From one day to the next, the value of the so-called bitcoin cryptocurrency could exceed $ 10,000 each. Beware of the bursting of the bubble! Because this hyper-speculation is in the crosshairs of the monetary authorities. Here's what you need to know about this virtual money.

1-Madness

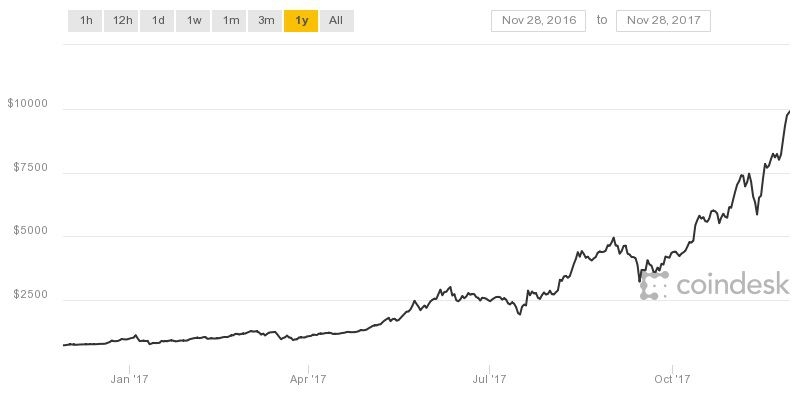

The most widespread cryptocurrency in the world, bitcoin, is reaching historic highs today: more than $ 9,900 on Monday, November 27, according to the Coindesk platform. As a result, its total market capitalization now exceeds $ 158 billion. A meteoric rise of more than 850% since January!

For Marc Fiorentino, from the independent consulting site Monfinancier.com

"Bitcoin is an important phenomenon, which is now part of the landscape, but it is a very speculative object, completely disconnected from all economic fundamentals, so nobody knows how much it is worth!"

2-Mystery

The birth of bitcoin, which aggregates the English words bit (unit of binary information) and coin (currency) is shrouded in mystery. Libertarian-inspired, this "peer-to-peer" electronic payment system was created in 2008 by a certain Satoshi Nakamoto. But nobody knows if it's a real person, or a group of anonymous developers. Published in open-source in 2009, the software platform quickly gives birth to a real global market.

Excluding any monetary or governmental institution, the system is universally accessible and 100% decentralized: it operates without a central authority or a single administrator. Bitcoin - whose creation is limited to 21 million units - is the subject of cryptographic transactions.

The technology behind bitcoin uses coded and authenticated transaction blocks, which add to each other. They are verified by the nodes of a dedicated computer network, and irreversibly recorded in a public register called blockchain. This "chain of blocks" is deemed unfalsifiable because, in order to modify information, it will have to be changed at the same time in all users, which is supposed to ensure the stability of the system.

3-Speculation

Bitcoin may have the wind in its sails, no one knows if it is a giant bubble ... or a permanent asset. Even the future of money! Fund managers are starting to be hit by phone calls from their customers, asking why their portfolio does not include this asset class, so rewarding. But if bitcoin has made the fortune of more than one pioneer, it keeps on playing roller coasters and can collapse overnight.

Nothing to do with a good father placement. For wealth manager Chris Burniske:

"Savers who risk themselves on cryptocurrencies must be ready to lose all of their stake!"

The specialist, who is preparing to publish a book on the subject, has established a strong correlation between the evolution of bitcoin and the frequency of searches for the term "bitcoin" on the Internet, identified by Google Trends. He notably spotted three recent episodes of bubble / crash of bitcoin: in June 2011, he recorded a fall of 93% between maximum and minimum; in November 2013, 71%, and in February 2014, 85%!

4-Secession

Not content to be hyper-volatile, bitcoin is also fragmented: part of the community seceded on 1 August 2017 to create a new variant called "bitcoin cash". The dispute with their comrades, who remained faithful to the original motto, was about the speed of transactions.

The process of creating bitcoin, called "mining", consists in solving complex mathematical problems, via powerful computers. When it first appeared, it was easy enough to "mine" a bitcoin. But as transactions multiply and there are fewer units to create (the ceiling is set at 21 million), this activity has become increasingly complex and expensive for "minors".

After endless discussions, a group of developers created a second derivative currency, with a hotfix that allows for more transactions per second. However, this brand new "bitcoin cash" does not seem to convince a big world at the moment.

5-Multiplication

If bitcoin has become popular, it is only the bridgehead of a large family of crypto-currencies. There are ... hundreds of others. Together, all the crypto-currencies weigh more than 300 billion dollars! According to the list published by Wikipedia the main currencies whose market exceeded the billion dollars, at the beginning of August, are the ethereum, the ripple and the litecoin. But we can also mention the darkest maidsafecoin, dogecoin, monero, factum, bitshares, peercoin, namecoin, lisk, solarcoin ...

6-Mines

"mining", very artisanal at the beginning, very quickly became professionalized.

Surprise: the biggest industry of "mining" is ... in China, which weighs 60 to 70% of this global activity, far ahead of Iceland or Japan! There are also smaller European players, like the Austrian Hydrominer, who promises "green bitcoin" as it places its mining containers directly in hydroelectric stations ...

Bitcoin and blockchain: energy chasms

China has started manufacturing dedicated hardware (servers running on more energy-efficient chips) deployed in thousands of data centers.

But the sector also interests Russia. Vladimir Putin's associate, Dmitry Marinichev, is seeking to raise the equivalent of $ 100 million in cryptocurrency, to put the turbo on the mining. His company, Russian Miner Coin, will give its investors 18% of the revenue generated by its activity.

According to Bloomberg, the Kremlin's internet adviser explained at a press conference:

"Russia has the potential to capture 30% of the global cryptocurrency mining market in the future."

7-scammers

A Chinese-Russian hegemony worries you? Nothing new under the bitcoin sun which is, since its creation, linked to a series of illegal transactions on DarkWeb sites, like SilkRoad (closed in 2013). Criminal networks in all countries have used this perfectly anonymous currency as the currency of choice for gambling, the purchase of illicit substances or pirated databases.

Moreover, its brief history is marked by resounding bankruptcies, such as the MtGox exchange, in February 2014. The trial of its founder, the French computer scientist Mark Karpekles, accused of embezzlement (650,000 bitcoins have vanished ), opened in July in Tokyo.

8-Refuge ?

These scandals, considered marginal, do not seem to discourage the constant influx of capital into the cryptocurrency market. There is, of course, an ever increasing number of speculative traders, such as hedge funds, attracted by huge returns on investment: 82,000% for the ethereum! The trendy risk-all sport of finance is the ICO or "Initial Coin Offering": a crowdfunding fundraising in cryptocurrency, that is to say completely free of any regulation ... and any warranty.

Strangely, bitcoin is gradually acquiring the characteristics of a precious metal. Like gold, it seems to play the role of safe haven against the growing dangers: geopolitical risks linked to the tension between the United States and North Korea, economic risks with a sharp rise in US interest rates triggered by the uncontrolled spending of the Trump administration.

9-commoditization

As a result, bitcoin comes out of its marginality to become almost "mainstream". Leading tech figures such as Nvidia CEO Jen-Hsun Huang or Twitter and Square founder Jack Dorsey promise him a bright future. Above all, fund managers and other institutional investors - elephants of global finance - are now entering the dance.

Paris-based asset manager Tobam announced last week the launch of the first European fund dedicated to this cryptocurrency. According to its statement, the "Tobam Bitcoin Fund", unregulated, is intended to offer "a more effective and safer investment vehicle" for investors wishing to increase their exposure to cryptocurrency.

The American Fidelity has created a feature that allows customers to view their holdings in cryptocurrency, from their home account. Wall Street titan Goldman Sachs has announced plans to engage in cryptocurrency trading. More concretely, the Chicago Mercantile Exchange should inaugurate a bitcoin futures market before the end of the year!

The news, which provides a substantial institutional surety for Bitcoin assets, has helped to boost its course. But the event is double-edged: thanks to this market, speculators who are not cold eyed can also play bitcoin down ...

10-Regulation

Because as the bitcoin bubble swells, nervousness rises among regulators. How to frame, tax and control this crypto-finance, which threatens to come feed the iceberg still threatening shadow banking? With the inherent risks of loss of monetary sovereignty and global crash.

According to MarketWatch,

"A 40% drop in bitcoin is almost certain, and there is more than 80% chance that bitcoin will suffer a crash!"

Central banks are getting nervous. Some countries, such as Thailand, Bolivia, Ecuador, Morocco have simply banned bitcoin. China is trying to stop speculation without banning "mining". Others are more open. Everywhere, reflection is in progress. But according to most experts, the question is not whether cryptocurrencies will be regulated ... but when and how.

11-Blockchain

If the future of these digital currencies is unclear, the technology behind them - the "blockchain" or "chain of blocks" - seems to promise a bright future. His interest goes beyond the only financial industry.

Blockchain: technological revolution or mirage?

Around the world, hundreds of start-ups and large companies are testing its potential. Because the blockchain could become the universal means to make reliable the transactional registers of all kinds: cadastre, notarial deeds, civil status, commercial contracts ... Bitcoin would be in a way the tree that hides the blockchain forest.

Congratulations @elkassimiismail! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @elkassimiismail! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @elkassimiismail! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit