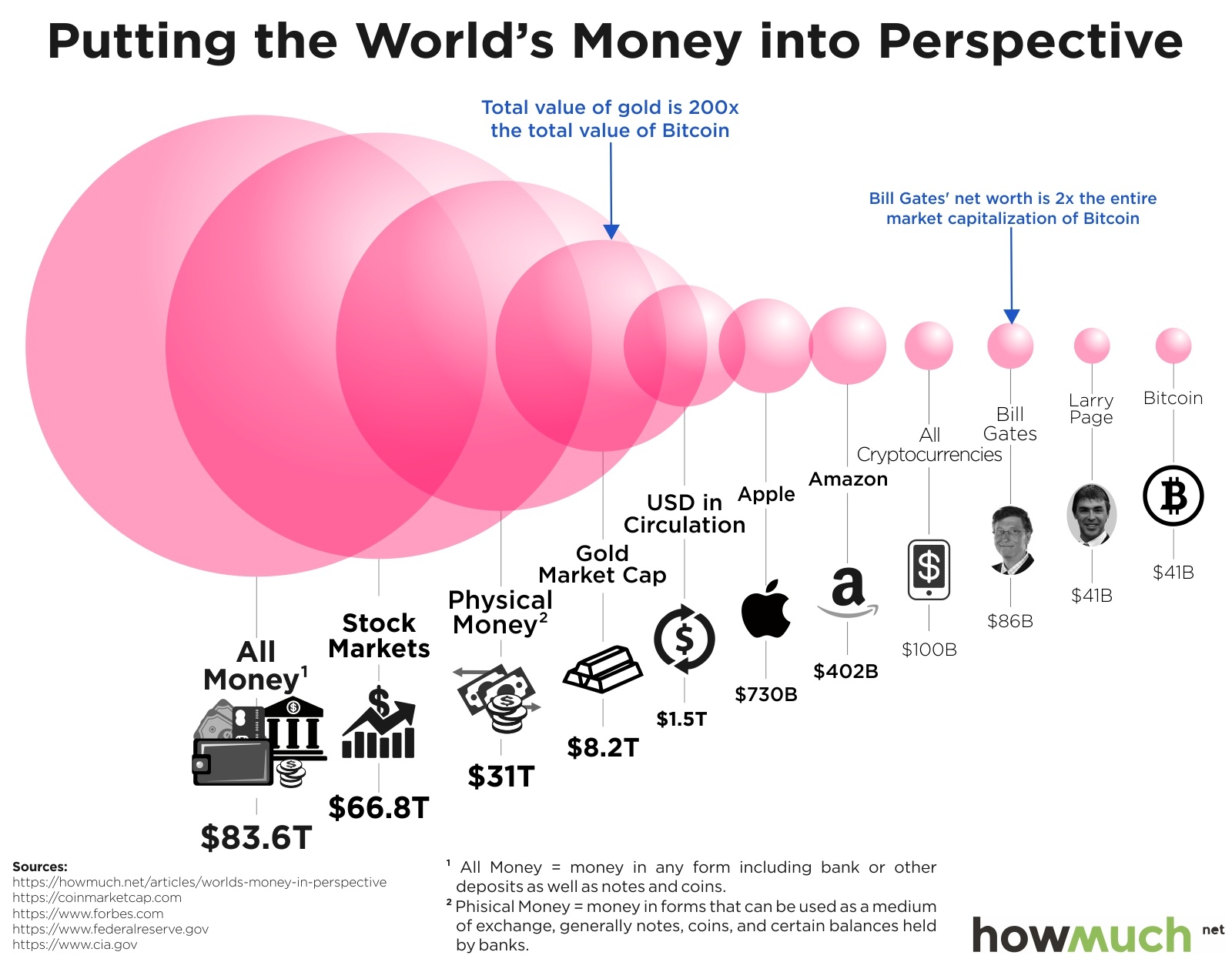

According to a beautiful (yet somehow scary) infographic published by HowMuch.net the total supply of cryptocurrency is equivalent to $100 billion dollars. That's somewhere between Amazon net worth (yes, that Amazon) and Bill Gates' net worth (yes, that Bill Gates).

Of all the crypto portfolio, Bitcoin, at around 40% market domination, holds around $41 billions, which happens to be the net worth of Google's co-founder, Larry Page.

image courtesy to HowMuch.net

This infographic is important not only because it clearly shows the shift that's happening in how the world understands money as a store of value, but also because it puts in perspective some other nice little details. Such as:

- two Apples combined would worth the total amount of dollars in circulation

- the total market cap of all altcoins is now bigger than Larry Page's total net worth

- if Amazon would spend 25% of its net worth, it could get a very strong hold of the entire cryptocurrency market (if there will be enough people selling obviously).

For more interesting facts about world's money, here's the link to the original article.

Oh, and if you're wondering how much of Steem supply you're holding (and are bound to receive as a result of your blogging in the next 7 days) there's always steem.supply.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

https://steemit.com/~witnesses

If you're new to Steemit, you may find these articles relevant (that's also part of my witness activity to support new members of the platform):

This really puts things in perspective. I've added STEEM to the graph just for fun ;)

The Steem sphere is to scale.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the input. You are so right putting Steem there, because that's the place form where the biggest growth is to be expected. These are the real winners, with 10x growth, for those who lost the Bitcoin or Ethereum train.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yep, the tininess of our little sphere clearly shows the we have a lot of room to grow into and looking at where bitcoin and all cryptos are actually situated, I think they still haven't reached their ceilings.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The fact that we can't really read anything on the image and we can't click to enlarge it shows that the Steemit interface needs a bit of work ;) Here's "our" part zoomed in:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I believe we are on an exponential curve, so there is a lot of growth potential.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Agree :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypto space got huge potential to grow... we are just about one person's wealth...i guess $500 Billion is not far away.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting. Imagine if Bill Gates buy some bitcoin. He said it is unstoppable, so he must like it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wouldn't doubt if he did. Seems like a no brainer with such a net worth. Microsoft is heavily invested in Ethereum which is not too far away from Bitcoin at 71.4% flippening

http://www.flippening.watch

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think he already owns some Bitcoin ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

kinda love the way you handle business, nice post, information and then boom a link to the super useful app you wrote. btw, awesome job on the touch up/tweaks. those column numbers look sweet now.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ineresting facts as usual from @dragosrua, thank you! It also shows that there still is a lot of money in the historical favourite gold!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, gold is now 200x of all Bitcoin. Still a long way to go.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Old money does not move very fast... ;-)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They didn't put a bubble for derivatives. (which dwarfs all the rest)

Further, they didn't put a bubble for illegal drug market cap.

Then we would see that bitcoin is not being utilized for the drug trade. It is no where near big enough.

BTW: All the big banks are in on money laundering for illegal drugs. They are the only ones big enough to flow that kind of cash. And many big banks have already been fined for such illegal activities.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Spot on for derivates. And also thanks for the last bit about banks. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The size of the derivatives market is actually mind-boggling. But are they really money?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think the real market cap now is less then 100 billion. The reason for that is high spread and volatility. Recent Ethereum crash has proven that cashing out $300 million (1% of the cap) can drop the price by 15%. Therefore, I assume that the real amount of cash is 10 times less.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

10% times less is a lot less. I don't think so. It's normal for the value to fluctuate based on supply and demand. But if you also "price in" the sentiment, extremely bullish, I think there's more hands coming in than cashing out, hence, the value remains strong.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great information and your steem.supply tool is awesome!!! Up-voted and re-steemed.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! If you like steem.supply, I will appreciate voting for my witness, it will help maintaining the project live and further development.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, nice.

At the same time the proportions of the balls are incorrect, as is usually the case with pop-infographic. It would be cool to see similar data with real proportions.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, this reminds me of those cool solar system visualizations, where Jupiter gets just 5 times bigger than Earth (although in reality it's 11 times).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

[edited, sorry misunderstood at first] There is one site. I`ll try to find the link.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes, I agree. And yet the case of the planets is all much more complicated:

I paid attention to the dimensions, cause when we deal with infographics describing the capitalization, it is quite realizable. I do not understand why not to do so))

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting fact. Now let us consider that the market cap that crypto coins have is given by a % of the coins that are in markets. So i think this 100bil $ is a big bubble.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I don't think so. There's still a lot of room to grow.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

There is a big room to grow, but think at this:

Let's take Waves coin market cap:

15 Waves Waves $486,712,000 $4.87 100,000,000 WAVES * $2,402,060

This price is given by a short amount that is traded. If a big share holder comes now to sell his coins he can't !! Why ? Because there is no such demand on this coin. So here we can say is a bubble.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Market cap is a thing, liquidity is another thing. Just because there aren't buyers at a certain moment it doesn't mean there won't be some in the future. The price is whatever we get at a certain point in time. If that's the price at which Waves it's traded now (even if it's just a small part of the entire supply) then that's the price of it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Let's rob em and put it all into crypto ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah, a little scary. While I am enjoying the new technology that the crypto and blockchain is, I can't bring myself to trust it yet.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really neat infographic! Thanks for sharing @dragosroua, it was real interesting to see where crypto ranks in the world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted and following. Understanding how all the world's currencies stand and how various figureheads have their stake in it has not been my strong suite. This certainly puts some things into perspective. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very cool stuff you present :)

Up voted followed

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That's a cool graphic.

I'm using the same argument to explain to some of my friends who laugh crypto off saying $100 bil is so very overvalued. $100 bil is nothing put in perspective, loads of $ still going to enter the market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Precisely :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please follow me i will follow you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow, I thought the crypto market was big, but it is nothing compared to what it could potentially be a few years down the line! The next few years are going to be very exciting, to say the least.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting! We have to think Bitcoin is very young compared to the other players in the list, if in a few years got from $0 to $41B, I think that only surpasses the rest. Imagine it evolving this way, we would have BTC on the third spot in maybe 10 years from now ...and boy, does that make me happy to be part of it. :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been ranked within the top 50 most undervalued posts in the second half of Jun 22. We estimate that this post is undervalued by $57.13 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jun 22 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit