September that cryptocurrencies could pose a long-term threat to the precious metal.

While gold buyers historically have looked to the precious metal as a place to hide during a market selloff, some suggest that virtual currencies are a new “hedge against chaos.”

Mr. Thomas of Zaner Precious Metals said authorized gold purchasers who buy directly from the U.S. Mint have been getting hurt, too, because of waning dealer demand.

“They end up having to stockpile coins,” he said.

“You would expect gold to be rocking at the present time, but it’s not," said Ross Norman, head of London-based gold dealer Sharps Pixley.

Furthermore, small investors appear to be getting gold exposure though ETFs with more than $8.5 billion flowing into State Street’s gold ETF, the largest gold ETF, since the end of 2015, reversing three years of net outflows and marking the biggest period for inflows since 2009, according to FactSet.

Jim Rickards (and Goldman) recently opined on the Bitcoin vs Gold debate...

From my perspective, you might as well discuss gold versus watermelons or bicycles versus bitcoin. In other words, it’s a phony debate. I agree that gold and bitcoin are both forms of money, but they go their own ways.

There’s no natural relationship between the two (what traders call a “basis”).

The gold/bitcoin basis trade does not exist. But people love to discuss it, and I guess Goldman Sachs is no different.

Goldman Sachs has released a new research report that comes down squarely on the side of gold as a reliable store of wealth rather than bitcoin, which is untested in market turndowns.

Precious metals like gold are “neither a historic accident or a relic,” said the report.

It affirmed that gold is more durable than cryptocurrencies because cryptocurrencies are vulnerable to hacking, government regulation and infrastructure failure during a crisis.

Goldman also reminds us that gold holds its purchasing better than cryptocurrencies and has much less volatility. In dollar terms, bitcoin has had seven times the volatility of gold this year.

Since Goldman’s research department has not been notable as a friend to gold, the fact that they favor gold over bitcoin is highly revealing in more ways than one.

I don’t deny that bitcoin has made some people multimillionaires, but I also believe it’s a massive bubble right now.

I don’t own any bitcoin and I don’t recommend it. My reasons have to do with bubble dynamics, potential for fraud and the prospect of government intrusion.

So bitcoin evangelists seem to think I’m a technophobe. But I’ve read many bitcoin and blockchain technical papers. I “get it” when it comes to the technology.

I even worked with a team of experts and military commanders at U.S. Special Operations Command (USSOCOM) to find ways to interdict and disrupt ISIS’ use of cryptocurrencies to fund their terrorist activities.

I will say, however, that I believe in the power of the technology platforms on which the cryptocurrencies are based. These are usually called the “blockchain,” but a more descriptive term now in wide use is “distributed ledger technology,” or DLT.

So although I am a bitcoin skeptic, I believe there is a great future for the blockchain technology behind them.

I’m not telling anyone not to own cryptocurrencies, but you need to do your homework before you do.

Finally, this gentlement seems to sum up the general perspective...

“You can’t be parked in gold," said Casey Frazier, a government administrator in Woodstock, Conn., who used to hold nearly a third of his savings in gold.

Source: ZeroHedge

CHECK OUT MY PREVIOUS POSTS:

Bitcoin All-Time-High on Google Trends - 91% strong correlation with its price

Why China (or governments) can’t stop crypto

ETHEREUM’S RAIDEN VS BITCOIN’S LIGHTENING – What’s happening?

SEE THE CHARTS! Segwit progressing slow but already helping ease congestion in the Bitcoin network

Tell me what you think of this post in the comments below. This is not professional investment advise. I'm not your financial advisor. Only invest money you can afford to lose!

Follow me for news and updates.

Happy crypto investing!

This will infuriate the gold-bugs even more.

It's hard to watch your gold stash sit idly by while bitcoin is making new highs on a daily basis, with global media coverage from every major news paper in the world.

I know some precious metals investors are already diversified into cryptos, but there are many stubborn ones who outright refuse to put even 1% of their wealth into bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's been a rough couple of years for the PM market. I really thought last year was going to be the big bull run, and then poof...everything knocked back down. I guess it's good to be diversified in a little bit of everything.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't dismiss Gold and PM in general, but I'm also not blind to the Cryptoo avalanche that's coming. It's always a good idea to be diversified.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Are you thinking all cryptos will go down or just BTC after the fork?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

doing great job!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

superb

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's been a rough couple of years for the PM market. I really thought last year was going to be the big bull run, and then poof...everything knocked back down. I guess it's good to be diversified..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good job...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Amazing post like it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's hard to watch your gold stash sit idly by while bitcoin is making new highs on a daily basis, with global media coverage from every major news paper in the world.

I know some precious metals investors are already diversified into cryptos, but there are many stubborn ones who outright refuse to put even 0% of their wealth into bitcoin.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's been a rough couple of years for the PM market. I really thought last year was going to be the big bull run, and then poof...everything knocked back down.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Frankly, it makes sense to hold gold and also hold bitcoins. Like you rightly said, we will be seeing lots of people pull out some of their investments in gold to put them into bitcoin, in fact this is already happening but not on a large scale to cause any panic...

I like your post. Its really elaborate... Wish i had come across it earlier than now.

Your post has been resteemed to my 2121 followers

Upvote this comment if you like this service

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don’t think that cryptocurrencies will ever replace gold, for a number of reasons. For one, cryptos are strictly forms of currency, whereas gold has many other time-tested applications, from jewelry to dentistry to electronics. Unlike cryptos, gold doesn’t require electricity to trade.

Finally, gold remains one of the most liquid assets, traded daily in well-established exchanges all around the globe.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

upvoted resteemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

wow fantastic post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

cryptocurrency is utdate money..wonderful post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.onenewspage.com/n/Markets/75eipu7pv/It-Been-Dismal-Gold-Coin-Sales.htm

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

cryptocurrency is verry good coine...thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cryptocurrency is increasing day by day.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@cryptoeagle by the way, have you checked the post I made about EOS about 6 days ago, it was only 50 cents. Now it has more than doubled.

In case you are interested, here it is https://steemit.com/steemit/@gold84/buying-opportunities-eos-a-decentralized-operating-system-2-of-the-series

Looking forward to your thoughts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! Crypto taking half of Gold's market cap by 2020 is a super bold call!

I also own both, and I that sir is a bet I would be very happy to take!

Care to make a gentleman's wager?

I've also been following this debate and I agree with Rickards. Bitcoin and all cryptocurrencies for that matter are a speculation. I'm happy to ride my profits higher, but I'm not confusing the two.

To me it is like the difference between my shares of Apple and my life insurance policy. Apple can't take the market cap of my life insurance. I know exactly how much my policy will be worth in 60 years, but have no idea if Apple will even be around.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, it's indeed very bold, so bold I'm not going to take the wage because the dollar numbers will likely be on your side. Gold will surely increase in it's dollar price.

The thing is I believe it will happen but on terms of actual purchasing value, not the dollar value. I'm foreseeing massive QE and dollar devaluation once the next global crisis hits and it seems it will be a big one. Gold will actually be a very good investment to pay off mortgages or any other dollar denominated debts. That's what I'm keeping mine for. Regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree completely.

It makes no sense to think that the store of value in the digital age will be in a physical asset. Sure there will be a place for it. However, the bulk of what takes place over the next decade will be the transformation away from the physical to the digital. We are seeing many things converted as we speak.

Cryptocurrency is the introduction of the Internet on steroids. Wall Street is just starting to find this market....we will see trillions enter this market over the next few years...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All those trillions created by reckless QE will end up flowing into Bitcoin heheh, the ironies of life... regards Taskmaster!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes isnt it ironic...the banksters handed the fiat and they take that an buy crypto since they know they cant make it go away.

Let me ask you, I know you love BTC, what are your views on STEEM? I know you are active on here and your account has decent value...do you see this platform really making it big?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

To tell you the truth I have many doubts on Steem scalability. It's often slow and buggy today so imagine what would happen if it ever got to Facebook's numbers. I hope I'm wrong because I love it, it's a place where I can share my views with people that will get what I'm talking about. If they can make it scale, easier to use and more social it could have a chance, especially in the third world where making a few cents blogging go a long way. Saludos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@cryptoeagle this problems withbthe sustem is a clear sign of growth. I believe steem is a winner and a big one. For sure this issues will be fixed with steemit. there are also other platforms like busy.org that make the same cunction as steemit. steem will scale and big I believe. Good this issues appear now, so they are rèolved once we reach a couple of million users. Facebook and the big ones also passed through issues at the beginning. upvoted. @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the ironies of life... regards Taskmaster.i agree with you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bitcoin top level

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@cryptoeagle I definitely agree with you that many of the trillions in gold will flow to crypto. Many starr investing on bitcoin firts, and when they see the potential of other great alts, they exhange some bitcoin for alts. I see you made a great contribution here in presenting the zerohedge article that compares gold and bitcoin. This is a great quality post for the steemit community. upvoted. @gold84

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

img credz: pixabay.com

Nice, you got a 79.0% @brains upgoat, thanks to @cryptoeagle

Want a boost? Minnowbooster's got your back!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The @OriginalWorks bot has determined this post by @cryptoeagle to be original material and upvoted(2%) it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

superb

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

interesting one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good one.

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit