Most people have claimed cryptocurrency is in a bubble over the past year. Given the current market sentiment, these claims seem to make some sense. At the same time, the real financial bubble is present in different sectors. It seems the tech industry is still the biggest bubble people need to be scared of right now.

The Tech Sector Bubble is Very Real

While it is true that technology firms are innovating, the money thrown at these companies is quite steep. More specifically, it seems Silicon Valley has given birth to dozens of new future billionaires in the past two years. Innovative products and services are launching virtually every other week. At the same time, these companies would not succeed without sufficient funding either.

We now see startups being valued at $1 billion or more without having a working product. Although this draws similarities to the cryptocurrency ICO sector, it is a bit more worrisome in the tech sector. Unfortunately, all good things must come to an end, even in Silicon Valley. More specifically, software engineers are trying to land jobs with firms whose business model is effectively working out. Most current startups raise a lot of capital only to realize they can’t deliver on their initial promise.

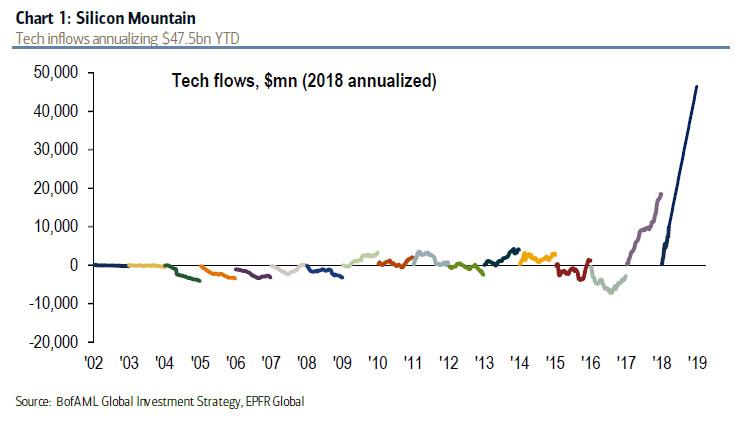

Additionally, various startups are seemingly running out of money. Venture capitalists are becoming a lot more picky as to how they invest in companies. The ‘big bets’ are slowly on the way out, or so one would think. Even so, the graphic above shows the annual tech flows are still incredibly bullish. This year, we may very well surpass the $50 billion mark in this regard.

Putting the Cryptocurrency Bubble to Shame

Comparing this trend with cryptocurrency, it is evident the tech industry is the real bubble. With so much money being thrown around lately and not much to show for it, something has to give. Cryptocurrency, on the other hand, has seen massive improvements over the years. Moreover, some of the biggest improvements have yet to come to fruition.

Interestingly enough, the tech sector in the US is at the same “value” as the total cryptocurrency market cap. According to the NY Times, the tech sector is valued at $299.6 billion. All cryptocurrencies are currently valued at $304 billion. As such, it doesn’t make sense to claim cryptocurrency is in a bubble. The dip from $750bn to $250bn has been quite steep, to say the least. However, the combined US tech and internet sector dropped from $780bn to $560bn between May 2015 and May 2016. Ever since, it has bounced back stronger and is now reaching new all-time highs.

How all of this will pan out, remains to be seen. If the tech sector is in a bubble, the future doesn’t look bright any means. With cryptocurrency, it is safe to say the best has yet to come, although it may not necessarily happen in 2018. Tech companies have high expectations to live up to, as it is almost crunch time. For Bitcoin and consorts, these are still the early stages of development and growth, by the look of things.

Wow nice post. Keep em coming. will folloy you for more in the future :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit