"It's no secret that community concerns have driven strong demand for stablecoins across the crypto space," said Leon Li, founder and CEO of Huobi Group.

Price volatility of cryptocurrencies is the primary factor behind the current craze about stable coins. Unlike normal cryptocurrency tokens, stable coins have their value pegged to real world stable assets like gold and fiat. The most successful stablecoins options have their value tied to US dollars, in a 1 coin =1 USD peg. The premise is that for each stable coin issued, there is one dollar held in a reserve bank to back it up. In essence, stablecoins allow investors to escape price volatility of cryptocurrencies without having to cash out into fiat.

Tether is the earliest and most widely adopted stablecoin, standing at the 9th largest cryptocurrency by market cap of $1,900,287,337 as of writing this article. Recent Tether FUD (Fear, uncertainty, doubt) has been attributed to the inability of the Tether Cooperation to communicate in a way that conclusively addresses community concerns about their stablecoin Tether in the face of price movements that saw tether break its peg to the USD, trading for as low as 0.87 across major exchanges. This drop in price was triggered by FUD stemming from news that Noble Bank International, a bank that Tether Cooperation is reportedly linked to, was in poor financial health. Additionally, fake news purporting that Tether was delisted from Binance, further compromised Tether's position.

Besides these recent developments, Tether has had a long history of controversy in regard to weather the cooperation has enough money in reserve to back the total amount of Tether Tokens issued. Earlier in the year, the Tether Cooperation fell out with its auditors Friedman LLP, and has yet to release a public audit to support their position.

With the entry of new stable coins in the market, Tether faces competition from multiple fronts, most notably from Gemini USD and Paxos Standard which are regulated. Launched by US exchange GEMINI is a fully regulated stablecoin approved by U.S regulators specifically the New York Department of Financial Services (NYFDS). The GUSD token is an ERC 20 standard with a peg of 1 GUSD = 1 USD, and is transferable over the etherium network. The dollars' reserve is held at State Streetbank and Trust Company which is independently audited by BPM, LLP, a registered public accounting firm. With the recent Tether FUD favoring Coins such as GUSD with a firm focus on transparency, the community sentiment can be judged to be pro-accountability.

At a first glance, having more stable coins in the market is healthy. It gives investors options in the event of FUD, ABSOLVENCY or any negative situation that may face a single stable coin. In addition, the competition compels the stable coin issuers towards providing better customer service and remaining accountable to its customer base.

Huobi Launches HUSD

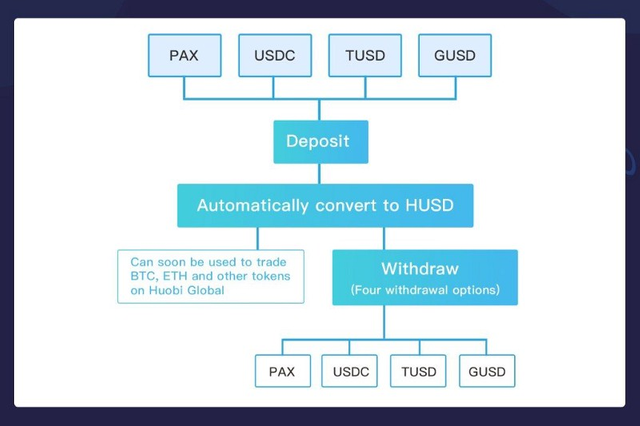

Recently, Huobi Global announced the listing of four stable coins, PAX, USDC, GUSD and TUSD. This move was to address the concerns of the crypto community by offering different stablecoin choices within the exchange. However, dealing with so many stablecoins results in multiple inefficiencies from the user's perspective as regards time and money costs of switching between different stablecoins. Huobi Global, therefore, developed an integrated solution in the form of HUSD.

Essentially, HUSD allows a user to make deposits and withdrawals in any stablecoin that is listed in the HUSD standard. Currently HUSD supports PAX,USDC, TUSD and GUSD.

- On depositing any of the four listed stablecoins on Huobi Exchange, their balances will be shown in HUSD in your account. Consequently, you can withdraw any stablecoin of your choice among the listed stable coins.

"For example, when you deposit 1 PAX, it will show as 1 HUSD in your account, and you can withdraw 1 TUSD (not considering transaction fees on the blockchain)."

The HUSD solution currently supports 4 stable coins, True USD, USD Coin, Paxos Standard and Gemini Dollars

Huobi Global continually tracks new stablecoins in the market and may add new stablecoins to the HUSD system if they meet the required standards.Curent stablecoins are continually evaluated, and incase any will not meet the required risk control standards, they will be removed from the HUSD system

The Full Schedule for HUSD Rollout

The Huobi site has the current schedule as being:

The deposit service of PAX, TUSD, USDC, and GUSD will start at 16:00, October 19 (GMT+8).

USDT/HUSD trading pair will be listed at 10:00 AM, October 22 (GMT+8) on Huobi Global.

Transfer service of HUSD between Huobi OTC and Huobi Global will start at 10:00 AM, October 22 (GMT+8), and trading services of HUSD on Huobi OTC will start at 10:00, October 23 (GMT+8).

Huobi Global will list the BTC/HUSD trading pair at 18:00, Oct. 22 (GMT+8), and will list the ETH/HUSD trading pair as situation may require.

Huobi App will support the trading service of USDT/HUSD, and the deposit and withdrawal services of HUSD will be available in the next App version.

Huobi Global will start the withdrawal services of the stablecoins at 18:00, Oct. 29 (GMT+8), you may withdraw any coin among PAX, TUSD, USDC and GUSD. The specific time and date will be notified via a separate announcement.

So far three of the listed stablecoins have shown positive support for the HUSD system through twitter.

Paxos standard shows their support for the HUSD solution.

Remarks

In the young industry that is crypto, FUD is rife and has drastic implications on the market performance of any given coin. Most importantly, fake news can easily change the perception of users towards any given coin. Therefore to safeguard investors against unwarranted losses and inconveniences from price movements, having more stablecoins options in the market adds a much-needed layer of security.

Huobi is at the forefront of promoting user convenience through secure and convenient blockchain solutions. By providing a single stablecoin option for use within the exchange platform, users are saved the worries of choosing between different stable coins. Most importantly, in the normal setup, a user would be charged exchange trading fees when switching between different stablecoins, with the need to perform up to three or more different trades to acquire the stablecoin of choice. The HUSD system saves costs when switching between different stable coins.

Be part of the stablecoin revolution by registering on Huobi Global here

Disclaimer: This article is not intended as investment advice. It is for informational purposes. You should always do your own research.

#HUSD - The Universal Stablecoin #Huobi Launches: HUSD #Huobi HUSD - My review is in,

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@caasi/huobi-launches-husd-an-intertgrated-stable-coin-solution-8601e8d91f17

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

is huobi will give tusd offer? i can't even think if its good to buy more stablecoins even if they will having special offer on kucoin, you can buy it for almost free. is it good enough?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Kucoin sometimes gives a limited discount offer of 99% for about 10 days for trading new coins which inludes the recently listed stablecoins like Paxos standard. Read here for more info https://news.kucoin.com/en/kucoin-will-add-paxos-standard-token-pax-market/

After the ten days expire you will be required to pay normal trading fees.

On Huobi's end, its HUSD stablecoin is a permanent integrated solution that eliminates the costs of switching between stable coins or the inconvenience of choosing between them. However, trading fees between HUSD pairs are standard exchange fee charges unless a special offer is announced.

I hope you get the difference :- )

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit