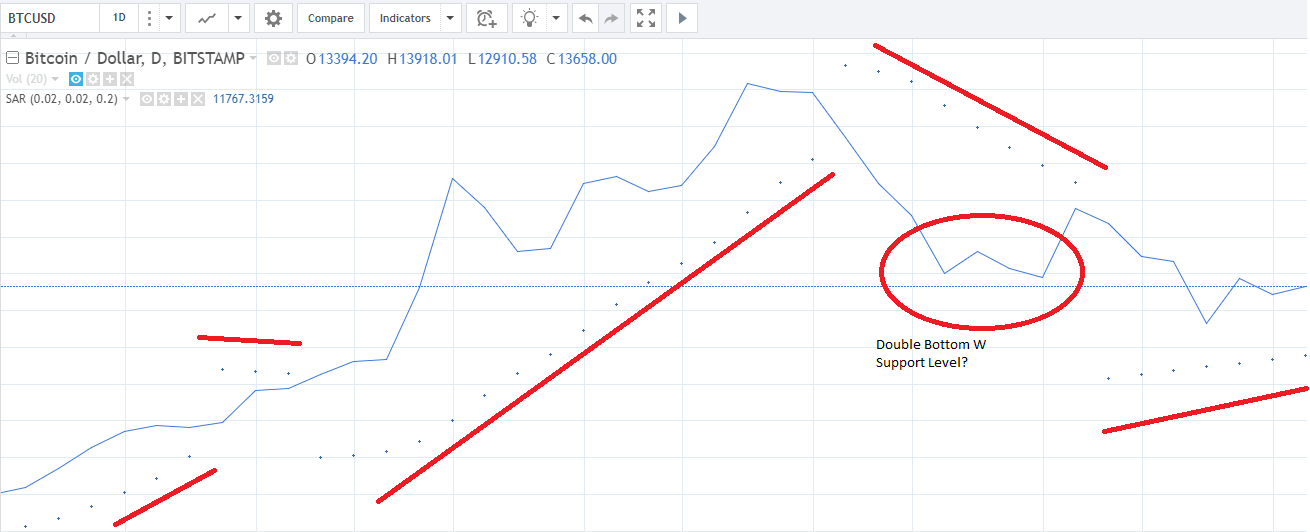

Earlier I had indicated to look for a W pattern as it would indicate a support level for the price of BTC but be wary if the price dropped below $12,000 (another support level). In order to simplify the idea of a support level, consider the types of people in society. Some people are like rabbits and quick to react. If the market drops they will quickly sell at a high level but will only make quick profits. Some people are like turtles and are slow to react ... they do not sell if there is a slight drop in the market but will sell if they perceive the price is dropping below their profit point. A turtle like me bought a couple BTC at $100 so has a much lower threshold for my sell off point. If you were a person who bought when the price was higher than it is now ... have probably sold already taking their loss or if real turtle will hang on until the price inevitably goes up.

Another measure to determine the mind of the market is to use the Parabolic SAR (Stop and Reverse). It is represented in this chart as the dots which I have underscored with red lines. It is helpful in seeing what the trendline is. It appears below the market price line when the price is ascending, while it appears the market price line when the price is descending. Even though we are in a sideways market, the SAR is below suggesting that the support is for the upside.

still have a hybrid between a rabbit and a turtle ... those who react quickly but not correctly and then from a shock - hang like turtles and lose all their money. :) :) :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Informative post, Thanks for sharing @dwarrilow2002

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please resteem if you think it is of value. Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit