As both BTC and ETH rebounded, the crypto market seems to have come out of the former shadows cast by Terra and Three Arrows Capital and absorbed the panic. Additionally, the whales of Uniswap, the leading DeFi project, brought $74.64 million worth of UNI in the past 16 days, and the NFT category also remains dynamic. Last week, we mentioned in an article that the NFT category is witnessing most fundraising activities in the crypto market.

Nansen tweeted that Yuga Labs, the team that issued Boring Ape NFTs, has earned $147.9 million through the four NFT series, which is proof of the incredible profits NFTs can bring. In the meantime, many traditional game makers have also flocked to this category. However, some game companies remain cautious about NFTs. Last week, Mojang updated its Usage Guidelines for the sandbox game Minecraft, announcing that blockchain technologies are not permitted to be integrated inside the Minecraft client and server applications nor may they be utilized to create NFTs associated with any in-game content, including worlds, skins, persona items, or other mods.

Mojang said that “each of these uses of NFTs and other blockchain technologies creates digital ownership based on scarcity and exclusion, which does not align with Minecraft values of creative inclusion and playing together.” The studio will also be paying close attention to how blockchain technology evolves over time. However, it has no plans of implementing blockchain technology into Minecraft right now.

Subsequently, Square Enix, the developer of the Final Fantasy games, partnered up with the blockchain game company Enjin, and Final Fantasy will release an NFTs series on Polkadot. Epic Game CEO Tim Sweeney also said on Twitter that they will not ban the use of NFTs and developers are free to decide how their games are built.

Minecraft is not the first game to publicly ban NFTs and games relating to blockchain technologies. Back in 2021, when the NFT sector boomed, Steam also explicitly banned NFTs. Its founder Gabe Newell later conceded that blockchain is “a great technology,” and said that “the ways in which (blockchain) has been utilized are currently all pretty sketchy. And you sort of want to stay away from that.”

Moreover, many more long-standing companies in the game industry now rely on NFT transactions to drive business growth. For example, GameStop, the world’s largest video game retailer, launched its Layer 2 NFT marketplace on July 12 and recorded a transaction volume of $2 million on the very first day.

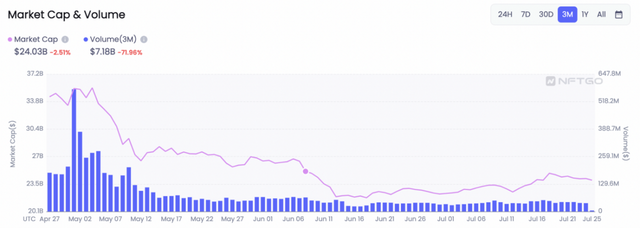

Since 2021, the NFT sector has told many get-rich-quick stories, and the market cap of NFTs had reached $36.8 billion at the peak, which attracted many non-blockchain users. Furthermore, there are even companies that use NFTs as a publicity stunt. Based on the overall funding flow, the NFT market is likely to become the funding gateway of the crypto market and start a new bull market. However, statistics show that NFT users are not that active.

According to the relevant data, the NFT trading volume has taken a plunge in the past three months, with a declining market cap.

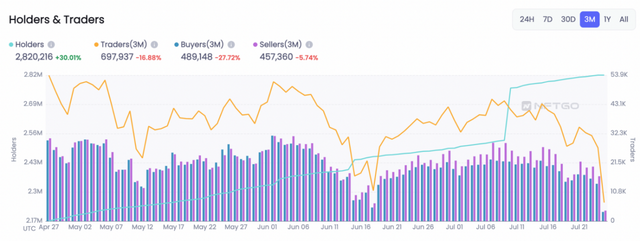

Despite that, the data of NFT holders indicates that the market has always been hot, and there haven’t been many changes in trading users. These figures are probably related to the poor liquidity of the NFT market.

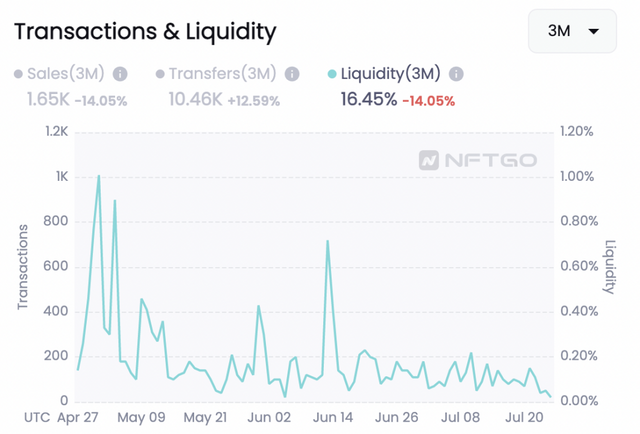

For example, Bored Ape Yacht Club’s liquidity exceeded 1% on only one day in the past 90 days.

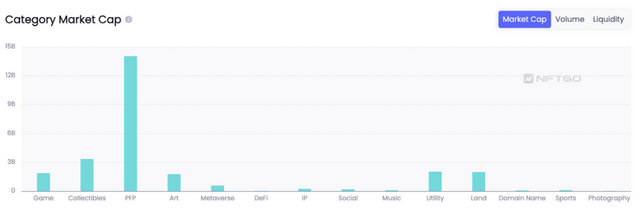

In terms of the market cap, PFP has taken the lion’s share, but we do not know whether this includes projects that are overvalued and illiquid.

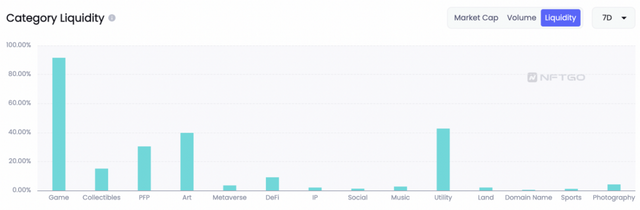

Let’s turn to liquidity. In this regard, game projects offer the most liquid NFTs. The poor liquidity of NFTs has always been a top concern for most investors. This has triggered the appearance of many NFT-related lending platforms that have offered liquidity solutions and earned the recognition of institutional investors.

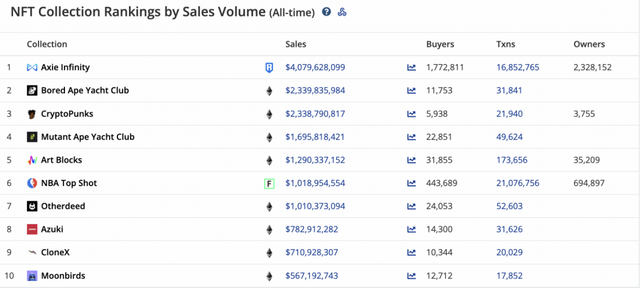

According to the trading volume ranking, as of July 25, 2022, the following 10 NFTs have recorded a total sales volume of more than $15.45 billion. In particular, Axie alone accounts for 25.89%, with a big user base and promising copyright earnings.

This is also evident that superior liquidity is a must if projects plan to hit a high market cap, and the game sector might be the best channel for improving the liquidity of NFTs. In a world that suffers from a liquidity crunch, plenty of companies and institutions are still injecting liquidity into the NFT category, making for a gateway of external funds, and the boom of game NFTs could start the next bull market.

That said, investors don’t necessarily have to struggle in the current bear market. There are plenty of ways we can profit, and successful investors are those who are sensitive to market dynamics. For instance, CoinEx has recently introduced the CoinEx Ambassador (Futures Special Program). Offering 60% commissions, the project offers exceptional yields in today’s bear market. While earning profits by trading futures, Ambassadors can also earn 60% commissions, which enables win-win cooperation.

For more information, please refer to https://www.coinex.com/.

Disclaimer: This article offers no investment advice, and all statistics mentioned herein are for reference only. The information provided herein may not be relied upon for investment decisions, for which you will be fully liable.

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit