Buy bitcoin bitcoin bitcoin, does that sound FOMO? (of course i am not stupid to buy btc this late)

well get ready for different jarheads. well btc is all over airways because it shattered 18.5k ceiling, rising basically nonstop BUT BUT BUT there is bigger opportunity lying somewhere else.

btconethereum.com tracks live how much cap HODLers are transferring their assets from bitcoin HODL to eth HODL. This trend has been blastoff since Aug2020. Out of total 21M btc supply that will ever be made, 0. 73 % of total supply is on eth now.

Eth's DEFI is swallowing btc much faster and faster.

So, Eth looks more bullish than btc on long run. As we see on above links, we see 1% of btc is locked on eth in 2020, 5% in 2025 and 10% in 2030 and these are low estimates.

Now, if we see btc UTXO= unspent tx output, its what wallets have left after doing btc tx. thus , we can use btc UTXO to track how much btc has been held in the last wallet (-https://bitinfocharts.com/top-100-richest-bitcoin...). so, we can see 70% of btc has not been moved at all through all these years.

So, isnt that bullish for btc? well, yeah, holding it and not adding it to trading supply is bulish cause based on supply and demand rule

BUT AT SAME TIME, not to be forgotten is: 30% of btc have been moved under a yr ,and 1% of that 30% move with the bulk of it in last 3 months was to ETHEREUM.

So, hmmm, those btc moving to eth would be there for sometime to earn 32 eth staking interest so, eventually large bulk would turn into 1+ year UTXO. that would look good for BTC in chart but in reality, its not unless btc embraces eth as LAyer2 solution but IMO, its not happening.

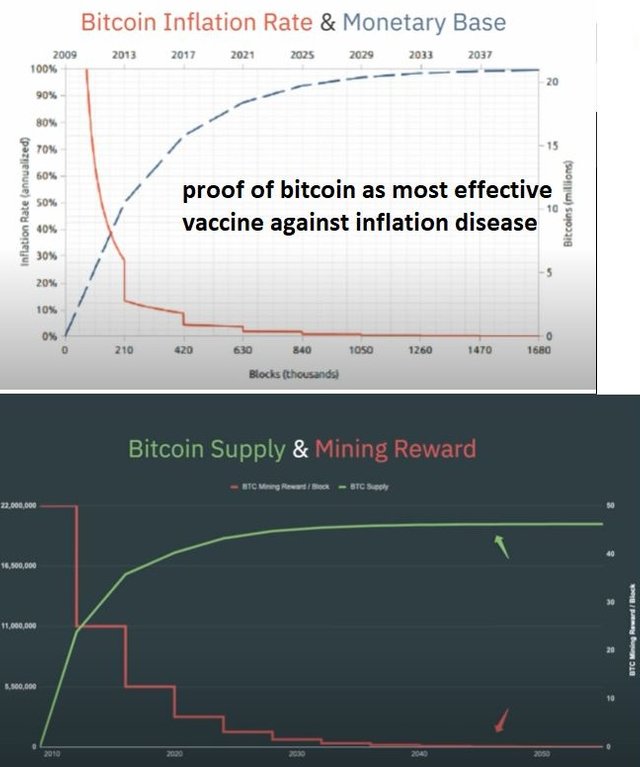

So, why is that bad? well, based on btc's PoW algorithm, you have to keep miners happy. btc inflation rate is currently at 1.8% and after next halving in 4 yrs (btw, fyi: for each successful block, miners were paid 12.5 btc till 2012, then 5.25 btc till 2016, now its 2.125), btc inflation rate will be <1%.

Remember: eth may be taking 1% of btc supply per year. so by 2024, 4% of btc will already be there on eth and then its going to take more than inflation rate too.

As time goes on, 2030 new btc rewards by mining will be under 0.5% , on other side, >10% btc will be moved to eth by 2030 because lucrative staking reward on eth. relate this paragraph to chart 2.

so, with new btc supply diminishing and reaching flat, more btc moving to eth, btc being stored as HODL, and more world economic activities happening on eth, guess which will be better long term assets. It is ETHEREUM