Step 2: Coin Supply

After finishing my first step of looking at the market capitalization of a cryptocurrency, my next order of business is analyzing the token metrics. What I’m looking for here is the total supply of a given cryptocurrency in the market currently and what’s to come in the future. The circulating supply, total supply, and max supply are important factors to consider when analyzing a potential blockchain investment. In case you are unfamiliar, circulating supply refers to the amount of coins/tokens that are currently trading and in the public’s hands; total supply refers to the amount of coins/tokens that are currently in existence (some may be locked up), and max supply refers to the total amount of coins/tokens that will ever be created.

In my last posting, I talked about how market capitalization is calculated. If you remember back, you’ll remember how much of an impact the circulating supply has on a cryptocurrency’s market cap. For those who don’t remember, the equation for a coin’s market capitalization is simple:

(Amount of Coins in Circulation)x (Price per Coin)= Market Capitalization

This means that if we have a cryptocurrency that’s sitting at a low price point, but its market cap is still in the top 50 or so, there must be a large supply of coins/tokens in the market. On the opposite side of things, if we find a cryptocurrency that has a low market cap and comparatively low amount of coins in circulation, then we may have just found an explosive growth opportunity.

Even if we were to not use the simple equation for calculating market capitalization, the rules of supply and demand are quite clear here. If a project does well and provides real value to the market then the demand for the coin/token is likely to go up. As the demand increases, it’s offset by the supply available for traders and investors to purchase.

With a lower total and/or max supply of coins/tokens, there’s an added element of scarcity in the market that we wouldn’t be likely to see with a coin that has a much larger supply. As with anything else, when supply can’t keep up with growing demand, the price is naturally going to rise.

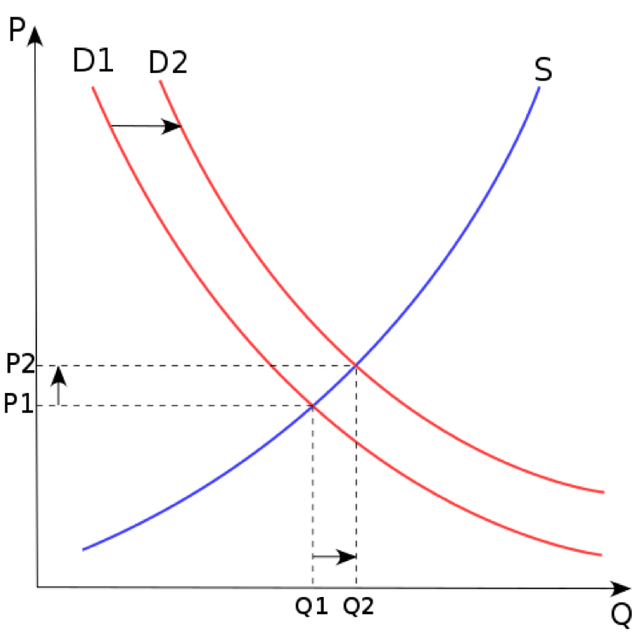

Price vs Quantity, Demand Increase (D1 to D2)

Chart Courtesy:Paweł Zdziarski (faxe), Astarot — Own work, CC BY-SA 3.0,

As we can see with the supply and demand chart above, an increase in demand (while the supply remains constant) results in a higher price per coin. The red “D2” represents our new higher demand level. Because of that, the new location where supply and demand meet (where the red and blue lines cross over each other) is at a higher price than the previous demand curve. Okay great, but what about the opposite?

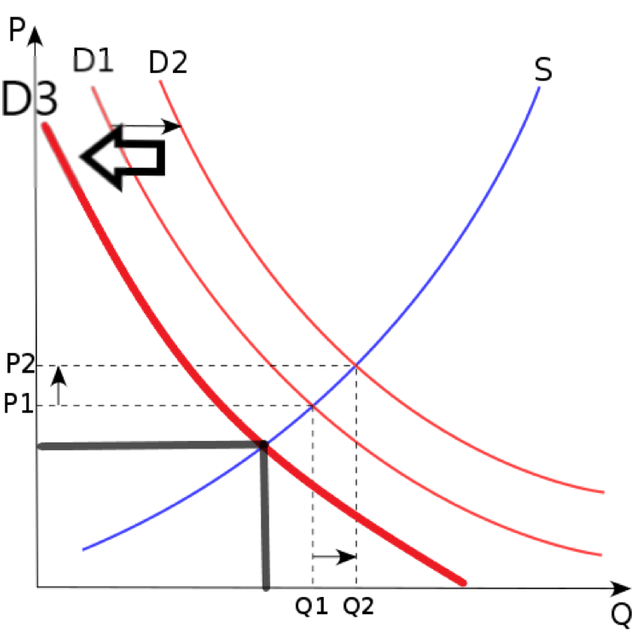

Price vs Quantity, Demand Decrease (D1 to D3)

In this example, we’ve actually decreased demand. As that demand curve starts goes to the left (getting smaller), we see the new location on the graph of where supply and demand intersect and it’s much lower than our previous two points. Now “D3” is our new demand line and it’s dropped the price significantly.

The important part to note is that both supply and demand affect the price of an asset, and since we know that the supply is typically going to be a fixed number, we’d prefer to keep that supply on the smaller side rather than the larger side. But first, one last graph to illustrate! Using the same graph we’ve been looking at, let’s manipulate it to reduce the supply compared to the standard “S” on the graph now.

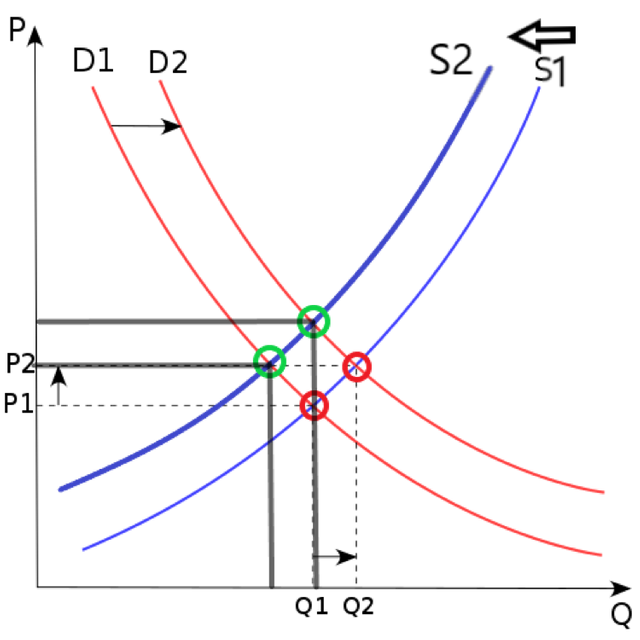

Price vs Quantity, Supply Decrease (S1 to S2)

In our last graph here, as supply decreases (moves to the left), we see that the price levels are higher than their previous positions, regardless of demand. The green circles show where the new intersection and price points are, while the red show us our old positions.

Takeaway

Now that everyone has had a quick refresher on how supply and demand work, the takeaway is pretty clear. When it comes to picking out projects that I want to include in my portfolio for growth, I’m going to be looking at cryptocurrencies with smaller circulating supplies that aren’t intending on minting new coins/tokens every month, releasing significant amounts of lockedup ones in the near future, or expanding the supply regularly.

Remember, as supply increases, our “S” line above shifts to the right, thereby lowering our price. The only way to combat that price decrease is with an increase in demand. Since controlling the global market demand for specific cryptocurrencies is not within my power, I focus on the factors that I can study and make predictions with.

To give you an idea of what the standard number of tokens in circulation for a project is like, here are some of the big-name cryptocurrencies you’re likely already familiar with and the number of coins in circulation.

Bitcoin(BTC): 17,147,262 BTC

Ethereum (ETH): 100,668,308 ETH

Bitcoin Cash(BCH): 17,235,563 BCH

Litecoin(LTC): 57,387,708 LTC

XRP(XRP): 39,262,44,717 XRP

Looking at projects like XRP, we see a significantly higher number of tokens in circulation. Because of that, it’s going to take some drastic movement in demand for XRP to ever come close to the price range of our lesser-supplied coins like Bitcoin and Ethereum. These are all things I want to consider when building a portfolio and deciding on what to invest in. We’ll tie all these steps together at the end when we discuss building the portfolio itself. For now, you need to just have a solid understanding of what it is that we’re looking at. Happy Trading!!!

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cryptosally! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit