This article was orginially written on 14 January 2018 in Hungarian.

Bitcoin may seem to be a truly democratic network, a pioneer of decentralization, a system where everything is shiny and where power is really in the hands of individuals. But in fact, it was long ago when this statement applied. Today there is a lot of rivalry around Bitcoin, mainly between miners and developers and mining as an individual with a single PC became almost impossible, this field has become the arena of huge mining companies. In this article, we take a deep look into the nature of this rivalry, examine the Bitcoin forks and the birth of Bitcoin Cash.

Bitcoin’s functional ground, the blockchain is being maintained by miners (you can read about what the blockchain is and how it works in our previous article: https://steemit.com/blockchain/@cryptohu/what-is-blockchain-and-how-does-it-work

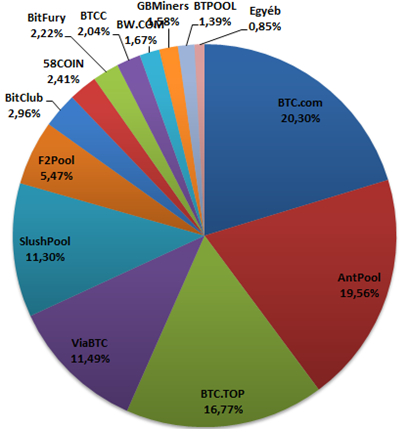

The following diagram shows which big mining companies are “maintaining” Bitcoin:

Some of these companies can be found in the close interest of Jihan Wu and Roger Ver (more about them later). Mining companies are competing with each other, but mainly with the core development team at Bitcoin. Bitcoin’s core developers are shaping the coin’s technology.

Basic problems

Bitcoin (until September 2017) issued every ten minutes a 1MB block. Blocks are put together by miners and they contain the transfers (transactions). Blocktime and blocksize are strongly limiting BTC’s permeability (max. 7 transfers/sec). As demand for Bitcoin has boomed massively in the past couple of years, one often has to wait several hours for transfers and transfer fee of more than 10$ is not unique either.

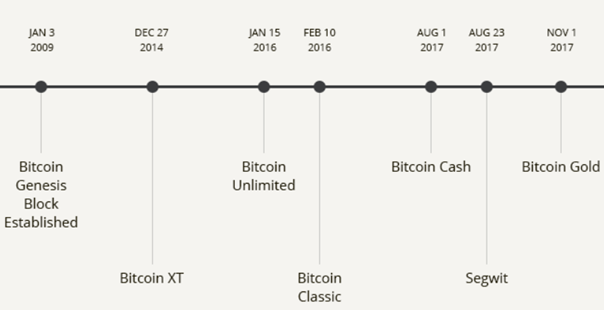

These permeability and scalability problems and the possible solution suggestions for them have generated Bitcoin to multiple tear apart. That phenomenon is called “hard fork” (when such changes occur within the blockchain that will not affect the mining protocol, it is called “soft fork”).

There were many internal fights in the history of Bitcoin regarding scalability: Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited are only a few from many attempts backed with mass media hype. They were trying to take over control of Bitcoin, unsuccessfully.

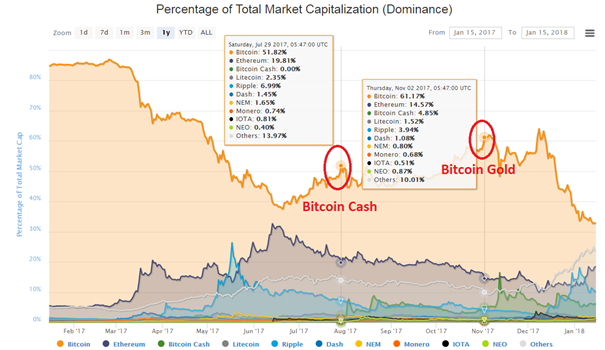

In these cases, a new protocol was created and a chain split occurred via hard fork meaning that the blockchain was split and a new coin was made. If someone keeps money in Bitcoin at the moment of the hard fork, automatically gets the exact same amount from the new coin as well. That is the reason behind BTC’s increased exchange rate in times of forks, everyone goes for “free money” and after the hard fork people float their money back into alt coins.

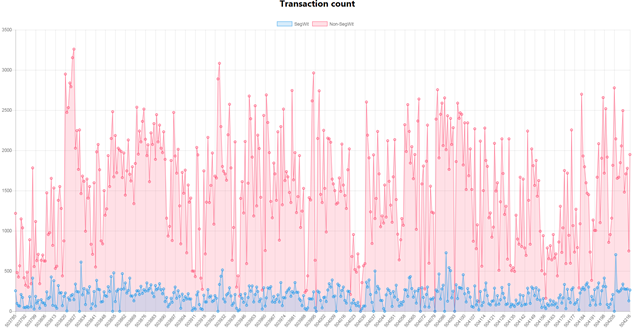

Originally, there is a consensus that the 1MB size needs to be increased. The conflict between miners and developers sharpened when core developer Peter Wuille submitted the BIP (Bitcoin Improvement Proposal) 62. This soft fork enabled an enlargement in the block size that would not cause any retrospective changes on the chain. Today the proposal is known as Segregated Witness (“SegWit”). The point of the technology is that Bitcoin divides the transactions to two segments by detaching the digital signatures needed for unlocking, therefore pulling the validating signature out of the block to create space. Then these signatures are attached to the transactions as a separate structure. As a result, even if there is still 1MB block limit it will be practically able to contain many more transactions- so the charging can be decreased significantly leading to much faster transaction approvals and less transaction fees.

The beauty and opportunity in this technology had been recognized immediately by part of the core developer team and Blockstream enterprise was founded and it plays a significant role in today’ core development team. Moreover, SegWit can be carried out via soft fork meaning there is no need to split a new chain from the original BTC blockchain. The average 2.5 (max 4-6) transaction/sec in Bitcoin’s network could be scaled to 10-12 (max 20) transactions/sec. Of course, it is still far away from Visa’s 2000tx/sec speed. BIP 62 and SegWit have made ways to such technologies like lightning network, atomic swap and two-way pegged sidechains.

In case of 100% SegWit implementation there is not only no need for 1MB block but they could be much smaller. Lightning network promises a way of payment where transactions are happening out of the blockchain but in the frame of smart contracts within the blockchain. Accordingly, only a vanishing part of the transactions will be booked within the blockchain resulting that transaction fees stop going into the miners’ pockets. With Lightning Network transaction fees go to those peers who the trustless smart contract chain is created through. That being said is forecasting an ugly future for miners-somewhat they are willing to fight against at any stake.

At this point, Blockstream changed the strategy and backed out of its former initiative to increase block stating that there is no need to rush this scaling when we have SegWit, it will solve everything anyway. In connection with that came then the famous tweet from Jihan Wu (who has serious interest in mining BTC) where he claimed that SegWit transaction fees will be unfairly low. They proposed to double the size of blocks (SegWit2x) to enhance permeability.

Here is to better understand Jihan’s motivation: Bitmain ASIC miner producing company practically became a monopoly on the market mainly because of a both hardware and software trick called AsicBoost. With the help of this they are able to enhance the speed of hashing power for every Bitmain machine. The whole opposition between SegWit and BigBlock is mainly based on the fact that BIP91 required by SegWit changes the Bitcoin protocol in a way that this certain AsicBoost algorithm no longer can make up to.

The miners have a 10 exahash capacity double-SHA256 mining system which hashing power requires almost 20TWh per year – about half the power of a nuclear plant. That being said it is NOT only advantageous for the miners. (No surprise that the Russian Federation would gladly restart its plants in Leningrad). Miners take home about $3,1bn worth coin every year and spend about $900m for all expenses. Do the math, the story is brutally profitable. No matter the battle, take-over, ultimate or whatsoever in the end of day it is all about the miners behind the hashing power that want to maintain their position and earn well.

Those involved in Bitcoin business and the bigger mining companies (lead by Jihan Wu and Barry Silbert) tried to take over control of the future of the Bitcoin blockchain from Bitcoin Core developers. From those developers who have been handling the code for 10 years.

Basically all Bitcoin-related internal fight comes back to the profitability of mining. By now, we have come to a story known as “scaling debate”: the two sides have reached a total conflict of interests. Miners are visioning that the money they worked so hard for is getting pulled out of their pockets. On the opposite, Blockstream is favoring its own solution which on the one hand is truly more future-compatible, and on the other, it indeed weakens the brutally strong miners.

So on the one side we have the UAHF(Bitcoin Unlimited+Bitmain) lead by Jihan Wu and Roger Ver=Antpool mining co. and Wu’s circle and on the other side there is the UASF (User Activated Soft Fork) completed with the Bitcoin Core developer team. As they were unable to come to terms, SegWit has been activated by the BTC Core team which solved the scaling with a soft fork, while team UAHF forked Bitcoin and created Bitcoin Cash (BCH) as a separate chain with 8MB block upgradeable up to 32MB. BCH does not support SegWit rather it implemented the “dynamic blockchain size”. It has a much bigger permeability than Bitcoin although it did not solved scalability only expanded the boarders.

Although SegWit has been activated on the Bitcoin network, its adaptation remains only at about 12% (blue line on the chart) Why don’t they use SegWit 100%, why are transaction fees still so high? Answer is that still not all the mining companies are using SegWit. However, its rate is growing day by day. The battle between miners and core developers probably still has some surprises left in the bag but for now it seems Bitcoin secures its position as king of cryptocurrencies and Bitcoin Cash’s takeover for the “Iron Throne” has failed.