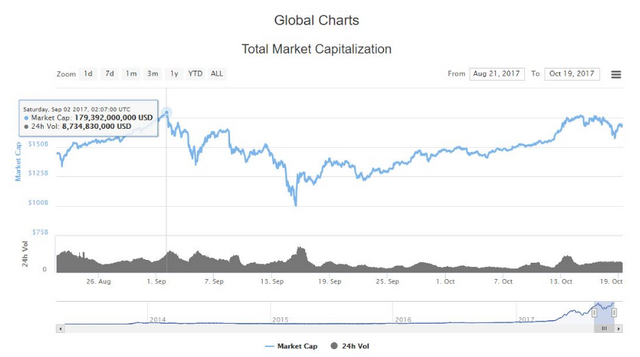

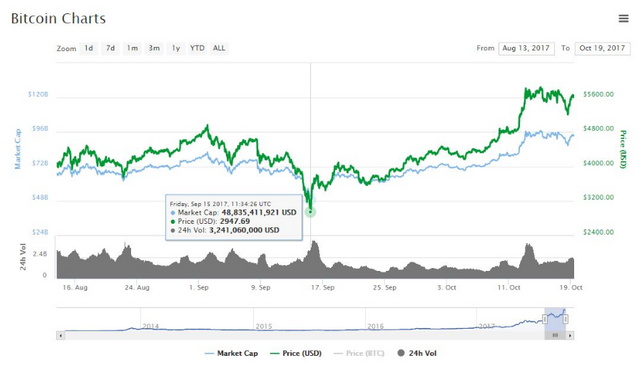

In what was a historic high bitcoin’s value exceeded $5,000, reaching $5,010, on the 2nd September, according to CoinDesk’s Bitcoin Price Index (BPI). At the time, the combined total market capitalization was worth nearly $180 billion.

Yet, after passing the notable milestone the cryptocurrency market experienced the biggest sell-off since mid-July, dropping its market cap to $166 billion in the same day. Bitcoin saw its price drop to a low of $4,539, a near $500 drop, figures from CoinDesk’s BPI show. On the 5th September, it was floating above $4,000, at $4,085.

Added to this was the news from the People’s Bank of China (PBoC) and other regulators that it had moved to ban initial coin offerings (ICOs). This was then followed by the announcement that Chinese bitcoin exchanges had received shutdown orders - after circulating rumors - due to the fact that they were operating without a formal license.

With the market reacting to these latest developments, bitcoin’s value dropped to a low of $2,947, on the 15th September, according to CoinMarketCap.

Since then market prices have recovered. So much so that bitcoin is now valued over $5,600, pushing its market cap up to $93.6 billion. The highest it has reached, to date, is $5,850, figures from CoinMarketCap show, pushing its market cap up to $97.2 billion, and making it worth more than Goldman Sachs by $5 billion.

However, according to David Motta, Internet entrepreneur, investor, and CEO of business consulting firm, ACQURE Business Solutions, had it happened a year ago the outcome would have been different.

“I believe it would have had a greater impact as the greater portion of trading was being conducted in yuan,” Motta said.

He doesn’t believe, though, that this means China is out of the cryptocurrency industry. Rather, Chinese authorities are attempting to figure out how to have more control over it.

This can be seen by the fact that China’s official press agency issued a statement calling for regulators to take a ‘zero tolerance’ approach to cryptocurrency-related crime.

Published on the 4th October by the Xinhua News Agency, the roughly translated statement said that trading platforms are known to have ‘concocted pyramid schemes’ and ‘engaged in illegal activities.’ It adds that ‘iron fist governance’ and ‘zero tolerance’ is required to block financial security risks.

Yet despite this and Russian President Vladimir Putin calling for the regulation of cryptocurrencies, reports Bloomberg, market prices have rebounded.

With the market achieving new record highs, it’s likely that Hong Kong may become a safe haven for future ICO projects coming out of Asia, says Motta.

“However, I hope the recent crackdown will discourage the fraudulent activity that many of those ICOs were doing, he added.

Regaining its poise within the market, bitcoin is demonstrating the apparent relative ease it has at recovering even though it remains in its infant stages. This could be attributed to increased trading from Hong Kong, South Korea, and Japan. Consequently, Motta believes that bitcoin will reach $10,000, a projection shared by Michael Novogratz, a former principal at investment firm Fortress and ex-partner at Goldman Sachs.

In an interview with CNBC’s ‘Fast Money,’ Novogratz said he sees bitcoin’s price increasing to over $10,000 in the next six to 10 months.

Congratulations @davidmotta! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit