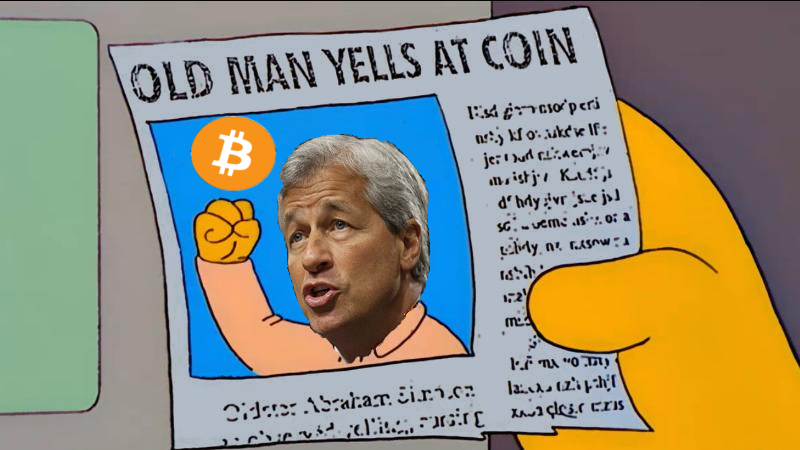

From Ray Dalio, to Warren Buffett, to JPMorgan CEO Jamie Dimon we've heard the phrase "Bitcoin is a bubble"

But is Bitcoin really a bubble? I really never gave it a thought, no matter who said it, to me they just didn't understand what Bitcoin is. It wasn't until I read that Ray Dalio and Warren Buffet (guys who I've admired for years as investors) were calling Bitcoin a bubble, that I stopped and said to myself "Maybe I should do some research". I figured that maybe I was too invested economically and emotionally to actually consider a different point of view. So this is the findings of that research.

Let's start with the most basic:

What's a bubble?

According to Jeffrey Kleintop (Chief Global Investment Strategist at Charles Schwab):

"Market bubbles have occurred across the globe and throughout history. In fact, the term "bubble" in reference to markets was coined in England nearly 300 years ago. An asset bubble is characterized by a wave of optimism that lifts prices beyond levels warranted by fundamentals and ends in a crash. Behavioral finance theory attributes bubbles to irrational investing behaviors characterized by groupthink and herd mentality. All it takes is a rising price on an overly optimistic outlook that gathers more followers as the trend is extrapolated into the future. The bubble bursts when the outlook is proven to be too optimistic, often after becoming the mainstream consensus."

Famous Bubbles in History

The Dutch Tulip Bubble: Tulipmania was the first major asset bubble. Investors began to madly purchase tulips, pushing their prices to unprecedented highs; and at its peak, some tulip bulbs commanded prices greater than the prices of luxury homes. Tulips sold for over 4000 florins, the currency of the Netherlands at the time. As prices drastically crashed over the course of a week, many tulip holders instantly went bankrupt.

The Dot-Com Bubble: Few bubbles could match the NASDAQ bubble of the 1990s. The introduction of the Internet triggered a massive wave of speculation in "New Economy" businesses, and as a result, hundreds of dot-com companies reached multi-billion dollar valuations as soon as they went public. The NASDAQ Composite, the host to most of these technology companies, soared from a level of under 500 at the beginning of 1990 to a peak of over 5,000 in March 2000. The index crashed shortly thereafter, plunging nearly 80% by October 2002 and triggering a US recession

The US Housing Bubble: Like the tech bubble, the housing bubble was characterized by an initial increase in housing prices due to fundamentals, but as the bull market in housing continued, many investors began buying homes as speculative investments. The government’s encouragement of broad homeownership induced banks to lower their rates and lending requirements, which spurred a home-buying frenzy that drove prices up by 50% to 100% depending on the region of the country. The home-buying frenzy drew in speculators who began flipping houses for tens of thousands of dollars in profits in as little as two weeks. It is estimated that during the period of 2005 to 2007, when housing prices reached their peak, as much as 30% of the valuation was supported by speculative activity.

Few Key Points:

After researching these historical events, I analyzed what characteristics are a common denominator, and which of these caused them to become a speculative bubble. These are:

Investors get enamored by a new paradigm, such as an innovative new technology or interest rates that are historically low.

Suspension of disbelief by most participants during the "bubble phase." There is a failure to recognize that regular market participants are engaged in a speculative exercise which is not supported by real intrinsic value.

Large public participation raising prices to unsustainable levels. Fear of missing out on what could be an once-in-a-lifetime opportunity spurs more speculation, drawing an increasing number of participants into the fold.

An asset price bubble is followed by a spectacular crash in the price of the securities in question.

Is Bitcoin a Bubble?

The right question would be: is Bitcoin in a Bubble right now? (on this exact date?).

The problem is people talking in very general terms. They ask if Bitcoin is a bubble, but they don't specify a period of time.

Bitcoin has gone through several bubble periods. Perhaps the most popular being the "November 2013 Bubble". Bitcoin went to an all-time high of $1,242 to then fall in the following months to about $260.

But, is Bitcoin in a bubble right now? As of the last 30 days, Bitcoin has moved between the range of $5.100 to $7.600; sitting right now at about $6.600. Are these unsustainable levels past intrinsic value?

I don't think so. I think that Bitcoin rally to $7.600 is justifified by a couple of reasons.

Segwit2x. A lot of people moved a lot of money from altcoins into BTC just to get "free money" once the hard fork happened.

CME group announcing the launch of Bitcoin Futures.

Increasing media coverage on the news and on social media (Twitter, Instagram, YouTube) about Bitcoin, bringing "new money" into the space.

This factors alone can explain Bitcoin recent rally. Furthermore, Bitcoin has had a recent pullback to about $6.600 which is consistent with Bitcoin Cash and some altcoins going back up in price.

A bubble in the future?

I'm pretty sure we'll see a couple Bubbles in the future. Let's keep in mind that Bitcoin is still relatively new. There's A LOT of people pending to enter this space.

We might see some unhealthy prices once Bitcoin Futures contracts go live or once an ETF gets approved. This institutional money will increase Bitcoin's price and this will bring new small investors who will want a piece of the action further increasing the price.

Is worth mentioning that even though the price might increase in the future and we might enter bubble territory, the consequent plunge will never be as steep as the ones we've experienced before (percentage wise). Let's not forget that Bitcoin has built a strong community of advocates who believe firmly in this cryptocurrency and in its potential to change the world for the better. These are people who don't trust in banks and who greatly value their privacy. These people won't sell their Bitcoin even if the price declined 40%. There would have to be a fundamental change in the cryptocurrency itself (all devs die for example) if we want to see real damage.

BONUS: Why Warren Buffett says Bitcoin is a bubble. To me, the answer is very simple, he just doesn't understand it. He's said it many times, he doesn't invest in what he doesn't understand. He hardly invests in Tech companies.

As much as I respect Warren Buffett, he's an old-school investor. Cryptocurrencies are not tangible investments. They don't generate earnings or pay dividends. To him, if you can't value something the traditional, old-fashioned way then it doesn't make sense. I hope that in the future he will realize his mistake.

If you are still skeptic about Bitcoin's price and think we are in a Bubble, I encourage you to read one of my articles called What Makes Bitcoin Valuable

Thank so much for reading, leave a comment below with your 2 cents about the subject 😉

While it may not be a scam in your opinion, it could be considered spam. Spam is not appreciated by the community and could be flagged or may result in action from the cheetah bot..

Some things that can be considered spam:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptonarco! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Since this steemcleaner bot decides to report post that aren't harmful I say we come together and up vote each others post. Let me know if this is something you're interested in. I'll do up vote for up vote with you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptonarco! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptonarco! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit