- Mainstream Currency Price as of 1:00 PM UTC from Coinbase Pro:

· BTC —9,344.06 USD

· ETH —183.16 USD

· EOS — 3.358 USD

· XRP —0.2968 USD

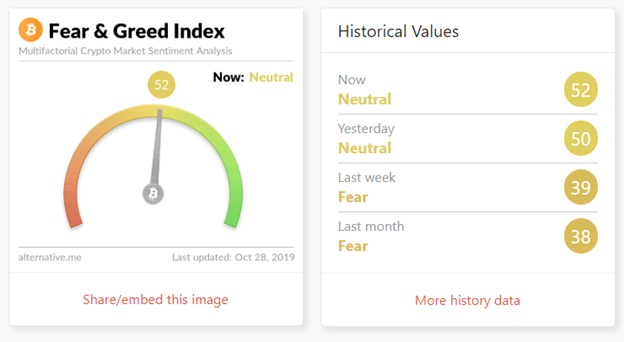

2 The Fear Greed Index: 52 — Neutral

3 Crypto Updates:

• Chinese Central Bank Official Calls for Commercial Bank Blockchain Adoption

The head of the technology department at the People’s Bank of China (PBoC) has called for commercial banks to adopt blockchain technology in digital finance.

As reported by Reuters, bank official Li Wei spoke Monday at a forum in Shanghai on commercial bank adoption.

The central bank is already currently developing its own digital yuan that is expected to launch soon. The potential launch of the Facebook-led Libra cryptocurrency payments network prompted calls for the PBoC to accelerate work on the digital currency.

Li Wei’s comments come hard on the heels of Chinese president and general secretary of the Communist Party Xi Jinping’s call for widespread blockchain adoption in China on Friday.

“[We must] clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation,” Xi said at the time.

Alongside a 16 percent leap in bitcoin’s price over the weekend, blockchain-related Chinese tech stocks jumped following Xi’s comments,. Bloomberg reports that the Shenzhen Information Technology Index jumped 5.3 percent Monday, with dozens of firms shooting past the daily 10-percent onshore limit.

• Bitcoin Price Chart Now Looks ‘Ridiculous’ After Record Gains: Analyst

Bitcoin (BTC) held above $9,000 on Oct. 28 as a weekend of bullish madness continued to captivate markets.

Data from Coin360 showed volatility remaining elevated for Bitcoin on Monday, with swings between $9,100 and $9,900 characterizing the past 24 hours.

On Friday, news that China was officially embracing blockchain technology appeared to reawaken enthusiasm across cryptocurrency markets. After trailing at $7,400 for several days, BTC/USD suddenly exploded, hitting local highs of nearly $10,500 early Saturday morning.

Those levels have since consolidated, with the press time price of $9,400 nonetheless corresponding to 3-day gains of 25%.

• China: Forex Regulator Warns Against Illegal Crypto Cross-Border Flows

China’s foreign exchange regulator has warned that emerging markets need to muscle in on cryptocurrency-enabled illegal cross-border capital flows.

Sun Tianqi, the chief accountant of China’s State Administration of Foreign Exchange (SAFE), made the remarks at a forum today in Shanghai, according to an Oct. 28 report from Reuters.

Tianqi called for global regulators to cooperate on countering illegitimate cross-border transactions, underscoring the risks that fintech innovation poses to foreign exchange control.

He revealed that the Chinese state had closed over 2,000 forex trading platforms, yet reportedly did not elaborate further.

Back in November, Tianqui had called for Facebook’s Libra to be classed as a foreign currency and integrated into the framework of China’s foreign exchange management. Failing this, the asset should be prohibited, he said.

• Blockchain Startup Raises $5M to Automate Airport Security Checks

Blockchain startup Zamna raised $5 million to automate airport security checks using blockchain and biometrics technology, tech news outlet Silicon Republic reports on Oct. 28.

The startup plans to use the funding to deploy its Advance Passenger Information platform. Zamna also said that International Airlines Group (IAG), Emirates Airlines and United Arab Emirates’ General Directorate of Residency and Foreigners Affairs are now among its clients.

According to company data website Crunchbase, the seed round was reportedly led by venture capital firms LocalGlobe and Oxford Capital partners alongside IAG, one of the world’s largest airline groups.

• Bitcoin Trading Spikes as Argentina Bans Buying More Than $200 a Month

Argentina is back on the radar for Bitcoin (BTC) proponents after sudden capital controls cut U.S. dollar purchasing power by 98%.

As news outlets reported, including Cointelegraph Brasil on Oct. 28, the country’s central bank has opted to reduce the amount of dollars a saver can purchase each month from $10,000 to just $200.

A drop of 98%, the stringent new rules appeared on Sunday, the day voters elected a new president. The previous $10,000 limit itself came into being as a result of capital controls in September.

Argentina has seen the value of its fiat currency, the Argentine peso (ARS), fall dramatically this year, with annual inflation exceeding 50%.

In a statement, the Central Bank of Argentina (BCRA) said the reduced dollar access would last for two months.

“Given the current degree of uncertainty, the Board of Directors of the BCRA decided to take a series of measures this Sunday that seek to preserve the reserves of the Central Bank. The measures announced are temporary, until December 2019,” it said in a statement.

The bank continued:

“It establishes a new limit of $200 per month for dollar purchases for individuals with a bank account and $100 for the amount of dollars that can be purchased in cash. These limits are not cumulative.”

4 Trader’s View:

• TradingAlchemist from TradingView: BTCUSD at strong support level

The past forecast came true

BTCUSD at strong support level of 9320 from which I expect growth to the level of 9900

• BillCharison from TradingView: $BITCOIN - Overall I'm Bullish, Bears are Blind

Crazy, crazy market. But bullish . Hate bears, they are blind - imho. The level of $9200 - $9350 is holding the price, but the breakdown of one will be bad for market. Important - downward spike is ok, fixation below $9200 is truly bad.

We need to remember about GAP on the CME. Its downward border is located at the ±8750 level. More likely we will see the price there at this week. Moreover, there is located the important horizontal level of the descending channel which we need to re-test. Therefore, the overall trend is bullish, that's what we need to keep in mind.

If the price consolidates above the $9350 level for a long time, we can start gaining LONG position even there and place additional buy orders in the $8500 - $8700 range. The breakout of the ascending resistance will lead to another pump where $16000 will seem very realistic.

• Patrikas10 from TradingView: Bitcoin $9800 achieved. What's next?

I'm happy to announce that our $9200 & $9800 targets has been reached with confidence!

We printed new low, I did not expect that to happen tbh. Although final targets reached with confidence.

If you open trades with me, open them with very small leverage in order to be safe. This type of volatility in the market can easily take you out.

We have parallel channel of this huge weekly/monthly wave up. mid-point of this channel is $6500, it's where momentum should start slowing down and price action - flatten out.

As you can see, 0.5fib (gap between channel's upper line and mid point) acted as very strong resistance.

Huge demand will be there to buy any wick below that crucial mid point of the channel.

Zone of interest to open longs is at 6350-6050. I would consider these regions as a long term investment points.

Attaching macro view as well so that you have better perspective :) I called for mid 6k after we reached 13k .

www.DueDEX.com

Our official social platforms:

Twitter: https://twitter.com/DueDEX_Official

Telegram English: https://t.me/DueDEX_en_Official

Telegram Russian: https://t.me/DueDEX_Ru

Facebook: https://www.facebook.com/DueDEXOfficial

Steemit: https://steemit.com/@duedex

DueDEX informs readers that the views, thoughts, and opinions expressed in the content come from various sources, and does not belong to DueDEX. It does not guarantee the accuracy or possible uses of the content posted. Under no circumstances whatsoever shall DueDEX be deemed responsible or liable for any decision made or damage incurred due to the content and information posted on this social media. Every investment and trading move involves risk, doing own research should be conducted when making a decision.

What's happening today is there are multiple events under the kucoin festival 11. 11 where the lockup and cash back plan lockup users of the first round will get to have an exclusive access of the second round based on this news: https://www.kucoin.com/news/en-the-kcs-lockup-and-cash-back-program-the-second-round-2/?utm_source=tftj

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit