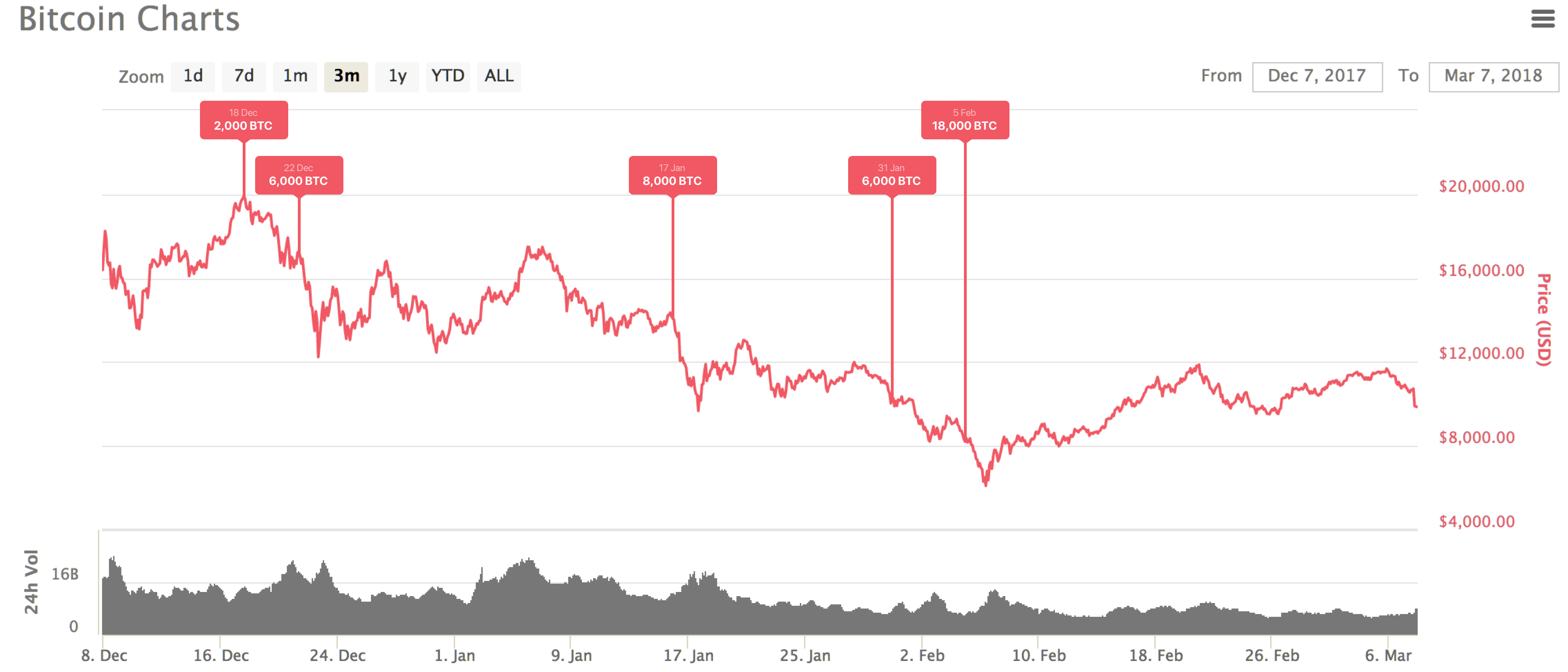

Coinbase have launched an Index Fund which will give investors exposure to the cryptocurrencies listed on Coinbase’s exchange, GDAX, weighted by market capitalization. The current allocation is Bitcoin 62.04%, Ethereum 27.24%, Bitcoin Cash 6.89% and Litecoin 3.83%. The fund will charge a 2% management fee. The recent lawsuit against Coinbase should serve as a warning to investors in this fund that they will underperform investors who choose the hold the underlying assets untill coinbase clarifies its position on forked coins (i.e. dividends). In a traditional Index Fund all dividends from the underlying companies are either distributed to holders of the ETF or reinvested, with Coinbase they have chosen to ignore forks for now after their mishandling of Bitcoin Cash.

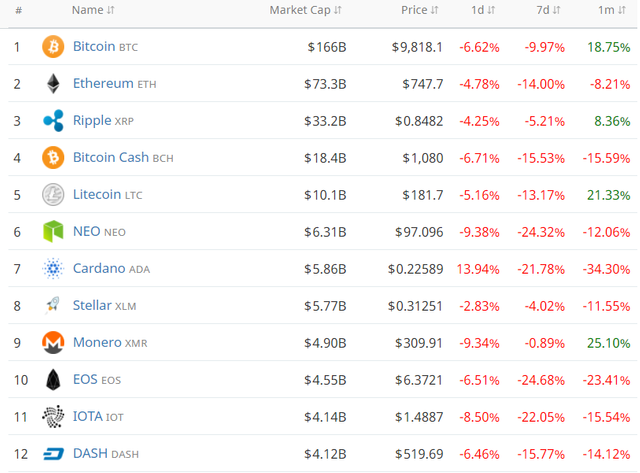

Trustees of the Mt Gox bankruptcy have revealed that they sold ~$400m USD worth of Bitcoin between September last year and today, with another $1.9bn left to come. Analysis of Mt Gox's wallets reveals that the date of the transfer to exchanges coincides with large drops in the price of Bitcoin (chart below). Back in December creditors petitioned Mt Gox to be taken out of Bankruptcy so that the Bitcoin assets remaining could be distributed to account holders. The issue arises from bankruptcy law which reduced the claims against Mt Gox for the stolen Bitcoin to yen amounts shortly after the bankruptcy and at an exchange rate of ~$400 USD per BTC. Since then the price of BTC has increased dramatically, allowing for the creditors to sell a portion of the recovered BTC to cover all the claims. The remaining BTC windfall will presumably to be distributed to the CEO Mark Karpeles.

In more exchange news - Binance, the worlds largest exchange by trade volume, was reportedly hacked however no customer funds were lost. The debacle with Mt Gox should serve as a constant reminder never to leave your Bitcoin on an exchange.

Tim Draper appeared on CNBC. On the disruptive nature of Bitcoin he said that the internet disrupted industries which were smaller than the ones Bitcoin is transforming, such as banking, real estate, insurance and health care. He also said that governments are an industry that is being disrupted. He believes in the future there will be virtual governance of which local governments will be competing for us by providing good service at a low cost.