Blockchain and cryptocurrency technology has made the actualization of decentralized finance (DeFi) a reality. One very common feature of DeFi is Yield Farming, a mechanism that involved Lenders in the staking and lending of crypto assets. Yield farming is a mechanism that generates passive income for lenders, as their staked crypto assets is Borrowed by others.

There is also a Leveraged Yield Farming, which involves lenders borrowing more tokens in order to enlarge their yield farming position, this is an excellent mechanism that's gaining a huge traction, although utilizing comes with a great risk of liquidation.

INTRODUCTION TO SAME FINANCE

SameFinance is a yield farming protocol, whose principal focus is on stable coins leveraged yield farming. SameFinance has developed an ecosystem that makes yield farming quite easy and accessible with an easy deposites system and intuitive user interface. what SameFinance did is that it deployed a complex solution that simply linked borrowers to lenders in order to improve the earning potentials of decentralized finance under a safe and conducive atmosphere.

While SameFinance is boosting to be the first yield farming protocol that is available for utilization in Huobi Eco Chain(HECO) wallets, the team also plan to make their protocol available to be used in other major blockchains in near time, particularly Polygon (MATIC) in Q3 2021, Hoo Smart Chain (HSC) in Q3 2021 and Binance Smart Chain (BSC) in Q4 2021.

With an available leveraged farming being integrated into MDEX and Depth.fi, SameFinance ecosystem support a number of based assets which includes:

- USDT

- HUSD and

- SAME

SAME FINANCE ECOSYSTEM AND HOW TO UTILIZE IT

SameFinance ecosystem powers quite a number of DeFi opportunities that can be utilized by anyone from any part of the world, these opportunities all have their ups and down sides. The major opportunities available includes:

Deposits: This SameFinace's opportunity, allow anyone to deposit their cryptocurrency assets into a deposit pool in order to earn interest from yield farmers that are leveraging their position by borrowing from the deposit pool. This is a complex feature but it has certainly been made quite easy for any kind of user to utilize, especially users that are more concerned about risk.

Yield Farm: This features an opportunity for anyone to be able to borrow from the deposit pool and leverage their farming position. This come with the potential of multiplying one's Annual Percentage Rate (APR) by up to 11✖. This is an opportunity that can be utilized by users that are less concerned about risk and are more concerned about higher APR. Major risk that accompany this opportunity includes: Impermanent lost and liquidation.

SAME FINANCE ECOSYSTEM'S PRODUCTS

The SameFinance ecosystem is powering quite a number of rich products which includes:

Samecoin: This is a utility assets that powers the entire SameFinance and Samecoin ecosystem. This assets empower users with the benefits and rewards that can be utilized for staking, governance and minting.

eSameUSD: This is an asset whose value is pegged on a 1:1 ratio to US Dollar, making the asset a stable store of value. This is an asset that is fully backed by a basket of widely available stablecoins whose reserve can seamlessly be verified by anyone.

SameEuro: This is an asset that is pegged on a 1:1 ratio to Euro, making it a true stable and digital store of value. This asset is the first decentralized stable coin that is developed to be used in the Eurozone. The introduction of this asset has shifted the idea of trading into stable USD and then into Euro.

samePay: This is a payment platform that simplifies the way anyone send, receive and buy cryptocurrency. Be it Samecoin, Bitcoin, Ethereum or any other cryptocurrency, SamePay has been organized with easy access to sending and exchanging of assets.

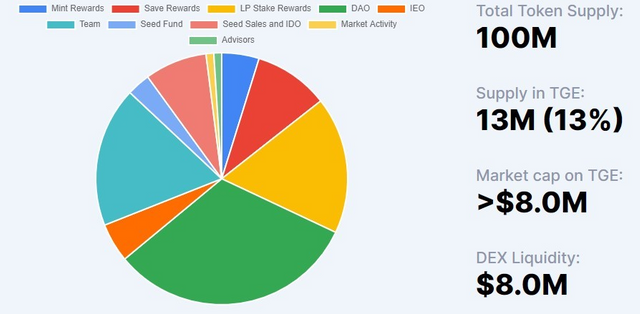

SAME FINANCE UTILITY TOKEN (SAME) AND ITS TOKENOMICS

SAME is the primary governance and utility token that powers SameFinance and Samecoin ecosystem, the token is minted with a total supply of 100,000,000 SAME and available in BSC, HSC and HECO blockchains. Being a governance token, SAME holders stands to propose changes to SameFinance products and vote on proposals by other holders. SAME have the following utilities:

- SAME is paid to users as rewars for minting, saving and staking SameUSD on Samecoin's Dapp.

- SAME can be used for paying transaction fees on SamePay. Taking advantage of this comes with a 50% discount and exclusive promotions from product partners.

- Quarterly token burn and halving of rewards in order to avoid token inflation and support the token market value.

SAME FINANCE PROJECT PARTNERS

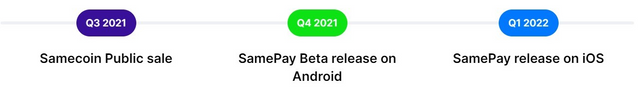

PROJECT DEVELOPMENT ROADMAP

CONCLUSION

SameFinence ecosystem is powering a suit of solutions that virtually every enthusiasts in the blockchain and cryptocurrency ecosystem will crave to lay their hands on. Ranging from the yield farming features to the suits of Samecoin's stable coins, SAME token will play a key role and will do well in supporting it supporters especially in the long run.

OFFICIAL RESOURCES

WEBSITE

WHITEPAPER

LITEPAPER

ONEPAGER

TELEGRAM

TWITTER

FACEBOOK

MEDIUM

GITHUB

WRITER'S INFORMATION

Bitcointalk Username: cryptowhitewalker

BITCOINTALK PROFILE

POA