Getting physical?

Why would Bitcoin do this? People like bitcoin because it's fast, it's cheap to use, it's private, and central governments can't take it away.

People believe that central banks/authorities are inherently evil (I somewhat agree after studying the GFC of 2007-2008) and can see the benefits of a decentralized currency. To some, Bitcoin is a salvation from the evils of centralized banking.

Other benefits include:

- More places are starting to accept it as a method of payment.

- It could be the future of financial banking after the crash of 2008

- Unlike a bank, it is never closed. It is accessible 24/7

- The price just keeps on rising.

- You don’t have to physically carry it around. You can ditch the paper or plastic and free up your precious pocket space.

Therein lies my question...why go physical?

Tangem is a start-up that operates from both Singapore and Switzerland. Both have announced that they are launching a pilot sale of physical notes of Bitcoin. It could take a lot to persuade people to use it as many prefer Bitcoin due to its anonymity of transactions and the speed at which they can be processed.

Nevertheless, it might be a step towards Bitcoin replacing fiat currency, which was the aim when it was developed years ago.

FIAT CURRENICIES are legal tender whose value is backed by the government that issued it.

So, just how will these ‘physical’ notes work?

Tangem notes will act as ‘smart banknotes’'. They will be fitted with a chip that was designed by Samsung Semiconductor. These smart notes allow consumers to physically carry Bitcoins that are stored in denominations of 0.01, and 0.05 BTC.

The release of these notes is currently running a pilot at them moment, but it will consist of 10,000 notes, which will be shipped from Singapore to potential partners and distributors all around the world.

The reason behind the creation of these notes was to help increase the ability to spend cryptocurrencies, such as Bitcoin, which, although is being increased, is still not as widespread as some believed it would be.

Singapore has a strong reputation when it comes to being a hubfor cryptocurrencies. Back in April, China and Singapore have also completed a shipment of gasoline entirely using blockchain technology. (https://bitsonline.com/asia-trading-blockchain/)

The month before as well, saw Singapore’s central bank reaffirmed its commitment to using blockchain technology for cross-border payments.

So it seems we have moved from the Gold Standard to fiat and then to crypto and almost ironically back to physical notes that won't be back by a central government.

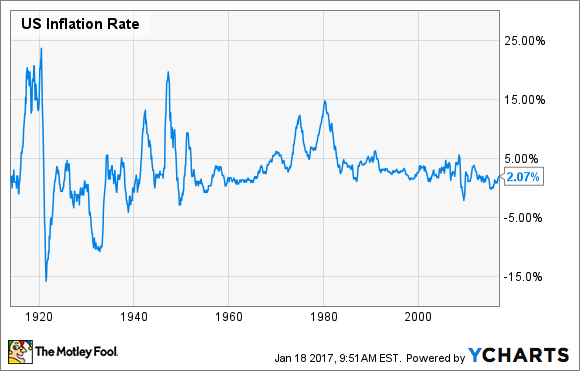

Let's look at the inflation rate of the USD:

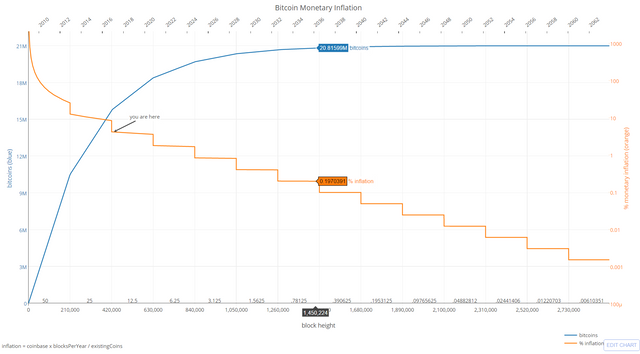

Here is Bitcoin monetary inflation:

If the aim is to have physical cryptocurrency without being backed by a central authority - I am all for it. However it still remains to be seen the effect of 'getting physical'.

Thanks,

Emma.