Bitcoin, Ethereum and Ripple - Price Analysis KW37 - The Pressure is Released

The pressure buildup was accompanied by a bang. The Bitcoin course still struggles with the bullish variant, while the courses of Ethereum and Ripple Land prevail. The bearish variants have had a full effect here.

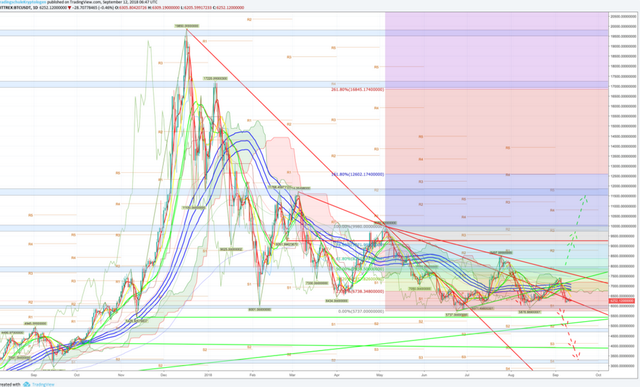

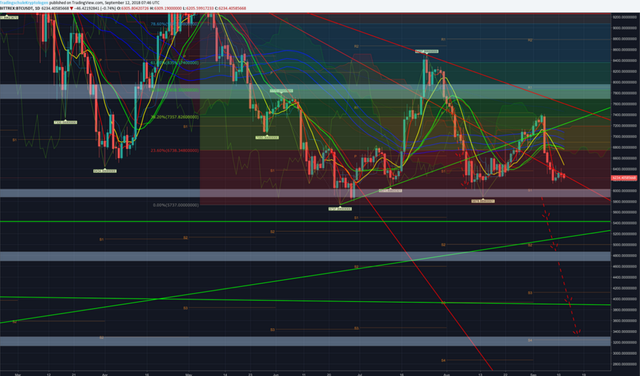

Bitcoin (BTC / USD)

A gradual up-shift also always carries the risk of a quick movement, in the case of Bitcoin course, this came down. The abandonment of the short-term uptrend led to massive sales. The Bitcoin is only slightly above the $ 6,000 mark. The struggle with the medium-term downtrend has begun. The moving averages have generated a sell-signal. The supporting cloud of the Ichimoku Kinko Hyo indicator has been abandoned. The cloud bottom is now at $ 6,700.

Bullish variant:

The ongoing correction ends above $ 5,877. At best, the medium-term downtrend is already supporting and the price is stabilizing at the $ 6,200 level. The further upward movement does not stop at the short-term massive resistance to the 7,200 US dollars. With this price level, the short-term uptrend would be recaptured again. In addition, the cloud of the Ichimoku-Kinko-Hyo-Indicator can help again.

A real buy recommendation can be pronounced only at a bitcoin price over $ 8,000. After that, these goals are:

- 9,261 US dollars

- $ 9,726

- 11,540 US dollars

Bearish variant:

The sell-off of the last few weeks was only a foretaste of the pending correction. The $ 6,000 mark is being tested. The losses continue and the $ 5,877 can no longer be held. The next price target is $ 5,428. If this variant continues, the movement of the last week could make a new price target on the bottom. This is at $ 4,872. In extreme cases, a $ 5,000 break may even set a correction target of up to $ 3,300.

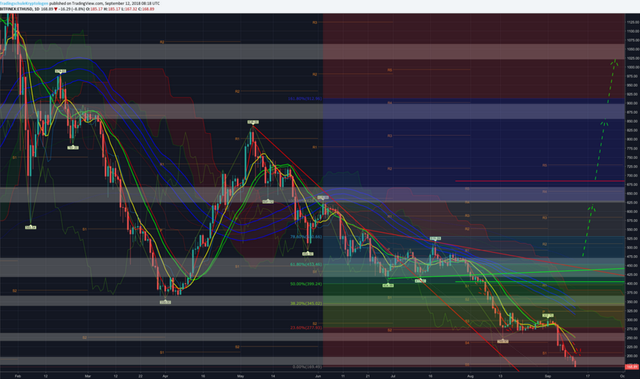

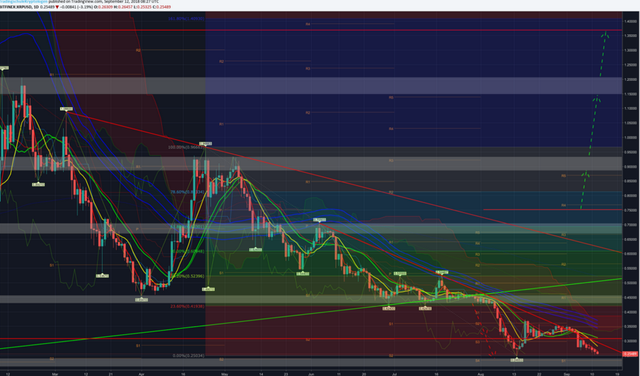

Ethereum

The Ethereum course is all as predicted. The weakness was predictable. The Ethereum rate not only dropped to the target price of $ 196, but significantly undercut it. The obvious condition for the bearish variant was met with rates below $ 241. Anyone who has put this into action can now record a price gain of just under 30 percent thanks to the "short". It is not an option to talk about the achieved price target of breathe. Ethereum is about to confirm another sell-signal.

Bullish variant:

Ethereum comes to a halt as soon as possible and makes a bullish reversal within that day. The Ethereum rate can just defend the area around $ 168. The confirmation can be seen in courses over $ 263. Clearly, the fastest possible increase would be $ 366, but this implies conversely that Ethereum must increase by 120 percent. Other upward goals are there, but make no sense at the current level, because, so far I can lean out of the window, until the next update in a week these are not achieved.

Bearish variant:

The further sell-signal was activated at prices below $ 174. The Ethereum course continues to decline. The new price target on the bottom is $ 129.

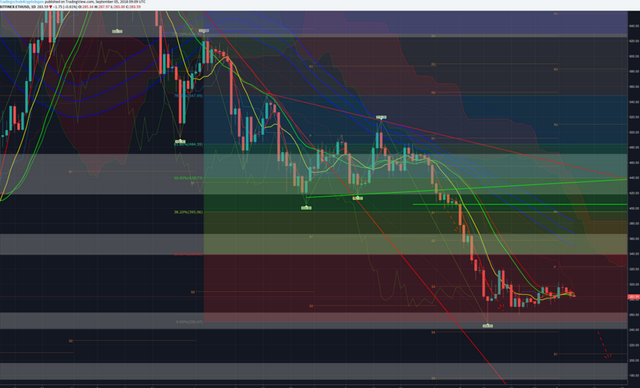

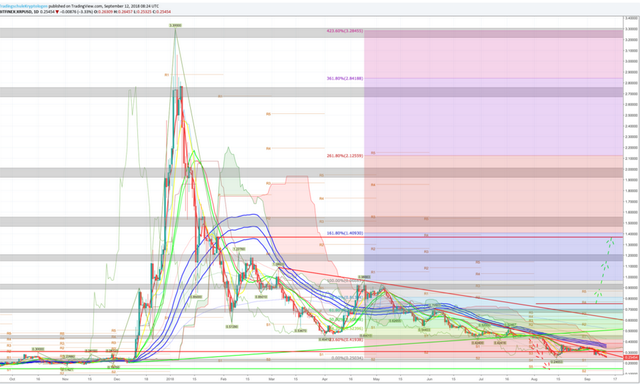

Ripple (XRP / USD)

The XRP course developed contrary to the long setup. The movement at Ripple shows how important it is to secure profits in a corrective market, because on the upside you could take 47 percent profit. The sluggish sideways phase, which was still the topic of last week, was accompanied by warnings that a dissolution would soon take place here. The XRP price is now back below the short-term downtrend and moving averages underscore the downside since $ 0.33.

Bullish variant:

The XRP rate can overcome the short-term downtrend as quickly as possible. This currently runs at 0.28 US dollars - falling trend. The Ichimoku Kinko Hyo Indicator cloud is at the same level as last week. Only $ 0.39 can raise Ripple above this cloud. The $ 0.45 increase is in line with the break of the 23.6 percent Fibonacci retracement level. Likewise, at Ripple, the upper price targets are initially canceled, as there are no signs of this.

Bearish variant:

The last bearish version has gone well:

"Below $ 0.31, short-term bottoming should be called into question, even if it remains intact to around $ 0.24."

If the 0.24 US dollars are taken out sustainably and fall the 0.21 US dollar, the next price target lies with 0.15 US dollar.

Conclusion:

The current correction is especially strong for the old coins. While the Bitcoin price remains reasonably stable above the $ 6,000 mark, the Altcoins continue to give. The next few days promise to be exciting. Especially Ethereum has suffered as announced massive price losses. But this weakness offers, further to "Shorten", only one should be on guard against a countermovement. Hedge and run, the profits after the weeks presented variants should be large enough to do so relaxed.

Disclaimer: The price estimates shown on this page do not constitute buy or sell recommendations. They are merely an assessment of the analyst.

Images based on data from bittrex.com and bitfinex.com created at 11:06 am on 5 September. USD / EUR price at the time of going to press: 0.86 euros.

I know, what is exactly the TA. I know, how its "works", and how can we use it. And i know the math and psichology behind it.

But for god's sake, this colorful lines seems to me a damn magic :D

Btw i'm really bullish-minded about this three coin...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, exactly mate. Lets see what happends ;-) The crypto-market is often surprising. Everything can turn around quick.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post mate!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks @grobsop

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @cryptoexpert Your article is very good Can you please tell that the rate of ripple is bigger in the next few days.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit