I'm fascinated by the idea of buying and holding ETF index funds in the stock market, and how 50% of individual stock-pickers can't beat the market in the long run. "Depending on what periods you focus on, the S&P 500 typically ranks above the median in the actively managed universe. This means that usually at least half of the active managers fail to beat the market" (Investopedia). Whether or not you agree with this premise, I wonder if the same rule would apply to the new crypto asset class?

Certainly, in the recent past, the total market cap of digital assets has been climbing, so in a "rising tide raises all boats" kind of market, it's hard to lose if you spread your money out over a variety of individual assets. However, the best simulations I could find showed that actually a pure Bitcoin allocation performed the best in the last few years.

This article from October 2016 asked that very question, and it's a very interesting simulation of Bitcoin vs. a basket of altcoins. However, I wasn't able to find a more recent study, and this simulation only includes baskets of 10 coins, not the entire market. I really like the author's conclusion: "I ask myself why we don’t parallel the stock market world, where indexes are very successful and my conclusion is that we are in a world of unvetted shitcoins."

DISCUSSION: Do you think the index fund advantage we see in stocks would apply to crypto if the altcoin market were a bit more established? Do you think the philosophy is sound, but that the market just isn't there yet? Or is "king" Bitcoin going to reign supreme in terms of portfolio performance for decades? Is there a simplified option to invest in a diversity of altcoins, similar to how an ETF is used in the stock market?

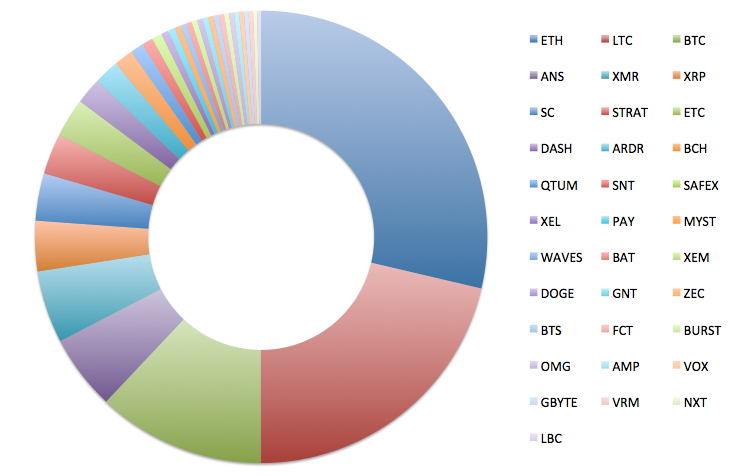

IMAGE: The image at the top is my portfolio allocation right now. I'm certainly a fan of passive index investing, but I have no idea if it will pan out in the bizarre world of crypto.