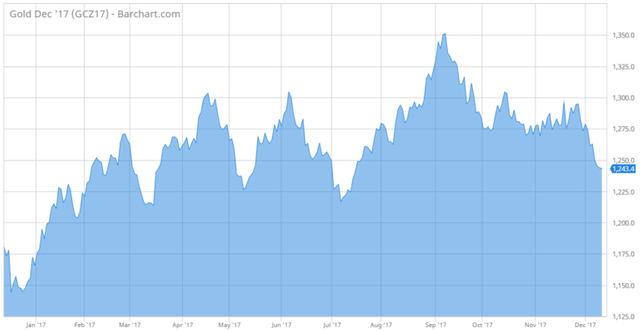

Bitcoin’s record-setting advance since the start of the year has left other asset classes out in the cold. As gold continues to struggle below $1,300, some analysts have noted an inverse correlation between the two asset classes.

Gold has long been valued as a safe haven and store of value capable of shielding against economic, financial and geopolitical risks. Although the yellow metal has lost much of its luster, it remains the go-to haven asset for investors concerned about the future. Case in point: gold has risen several times this year on geopolitical tensions between North Korea and the West.

At the same time, gold has been unable to break above $1,300 a troy ounce with any real conviction. Gold futures traded on the Comex division of the New York Mercantile Exchange appear to have peaked north of $1,350 in September before crashing back down.

@darshan1999 Certainly seems the case!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ya bitcoin is rising to much much......gold is nothing infront of it now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit